Baillie Gifford Bolsters Stake in American Superconductor Corp

Investment management firm Baillie Gifford (Trades, Portfolio) has recently increased its investment in American Superconductor Corp (NASDAQ:AMSC), a company specializing in energy solutions. On December 1, 2023, Baillie Gifford (Trades, Portfolio) added 594,909 shares to its position, bringing the total shares held to 2,086,279. This transaction had a modest impact of 0.01% on the firm's portfolio, with the shares purchased at a price of $9.78 each. The firm now holds a 6.88% stake in American Superconductor Corp, representing 0.02% of its total portfolio.

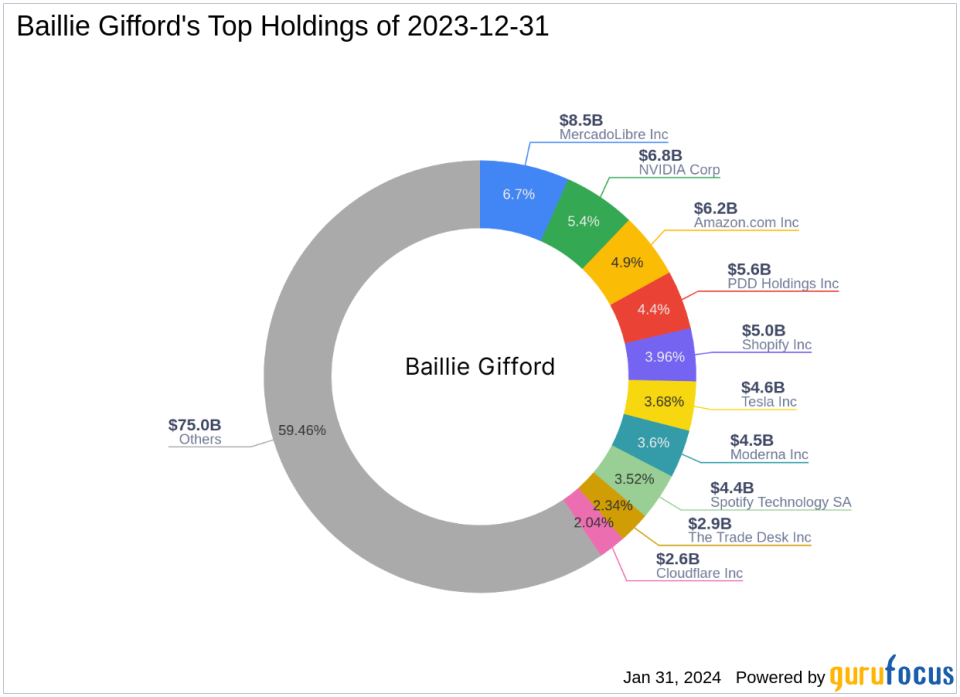

Investment Firm Baillie Gifford (Trades, Portfolio)'s Profile

With over a century of experience, Baillie Gifford (Trades, Portfolio) stands as a testament to investment excellence, focusing on the long-term and bottom-up investing. The firm's dedication to fundamental analysis and proprietary research is the cornerstone of its strategy, aiming to identify companies with sustainable growth potential. Baillie Gifford (Trades, Portfolio)'s portfolio includes a diverse range of international clients, emphasizing the importance of professional investor relationships. The firm's top holdings reflect a strong inclination towards technology and consumer cyclical sectors, with major positions in Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), NVIDIA Corp (NASDAQ:NVDA), Shopify Inc (NYSE:SHOP), and PDD Holdings Inc (NASDAQ:PDD), managing an impressive equity of $126.19 billion.

Overview of American Superconductor Corp

American Superconductor Corp, operating in the USA since its IPO on December 11, 1991, delivers innovative energy solutions through its Grid and Wind segments. The company's Gridtec Solutions optimize network reliability and performance, while Windtec Solutions support the launch of wind turbines. Despite being labeled as 'Modestly Overvalued' with a GF Value of $9.69 and a price to GF Value ratio of 1.14, the stock has seen a 12.58% gain since the trade, currently priced at $11.01. However, the stock has experienced a significant decline of -90.43% since its IPO, with a year-to-date change of 1.57%.

