Baillie Gifford Bolsters Stake in Affirm Holdings Inc

Significant Addition to Baillie Gifford (Trades, Portfolio)'s Portfolio

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, executed a notable transaction by increasing its investment in Affirm Holdings Inc (NASDAQ:AFRM). The firm added 1,442,321 shares to its position, representing a 7.58% change in shares held. This purchase had a 0.05% impact on Baillie Gifford (Trades, Portfolio)'s portfolio, bringing the total shares owned to 20,467,614. At the time of the transaction, the shares were acquired at a price of $37.67 each. Baillie Gifford (Trades, Portfolio)'s stake in Affirm Holdings now accounts for 0.7% of its equity portfolio and 8.45% of the company's outstanding shares.

Overview of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of experience, stands as a testament to investment management excellence. The firm prioritizes the interests of existing clients, often limiting new business to maintain the quality of its strategies and services. With a diverse client base that spans continents, Baillie Gifford (Trades, Portfolio) manages assets for some of the world's most prominent professional investors, including pension funds and financial institutions.

Investment Philosophy of Baillie Gifford (Trades, Portfolio)

The investment approach at Baillie Gifford (Trades, Portfolio) is rooted in rigorous fundamental analysis and proprietary research. The firm's strategy is to identify companies with the potential for sustainable, above-average growth over the long term, typically over a five-year horizon or more. This bottom-up approach has been the cornerstone of Baillie Gifford (Trades, Portfolio)'s philosophy for over a hundred years.

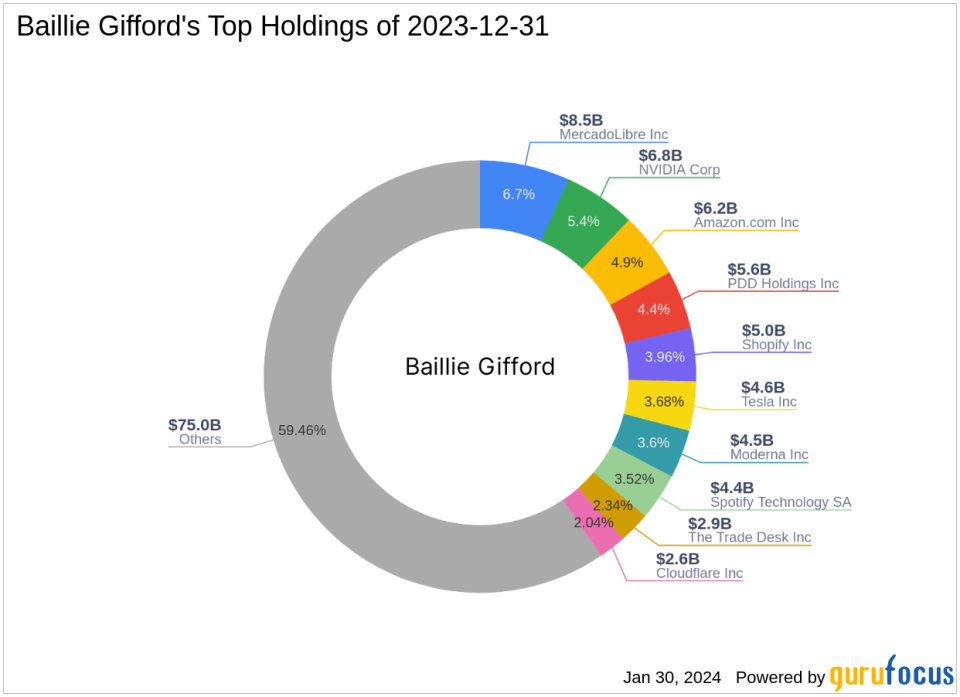

Portfolio Composition and Focus

Baillie Gifford (Trades, Portfolio)'s equity under management currently stands at $126.19 billion, spread across 288 stocks. The firm's top holdings include major players in the technology and consumer cyclical sectors, such as Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), NVIDIA Corp (NASDAQ:NVDA), Shopify Inc (NYSE:SHOP), and PDD Holdings Inc (NASDAQ:PDD). These selections underscore Baillie Gifford (Trades, Portfolio)'s focus on industries poised for growth and innovation.

