Baillie Gifford Adjusts Stake in Wix.com Ltd

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Transaction

Baillie Gifford (Trades, Portfolio), a renowned investment management firm, has recently altered its investment in Wix.com Ltd (NASDAQ:WIX), a leading cloud-based development platform provider. On December 1, 2023, the firm reduced its stake in Wix.com by 118,845 shares, which resulted in a 1.50% change in their holdings. The transaction was executed at a price of $105.7 per share, bringing Baillie Gifford (Trades, Portfolio)'s total share count in Wix.com to 7,788,745. This adjustment had a minor impact of -0.01% on the firm's portfolio, with Wix.com now representing 0.75% of Baillie Gifford (Trades, Portfolio)'s holdings and the firm holding a 13.63% stake in the company.

Profile of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of experience in investment management, has established itself as a partnership focused on the interests of its clients. The firm is recognized for its commitment to professional excellence, managing assets for some of the world's largest professional investors. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in fundamental analysis and proprietary research, aiming to identify companies with the potential for sustainable, above-average growth over the long term. The firm's approach has consistently been to invest with a horizon of five years or more.

Impact on Baillie Gifford (Trades, Portfolio)'s Portfolio

The recent trade has slightly decreased Baillie Gifford (Trades, Portfolio)'s exposure to Wix.com, yet the company remains a significant holding within the firm's portfolio. With a current position of 0.75%, Wix.com is a testament to Baillie Gifford (Trades, Portfolio)'s confidence in the company's future growth potential despite the recent reduction in shares.

Introduction to Wix.com Ltd

Wix.com Ltd, headquartered in Israel, has been a prominent player in the software industry since its IPO on November 6, 2013. The company offers a powerful cloud-based platform that enables users to create and manage websites with ease. Wix.com's product suite includes various web editors catering to different skill levels, from novices to tech-savvy users, and a range of marketing and workflow management applications and services.

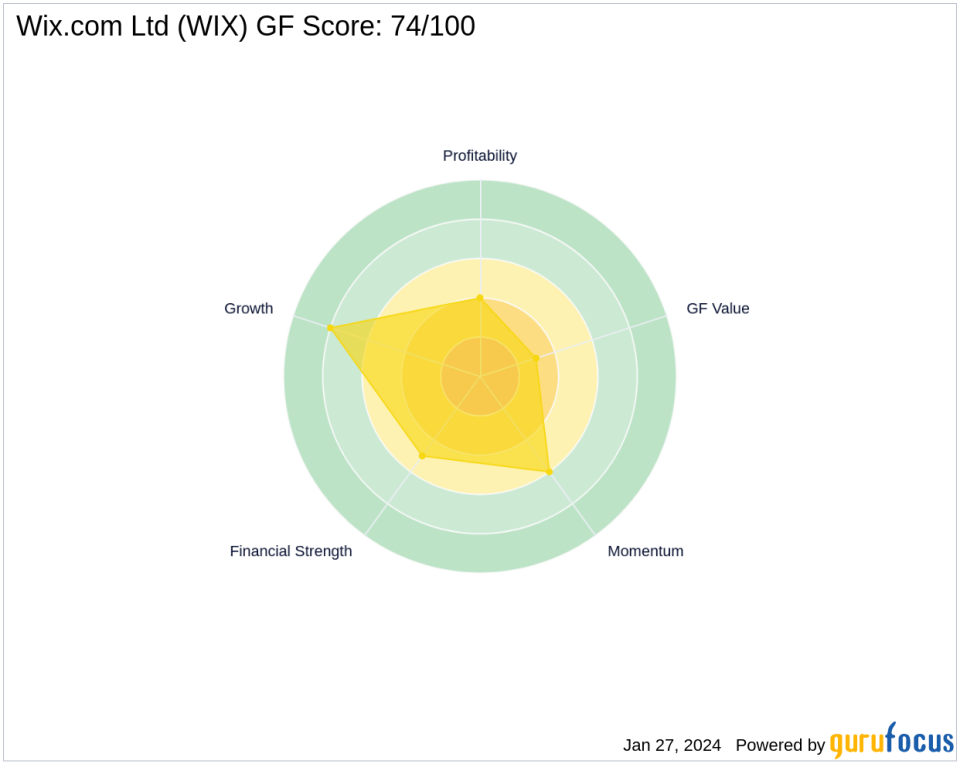

Financial Health and Stock Performance

As of the latest data, Wix.com Ltd boasts a market capitalization of $7.36 billion, with a current stock price of $128.75. Despite being labeled as "Modestly Overvalued" with a GF Value of $103.66, the company's stock has seen a significant gain of 21.81% since the trade date and a year-to-date increase of 9.11%. However, Wix.com's financial health shows mixed signals, with a PE Ratio of 0.00 indicating current losses, and a GF Score of 74/100, suggesting a potential for future performance.

