Baillie Gifford Bolsters Position in Warby Parker Inc

Introduction to the Transaction

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, expanded its investment in Warby Parker Inc (NYSE:WRBY) by acquiring an additional 378,781 shares. This transaction was executed at a trade price of $11.05 per share, increasing the firm's total holdings in Warby Parker to 6,430,452 shares. The trade reflects a 0.06% impact on Baillie Gifford (Trades, Portfolio)'s portfolio, with the firm now holding a 6.57% stake in the eyewear company.

Baillie Gifford (Trades, Portfolio)'s Profile

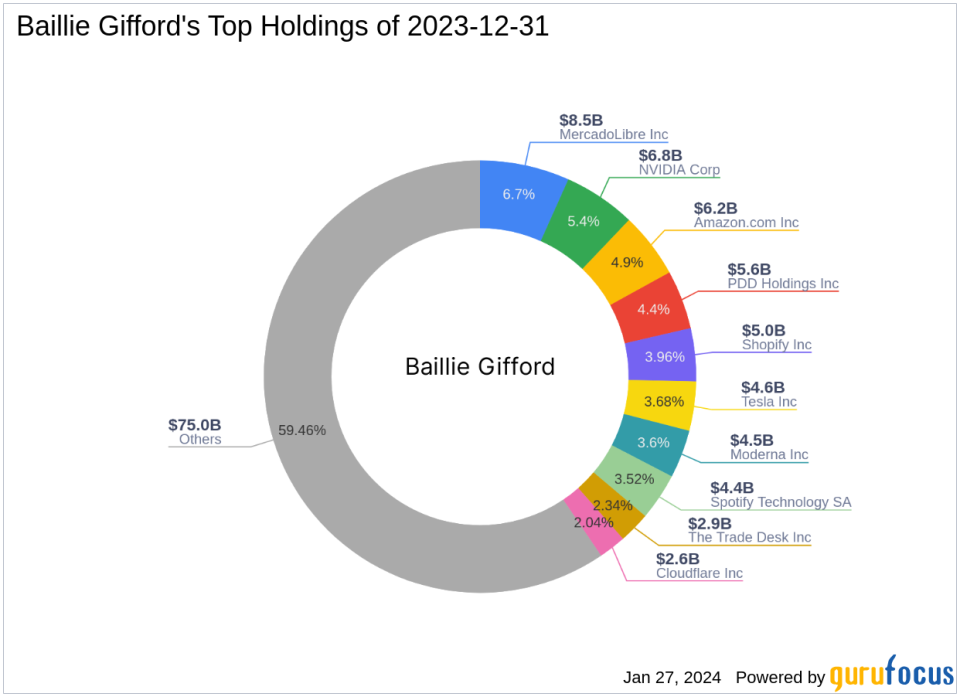

With over a century of experience, Baillie Gifford (Trades, Portfolio) has established itself as a leading investment management partnership, prioritizing the interests of its clients. The firm is recognized for its commitment to professional excellence and managing investments for some of the world's largest professional investors. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in a rigorous process of fundamental analysis and proprietary research, focusing on identifying companies with the potential for sustainable, long-term growth. The firm's top holdings include prominent names such as Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), and NVIDIA Corp (NASDAQ:NVDA), with a strong inclination towards the Technology and Consumer Cyclical sectors.

Warby Parker Inc's Company Overview

Warby Parker Inc, known for its innovative approach to eyewear, operates at the nexus of design, technology, healthcare, and social enterprise. Since its IPO on September 29, 2021, the company has been dedicated to offering designer prescription glasses, contacts, eye exams, and vision tests. Warby Parker generates revenue primarily through the sales of eyewear products and optical services, leveraging both physical stores and digital platforms. Despite its unique market position, the company's financial performance has been under scrutiny, with a current market capitalization of $1.53 billion and a stock price of $12.97, reflecting a significant drop since its public debut.

Analysis of the Trade Impact

The recent acquisition by Baillie Gifford (Trades, Portfolio) signifies a strategic move, as Warby Parker's shares have seen a 17.38% increase since the trade date. However, the company's overall performance since its IPO has declined by 76%. Baillie Gifford (Trades, Portfolio)'s increased stake in Warby Parker, now at 0.06% of its portfolio, suggests a belief in the company's potential for recovery and growth despite the current market challenges.

