Baillie Gifford Adjusts Stake in Copa Holdings SA

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Transaction

Baillie Gifford (Trades, Portfolio), a renowned investment management firm, has recently adjusted its holdings in Copa Holdings SA (NYSE:CPA), a leading provider of airline passenger and cargo service. On December 1, 2023, the firm reduced its position in Copa Holdings by 44,777 shares, which resulted in a trade impact of 0% on its portfolio. The shares were traded at a price of $94.11, leaving Baillie Gifford (Trades, Portfolio) with a total of 3,803,340 shares in the company. This transaction altered the firm's stake in Copa Holdings to 0.33% of its portfolio, representing an 11.97% ownership of the traded stock.

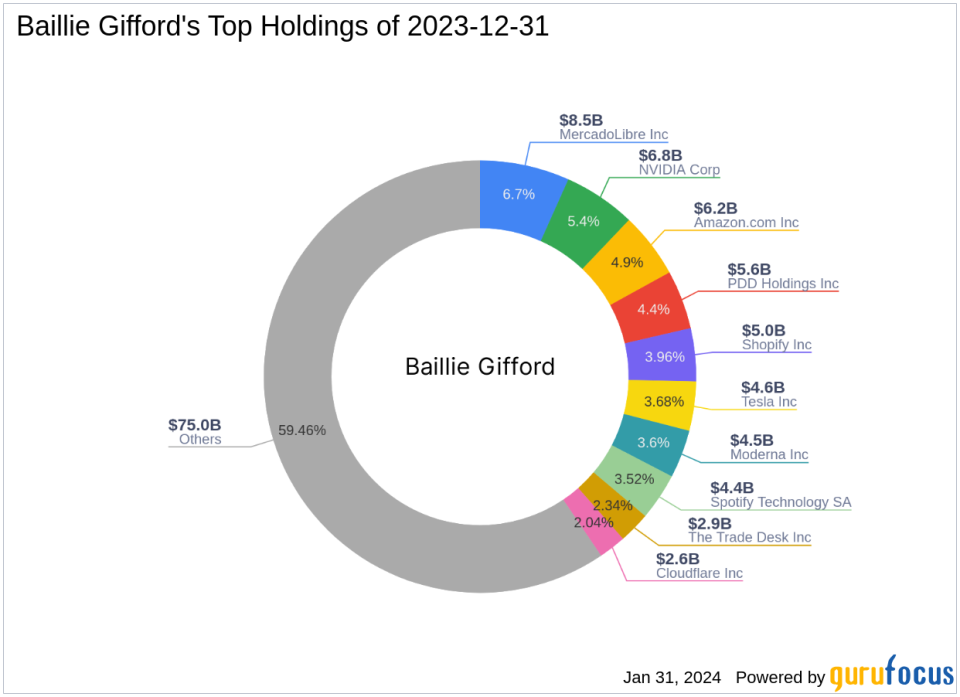

Investment Philosophy of Baillie Gifford (Trades, Portfolio)

Established over a century ago, Baillie Gifford (Trades, Portfolio) has a long-standing history of prioritizing existing clients' interests and maintaining the integrity of its investment strategies. The firm manages assets for some of the world's largest professional investors, with a focus on long-term, bottom-up investing. Baillie Gifford (Trades, Portfolio)'s investment approach is rooted in rigorous fundamental analysis and proprietary research, aiming to identify companies with the potential for sustainable, above-average growth. The firm's top holdings include Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), NVIDIA Corp (NASDAQ:NVDA), Shopify Inc (NYSE:SHOP), and PDD Holdings Inc (NASDAQ:PDD), with a strong presence in the Technology and Consumer Cyclical sectors.