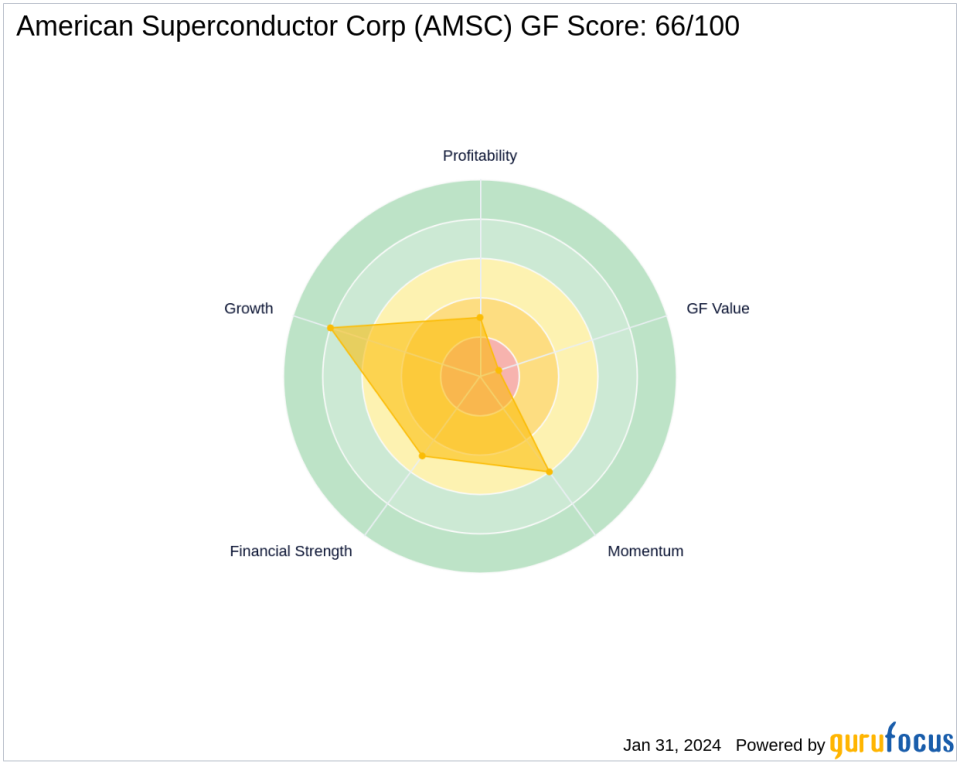

Financial Health and Growth Prospects

American Superconductor Corp's financial health and growth metrics present a mixed picture. The company holds a GF Score of 66/100, indicating potential for future performance. Its Financial Strength is rated at 5/10, while the Profitability Rank is lower at 3/10. The company's Growth Rank is more promising at 8/10, but the GF Value Rank is at the lower end with 1/10. The Momentum Rank stands at 6/10, reflecting a moderate market trend.

Strategic Position in Baillie Gifford (Trades, Portfolio)'s Portfolio

Baillie Gifford (Trades, Portfolio)'s acquisition of additional shares in American Superconductor Corp aligns with its strategy of investing in companies with long-term growth potential. The firm's portfolio is heavily weighted towards technology and consumer cyclical sectors, and AMSC's focus on energy solutions complements this approach. The firm's investment in AMSC, although a small fraction of its total portfolio, signifies confidence in the company's future prospects.

Comparative Market Analysis

When compared to industry peers and overall market trends, American Superconductor Corp's performance has been relatively volatile. The largest guru shareholder in AMSC, Leucadia National, has not disclosed its share percentage, making it challenging to directly compare Baillie Gifford (Trades, Portfolio)'s position. However, Baillie Gifford (Trades, Portfolio)'s recent trade suggests a belief in the company's potential to overcome market challenges and capitalize on growth opportunities.

Conclusion

Baillie Gifford (Trades, Portfolio)'s recent trade in American Superconductor Corp is a strategic move that reflects the firm's investment philosophy and confidence in the company's growth trajectory. While the addition to its stake is modest, it underscores Baillie Gifford (Trades, Portfolio)'s commitment to identifying companies with sustainable growth potential. For American Superconductor Corp and its investors, this could signal a positive outlook, as the backing of a seasoned investment firm like Baillie Gifford (Trades, Portfolio) may bode well for its future performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.