Insight into Affirm Holdings Inc

Affirm Holdings Inc operates a digital and mobile-first commerce platform, offering payment solutions at the point of sale for consumers, merchant commerce solutions, and a consumer-focused app. The company's revenue streams include card network revenue, gain on sales of loans, interest income, merchant network revenue, and servicing income. With a majority of its revenue generated in the United States, Affirm has a market capitalization of $12.85 billion and a current stock price of $42.59.

Financial Health and Market Performance

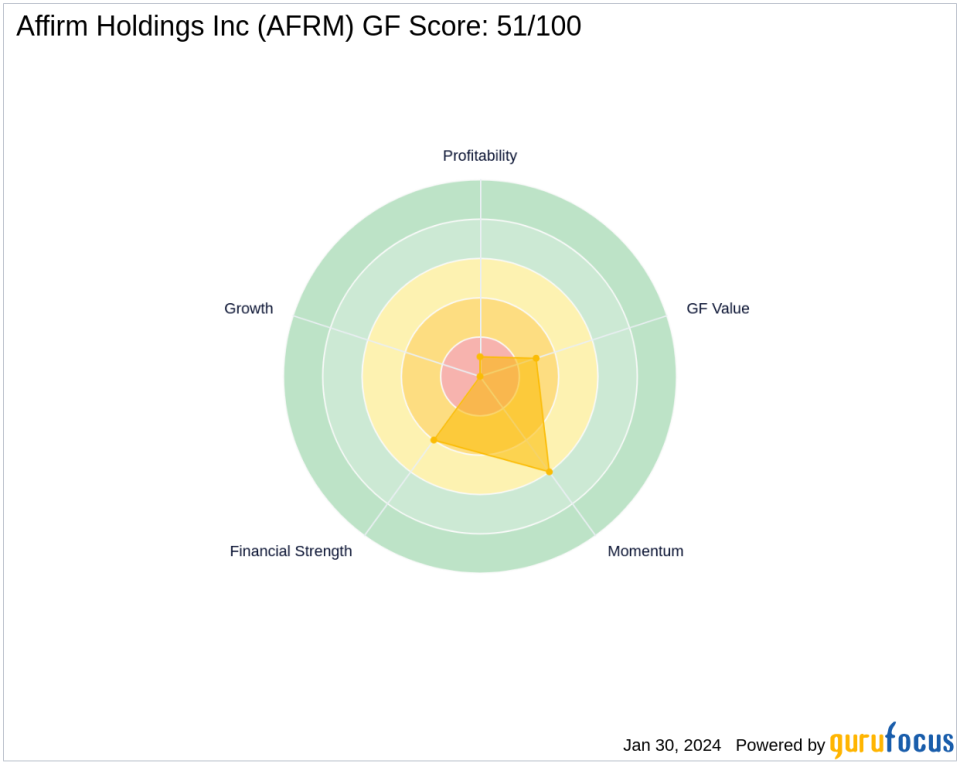

GuruFocus labels Affirm Holdings Inc as "Modestly Overvalued" with a GF Value of $36.43 and a price to GF Value ratio of 1.17. The stock has experienced a 13.06% gain since Baillie Gifford (Trades, Portfolio)'s recent transaction but has seen a significant decline of 53.15% since its IPO. Year-to-date, the stock's performance has dipped by 8.61%. Affirm's financial strength is rated 4/10, while its profitability rank is a low 1/10. The company's growth rank is not applicable, and its GF Value rank stands at 3/10. The stock's momentum rank is 6/10, indicating some positive movement in the market.

Comparative and Predictive Analysis

When compared to the largest guru shareholder, GAMCO Investors, Baillie Gifford (Trades, Portfolio)'s recent acquisition further solidifies its position as a significant investor in Affirm Holdings Inc. The firm's increased stake is a strategic move that aligns with its long-term growth-oriented investment philosophy. With a GF Score of 51/100, Affirm Holdings Inc's future performance potential is considered to be on the lower end, suggesting that Baillie Gifford (Trades, Portfolio) may be taking a contrarian view or sees unrecognized value in the company's prospects.

Transaction Impact and Outlook

Baillie Gifford (Trades, Portfolio)'s recent transaction in Affirm Holdings Inc reflects a confident outlook on the company's future despite mixed financial indicators. The firm's increased stake may provide a vote of confidence in the stock, potentially influencing market sentiment. As Baillie Gifford (Trades, Portfolio) continues to leverage its investment expertise, the impact of this transaction on both the stock and the firm's portfolio will be closely monitored by investors seeking to understand the nuances of value investing.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.