Baillie Gifford Adjusts Stake in Coursera Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Stock Transaction

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, made a significant adjustment to its investment in Coursera Inc (NYSE:COUR), an established player in the online education sector. The firm reduced its holdings by 1,670,372 shares, resulting in a 6.47% change in its stake in the company. This transaction had a minor impact of -0.03% on Baillie Gifford (Trades, Portfolio)'s portfolio, with the shares being traded at a price of $20.21 each. Following the trade, Baillie Gifford (Trades, Portfolio)'s remaining share count in Coursera stood at 24,156,815, representing a 0.45% position in its portfolio and a 15.84% holding in the company.

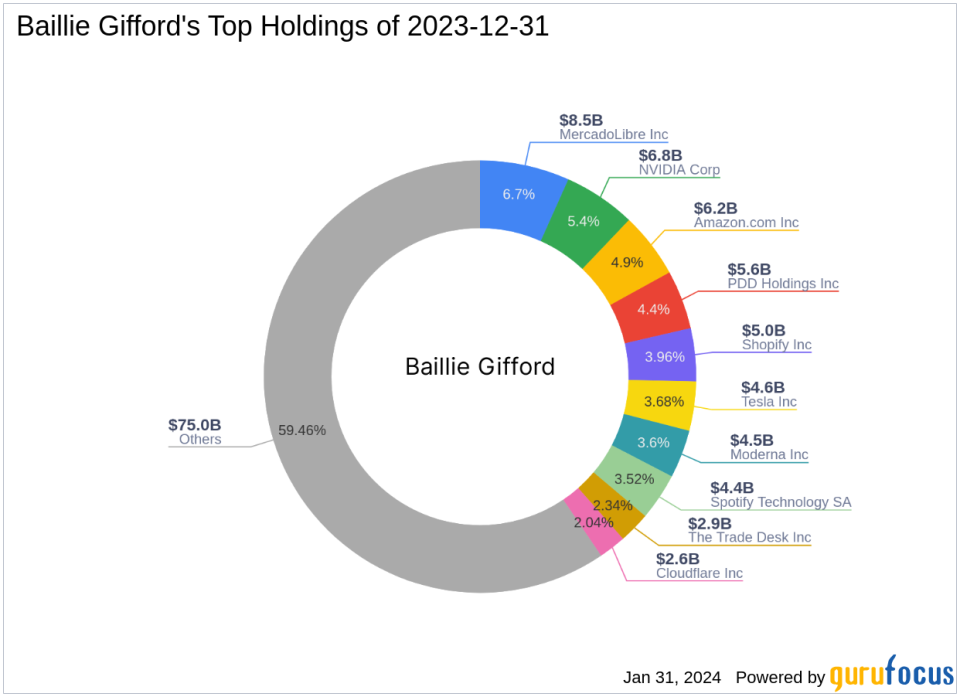

Profile of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio)'s legacy spans over a century, with a focus on prioritizing existing clients' interests and maintaining the integrity of its investment strategies. The firm manages assets for some of the world's largest professional investors, including pension funds and financial institutions across various continents. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in fundamental analysis and proprietary research, aiming to identify companies with the potential for sustainable, above-average growth over the long term. The firm's top holdings include tech giants and consumer cyclical companies such as Amazon.com Inc (NASDAQ:AMZN) and NVIDIA Corp (NASDAQ:NVDA), with a significant equity of $126.19 billion predominantly invested in the Technology and Consumer Cyclical sectors.

Introduction to Coursera Inc

Coursera Inc operates a comprehensive online learning platform that serves learners, educators, and institutions worldwide. The company's mission is to offer accessible, affordable, and relevant educational content through a unified platform that combines high-quality courses, data-driven personalized learning, and credentials from university and industry partners. Coursera's business is segmented into Consumer, Enterprise, and Degrees, with the majority of its revenue stemming from the Consumer segment. The company went public on March 31, 2021, and has since been a key player in the education industry.

Impact of the Trade on Baillie Gifford (Trades, Portfolio)'s Portfolio

The recent trade by Baillie Gifford (Trades, Portfolio) reflects a slight reduction in its exposure to Coursera Inc. With the trade price at $20.21, the firm's decision to reduce its position came at a time when Coursera's stock was deemed "Fairly Valued" according to the GF Value, with a close GF Value to price ratio of 0.99. Since the transaction, Coursera's stock price has experienced a decline of 5.29%, indicating a potential reassessment of the stock's value by the market.