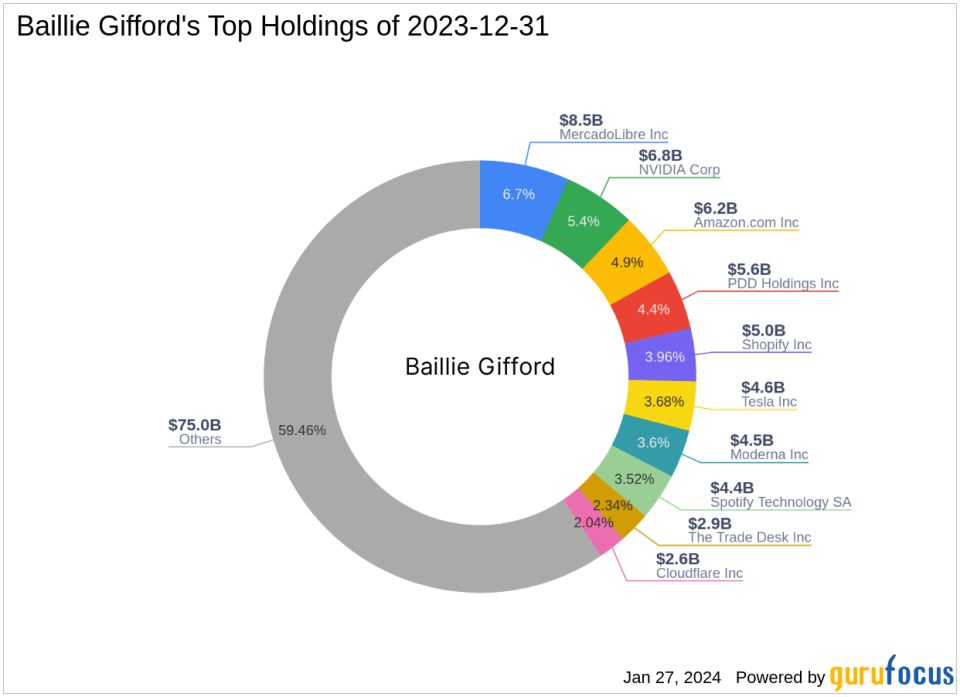

Baillie Gifford (Trades, Portfolio)'s Investment Focus

Baillie Gifford (Trades, Portfolio)'s portfolio is heavily weighted towards the technology and consumer cyclical sectors. The firm's top holdings include industry giants such as Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), and NVIDIA Corp (NASDAQ:NVDA). Wix.com's position within Baillie Gifford (Trades, Portfolio)'s portfolio is significant, reflecting the firm's belief in the company's growth trajectory within the technology sector.

Market Reaction and Future Prospects

Since Baillie Gifford (Trades, Portfolio)'s trade, Wix.com's stock has performed well, with a notable uptick in its price. The company's growth prospects remain strong, as it continues to innovate and expand its offerings in the competitive software industry. Investors are closely watching Wix.com's market position and its ability to capitalize on the increasing demand for web development solutions.

Comparison with Baron Funds

Baron Funds, the largest guru shareholder of Wix.com Ltd, has a different investment approach compared to Baillie Gifford (Trades, Portfolio). While both firms may share an interest in Wix.com, their strategies and positions in the company may vary, reflecting their unique investment philosophies and market outlooks.

Transaction Analysis

Baillie Gifford (Trades, Portfolio)'s recent reduction in Wix.com shares appears to be a strategic move, possibly to rebalance the firm's portfolio or to take profits after the stock's price increase. Despite this reduction, the firm maintains a substantial stake in Wix.com, indicating a continued belief in the company's long-term value. As the market evolves, Baillie Gifford (Trades, Portfolio)'s adept portfolio management will be crucial in navigating the dynamic landscape of the technology sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.