Market Performance of Warby Parker Inc

Warby Parker's stock currently trades at $12.97, which is higher than the trade price of $11.05. However, the company's PE ratio stands at 0.00, indicating that it is not generating profits at the moment. The lack of a GF Value makes it challenging to assess the stock's intrinsic value, and the stock's gain percentage since the trade is 17.38%. Year-to-date, the stock has experienced a decline of 12.95%, reflecting the volatility and uncertainty surrounding the company's future performance.

Sector and Financial Health of Warby Parker Inc

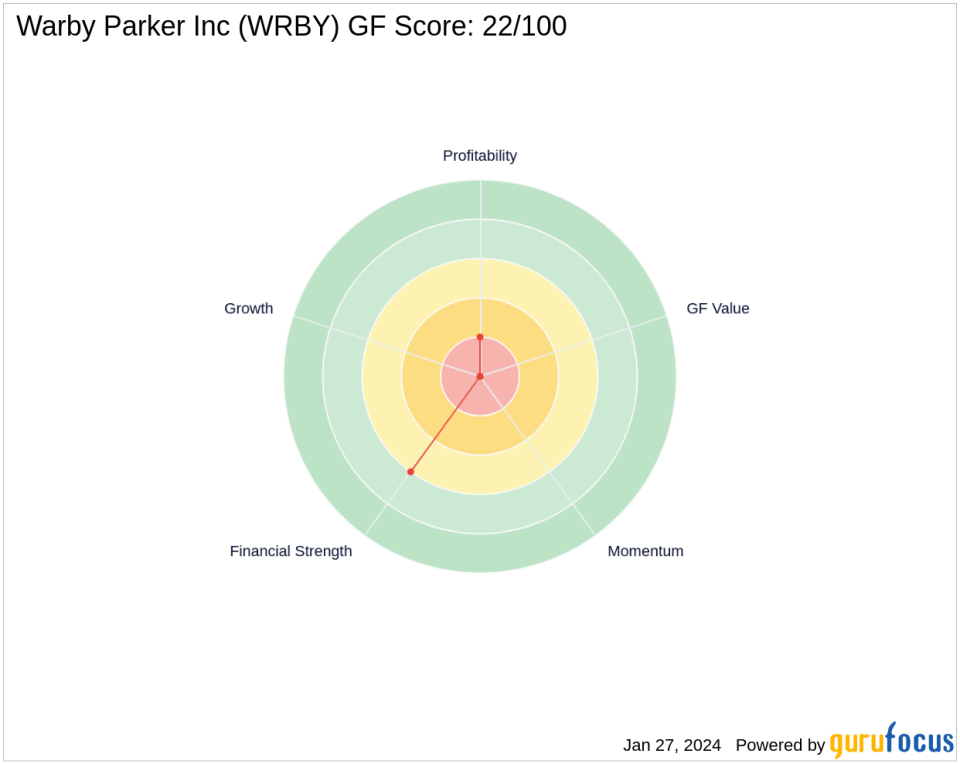

In the competitive Medical Devices & Instruments industry, Warby Parker's financial health is a mixed bag. The company's Financial Strength is rated 6/10, with a Z-Score of 3.01 and a Cash to Debt ratio of 1.27. However, its Profitability Rank is low at 2/10, and the company has not demonstrated significant growth in recent years, with a three-year revenue growth rate of -46.10%.

Other Notable Investors in Warby Parker Inc

Baron Funds stands as the largest guru shareholder in Warby Parker, while other notable investors include Joel Greenblatt (Trades, Portfolio). Their involvement suggests that despite the company's current challenges, there is interest from seasoned investors who may see long-term value in Warby Parker's business model and market position.

Conclusion

Baillie Gifford (Trades, Portfolio)'s recent trade in Warby Parker Inc underscores the firm's confidence in the eyewear company's potential. While the current financial metrics present a cautious picture, the firm's increased stake could be indicative of a belief in Warby Parker's ability to turn around its performance. Investors will be watching closely to see if this value investment approach bears fruit in the long term.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.