Baillie Gifford Bolsters Stake in Atlassian Corp

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Trade

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, made a significant addition to its holdings in Atlassian Corp (NASDAQ:TEAM), a leader in team collaboration and productivity software. The firm acquired 1,511,318 shares, which marked a 20.71% change in their holdings, at a trade price of $195.11. This transaction increased Baillie Gifford (Trades, Portfolio)'s total share count in Atlassian to 8,807,619, representing a 1.56% position in their portfolio and a 5.68% stake in the company. The trade had a 0.27% impact on Baillie Gifford (Trades, Portfolio)'s portfolio.

Investment Firm Profile: Baillie Gifford (Trades, Portfolio)

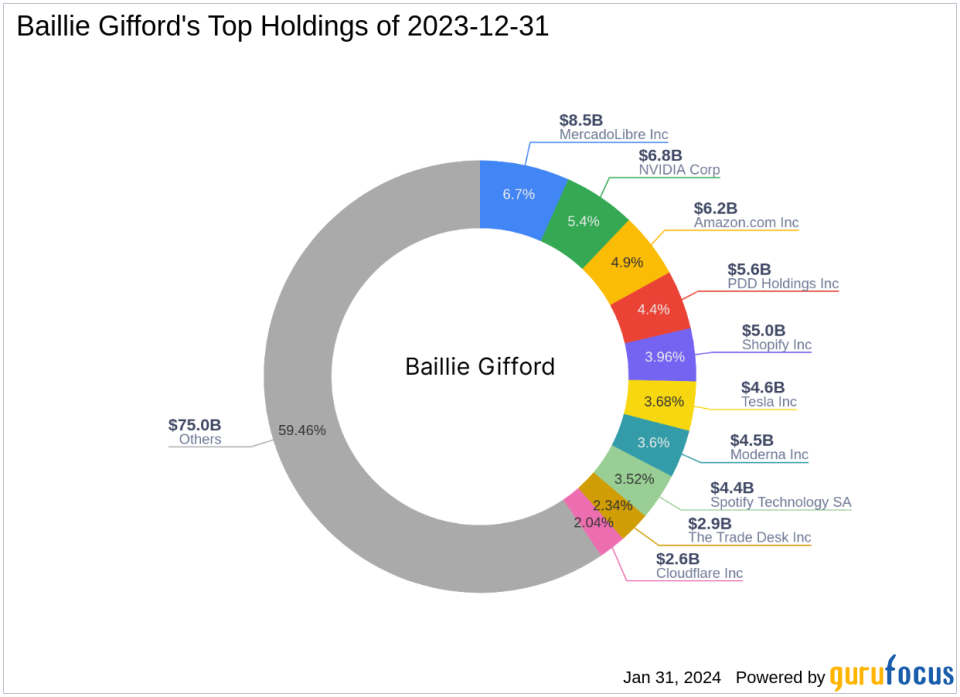

Baillie Gifford (Trades, Portfolio), with over a century of investment experience, operates as a partnership focused on delivering exceptional service and investment strategies to its clients. The firm is known for its long-term, bottom-up investing approach, emphasizing fundamental analysis and proprietary research. Baillie Gifford (Trades, Portfolio) manages a diverse portfolio with a significant emphasis on technology and consumer cyclical sectors, with top holdings including Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), and NVIDIA Corp (NASDAQ:NVDA). The firm's equity stands at $126.19 billion, showcasing its substantial market influence.

Atlassian Corp: A Software Powerhouse

Founded in 2002 and headquartered in Sydney, Australia, Atlassian Corp specializes in software designed to enhance team efficiency and collaboration. The company's offerings span across project management, collaboration tools, and IT help desk solutions, segmented into subscriptions, maintenance, and other services, including its Atlassian Marketplace app store. Atlassian's commitment to innovation has positioned it as a key player in the software industry.

Atlassian's Market Performance

As of the latest data, Atlassian Corp boasts a market capitalization of $64.46 billion, with a current stock price of $249.8. Since its IPO on December 10, 2015, the stock has seen an impressive 802.78% increase. Year-to-date, the stock has risen by 10.2%, and since Baillie Gifford (Trades, Portfolio)'s recent transaction, it has gained 28.03%. Despite these gains, Atlassian's PE Percentage stands at 0.00, indicating the company is not currently profitable.

Financial Health and Valuation Insights

Atlassian's financial health and growth prospects are reflected in its GF Score of 85/100, suggesting strong outperformance potential. The company's GF Value is calculated at $363.29, with the stock trading at a 0.69 price to GF Value ratio, indicating it is significantly undervalued. Atlassian's financial strength and profitability are ranked at 6/10 and 5/10, respectively, while its growth rank is an impressive 9/10. The GF Value Rank and Momentum Rank both stand at 10/10, further highlighting the stock's potential.

Strategic Investment by Baillie Gifford (Trades, Portfolio)

Atlassian Corp represents a strategic investment for Baillie Gifford (Trades, Portfolio), aligning with the firm's philosophy of identifying companies with sustainable growth potential. The addition of Atlassian shares has further diversified Baillie Gifford (Trades, Portfolio)'s portfolio, which is heavily weighted in the technology sector. This move also positions Baillie Gifford (Trades, Portfolio) alongside other notable investors in Atlassian, such as Fisher Asset Management, LLC, Ron Baron (Trades, Portfolio), George Soros (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio).

Comparative Industry Analysis

Within the competitive landscape of the software industry, Atlassian stands out for its robust suite of products and consistent growth. The company's focus on team collaboration software places it at the forefront of a rapidly evolving market, where digital transformation and remote work trends continue to drive demand.

Concluding Thoughts on Baillie Gifford (Trades, Portfolio)'s Transaction

Baillie Gifford (Trades, Portfolio)'s recent acquisition of additional shares in Atlassian Corp underscores the firm's confidence in the software company's future. This transaction not only enhances Baillie Gifford (Trades, Portfolio)'s portfolio but also reflects a shared vision for long-term growth. With Atlassian's strong GF Score, undervalued status, and promising growth metrics, the investment is poised to contribute positively to Baillie Gifford (Trades, Portfolio)'s performance, aligning seamlessly with its investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.