Baillie Gifford Bolsters Position in Chewy Inc with Significant Share Acquisition

Details of Baillie Gifford (Trades, Portfolio)'s Chewy Inc Investment

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, expanded its investment in Chewy Inc (NYSE:CHWY) by adding 2,654,376 shares to its holdings. This transaction has increased the firm's total share count in Chewy Inc to 18,482,764, marking a significant vote of confidence in the online pet retailer. The trade was executed at a price of $18.32 per share, impacting Baillie Gifford (Trades, Portfolio)'s portfolio by 0.04%. Following this addition, Chewy Inc now represents 0.31% of Baillie Gifford (Trades, Portfolio)'s portfolio, with the firm holding a 15.37% stake in the traded company.

Profile of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of investment management experience, is known for its commitment to long-term, bottom-up investing. The firm's approach is rooted in rigorous fundamental analysis and proprietary research, aiming to identify companies with the potential for sustainable, above-average growth. Baillie Gifford (Trades, Portfolio) manages assets for some of the world's largest professional investors, emphasizing the quality of service and the integrity of investment strategies. With a portfolio equity of $126.19 billion, the firm's top holdings include Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), NVIDIA Corp (NASDAQ:NVDA), Shopify Inc (NYSE:SHOP), and PDD Holdings Inc (NASDAQ:PDD), with a strong focus on the Technology and Consumer Cyclical sectors.

Chewy Inc at a Glance

Chewy Inc, the largest e-commerce pet care retailer in the U.S., has made a significant mark in the industry since its IPO on June 14, 2019. The company, which generated $10.1 billion in sales in 2022, offers a wide range of products including pet food, treats, medications, and hard goods. Despite a challenging market, Chewy has maintained a strong market position with a current market capitalization of $7.69 billion and a stock price of $17.82. The company's stock is currently deemed Significantly Undervalued with a GF Value of $49.81, indicating a potential margin of safety for investors.

Strategic Importance of Baillie Gifford (Trades, Portfolio)'s Trade

The recent acquisition of Chewy Inc shares by Baillie Gifford (Trades, Portfolio) is a strategic move that aligns with the firm's investment philosophy of identifying growth opportunities. This addition to Baillie Gifford (Trades, Portfolio)'s portfolio could signal a belief in Chewy's long-term growth potential, despite the stock's current undervaluation and recent market performance. The trade's impact on Chewy Inc's stock performance will be closely watched by investors, as Baillie Gifford (Trades, Portfolio)'s actions often influence market sentiment.

Chewy Inc's Market Context and Valuation

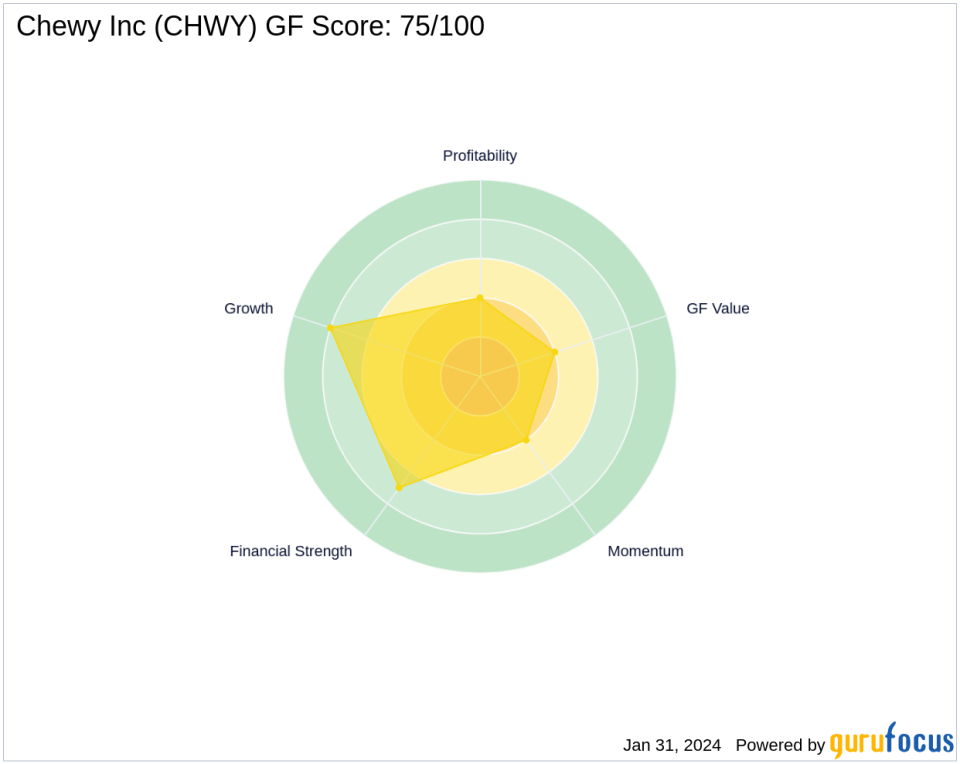

Chewy Inc's stock has experienced a -2.73% price change since the transaction, with a -50.5% change since its IPO and a -20.27% change year-to-date. However, the company's GF Score of 75/100 suggests a strong potential for future performance. Chewy's financial strength is reflected in its Financial Strength rank of 7/10, while its Profitability Rank stands at 4/10. The company's Growth Rank is impressive at 8/10, indicating robust growth prospects.

Chewy Inc within Baillie Gifford (Trades, Portfolio)'s Investment Strategy

Chewy Inc fits well within Baillie Gifford (Trades, Portfolio)'s investment strategy, which favors companies with strong growth potential. The firm's top sector allocations in Technology and Consumer Cyclical complement Chewy's business model, as the pet care retailer continues to innovate and expand its e-commerce platform. Baillie Gifford (Trades, Portfolio)'s increased stake in Chewy Inc demonstrates a belief in the company's ability to outperform in these sectors.

Comparative Performance Metrics and Ranks

Chewy Inc's financial health and market performance are further highlighted by its Piotroski F-Score of 7, indicating a healthy financial situation. The company's Altman Z-Score of 4.79 suggests a low risk of financial distress. Chewy's Operating Margin growth remains at 0.00, reflecting the competitive nature of the retail industry. The company's Revenue Growth over the past three years stands at 24.70%, showcasing its ability to expand its market share.

Identifying the Largest Guru Shareholder in Chewy Inc

While Baillie Gifford (Trades, Portfolio) has increased its holdings in Chewy Inc, the largest guru shareholder remains First Eagle Investment (Trades, Portfolio) Management, LLC. The comparison of Baillie Gifford (Trades, Portfolio)'s position to that of First Eagle Investment (Trades, Portfolio) Management will be of interest to investors monitoring the dynamics between these significant shareholders and their influence on Chewy's stock.

In conclusion, Baillie Gifford (Trades, Portfolio)'s recent trade reflects a strategic investment decision that could have a notable impact on Chewy Inc's stock performance. With the firm's history of successful long-term investments, this move is likely to be followed with interest by the investment community.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.