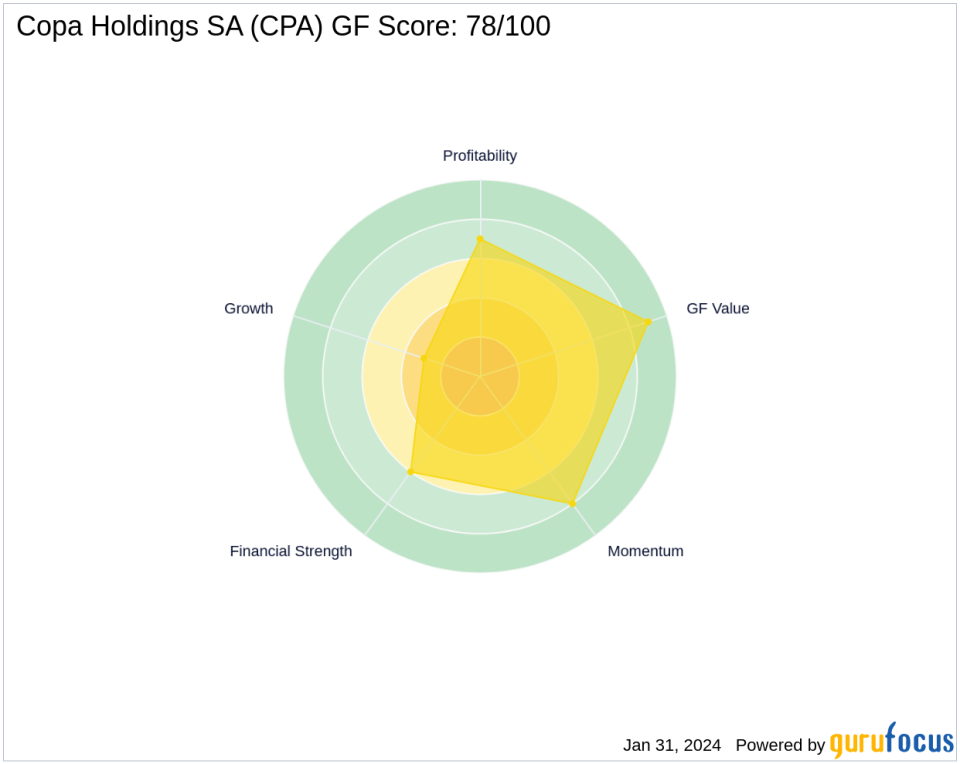

Copa Holdings SA: An Airline Industry Contender

Copa Holdings SA, based in Panama, has been a significant player in the airline industry since its IPO on December 15, 2005. The company specializes in international and domestic air transportation for passengers, cargo, and mail, leveraging its strategic Panama City hub. With a market capitalization of $4.04 billion and a PE ratio of 9.27, Copa Holdings is considered modestly undervalued according to GuruFocus's GF Value of $126.52. The stock is currently priced at $96.06, reflecting a 2.07% gain since the reported transaction and a 326.36% increase since its IPO. Despite a year-to-date price decline of 7.63%, the company's GF Score stands at 78/100, indicating a strong potential for future performance.

Trade Impact on Baillie Gifford (Trades, Portfolio)'s Portfolio

The recent reduction in Copa Holdings SA shares has a minor impact on Baillie Gifford (Trades, Portfolio)'s portfolio, given the 0% trade impact. However, the firm's remaining stake of 3,803,340 shares, accounting for 0.33% of its portfolio, still signifies a substantial investment in the airline company. This move reflects Baillie Gifford (Trades, Portfolio)'s strategic portfolio adjustments and its commitment to value investing principles.

Market and Sector Analysis of Copa Holdings SA

Copa Holdings SA's stock valuation and performance indicators suggest a company with a solid financial foundation and potential for growth. The stock's modest undervaluation, coupled with a GF Score of 78, indicates a favorable outlook. Within the transportation industry, Copa Holdings stands out with a strong return on equity (ROE) of 25.74% and return on assets (ROA) of 8.53%. The firm's top sectors, Technology and Consumer Cyclical, showcase its diversified investment approach, with Copa Holdings complementing its portfolio in the transportation sector.

Notable Investors in Copa Holdings SA

Brandes Investment is currently the largest guru shareholder in Copa Holdings SA, while other notable investment firms like Dodge & Cox also maintain positions in the company. The presence of these esteemed investors underscores the attractiveness of Copa Holdings as a valuable addition to a diversified investment portfolio.

Concluding Thoughts on Baillie Gifford (Trades, Portfolio)'s Trade Action

Baillie Gifford (Trades, Portfolio)'s recent reduction in Copa Holdings SA shares is a strategic move that aligns with the firm's investment philosophy and portfolio management practices. While the trade has a minimal immediate impact on the firm's portfolio, it reflects Baillie Gifford (Trades, Portfolio)'s ongoing assessment of the stock's potential and its broader investment objectives. Value investors following Baillie Gifford (Trades, Portfolio)'s actions may find this transaction indicative of the firm's confidence in Copa Holdings' long-term prospects and the overall health of the transportation industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.