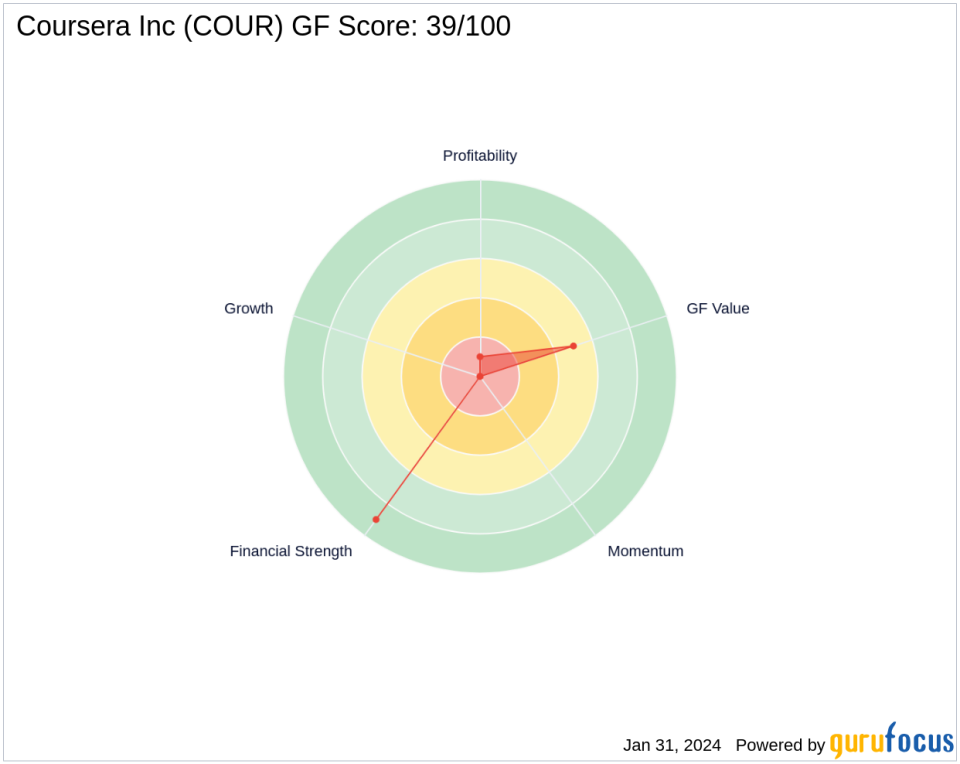

Coursera Inc's Market Performance and Valuation

Coursera Inc currently holds a market capitalization of $2.92 billion, with a stock price that has seen a significant drop of 50.92% since its IPO. The company's stock performance has been underwhelming, with a year-to-date price change ratio of -0.78%. Coursera's GF Score stands at 39 out of 100, suggesting a less favorable future performance potential. The company's financial health is reflected in its high Financial Strength rank of 9 out of 10, but it struggles with a low Profitability Rank of 1 out of 10 and a Growth Rank of 0 out of 10.

Baillie Gifford (Trades, Portfolio)'s Continued Investment in Coursera

Despite the reduction, Coursera Inc remains a notable holding for Baillie Gifford (Trades, Portfolio), accounting for 0.45% of its portfolio. The firm's 15.84% stake in Coursera underscores its belief in the company's long-term growth potential, aligning with Baillie Gifford (Trades, Portfolio)'s investment philosophy of seeking sustainable growth opportunities.

Financial Health and Future Outlook of Coursera

Coursera's balance sheet remains robust, with a high Cash to Debt ratio of 85.15, indicating strong liquidity. However, the company's profitability metrics, such as ROE and ROA, are negative, reflecting current challenges in generating earnings. The future performance potential of Coursera, based on its GF Score and other financial metrics, suggests that there may be headwinds ahead, but the firm's strong financial position could provide a foundation for future growth.

Comparative Market Analysis

In comparison to the broader market and the education industry, Coursera's stock performance has been lackluster. The company's financial health, while strong in terms of liquidity, lags in profitability and growth when compared to industry peers and sector averages. Baillie Gifford (Trades, Portfolio)'s recent transaction may indicate a strategic move to optimize its portfolio in light of these market dynamics.

Conclusion

Baillie Gifford (Trades, Portfolio)'s adjustment in its Coursera Inc holdings reflects a nuanced approach to portfolio management, balancing long-term growth prospects with current market valuations. As Coursera navigates the competitive landscape of online education, investors will closely monitor the company's financial health and growth trajectory to gauge its future performance potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.