Baillie Gifford Bolsters Stake in Coupang Inc

Baillie Gifford (Trades, Portfolio), a renowned investment management firm, has recently increased its investment in Coupang Inc (NYSE:CPNG), an e-commerce giant based in the USA. On December 1, 2023, the firm added 25,843,034 shares to its holdings, bringing the total share count to 145,524,128. This transaction had a 0.37% impact on Baillie Gifford (Trades, Portfolio)'s portfolio and was executed at a trade price of $15.80 per share. The firm's position in Coupang Inc now represents 2.09% of its portfolio and 9.02% of the company's outstanding shares.

About Baillie Gifford (Trades, Portfolio)

With over a century of experience, Baillie Gifford (Trades, Portfolio) has established itself as a leading investment management partnership, prioritizing the interests of its clients. The firm is known for its commitment to professional excellence and managing investments for some of the world's largest professional investors. Baillie Gifford (Trades, Portfolio)'s investment philosophy is centered on long-term, bottom-up investing, focusing on companies with the potential for sustainable, above-average growth. The firm's approach is underpinned by rigorous fundamental analysis and proprietary research, aiming to identify global opportunities over a five-year horizon or more.

Coupang Inc at a Glance

Coupang Inc, with its stock symbol CPNG, operates in the retail - cyclical industry and went public on March 11, 2021. The company's business model includes Product Commerce and Developing Offerings, with the former being the primary revenue driver. Coupang Inc's market capitalization stands at $25.03 billion. The company has been making strides in the e-commerce sector by selling a wide array of products, from apparel to electronics and food items.

Financial Health and Market Position of Coupang Inc

Coupang Inc's current stock price is $14, which is below the trade price of $15.80 and significantly undervalued according to the GF Value of $20.07. The stock's price to GF Value ratio is 0.70, indicating a potential margin of safety for investors. However, the stock has experienced a decline of 11.39% since the trade date and a substantial drop of 77.95% since its IPO. The company's year-to-date performance also reflects a downward trend with an 11% decrease. Coupang Inc's GF Score stands at 43/100, suggesting poor future performance potential, with a Financial Strength rank of 7/10 and a Profitability Rank of 2/10. The company's Growth Rank is not applicable, while its GF Value Rank is a perfect 10/10. The stock's Piotroski F-Score is 7, and its Altman Z score is 3.40, indicating financial stability. The company's cash to debt ratio is 1.74, and it has an interest coverage of 10.23.

Impact of Baillie Gifford (Trades, Portfolio)'s Increased Stake

The addition of Coupang Inc shares has a notable impact on Baillie Gifford (Trades, Portfolio)'s portfolio, reinforcing the firm's confidence in the e-commerce company's growth prospects. With a 2.09% portfolio position, Coupang Inc becomes a significant holding for Baillie Gifford (Trades, Portfolio), reflecting its investment strategy that targets companies with high growth potential.

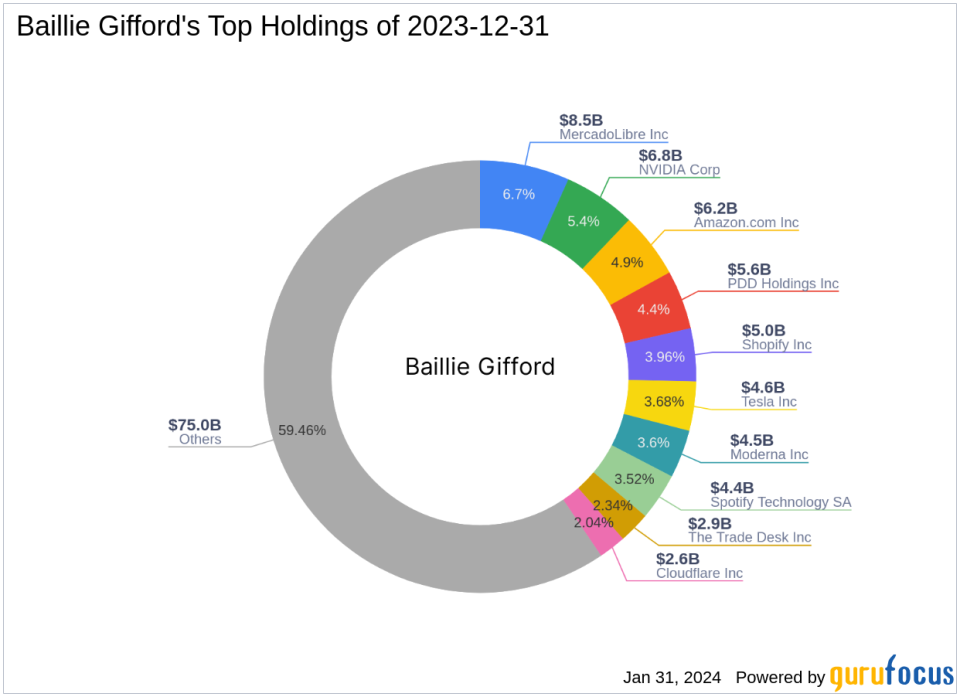

Baillie Gifford (Trades, Portfolio)'s Sector Focus and Top Holdings

Baillie Gifford (Trades, Portfolio)'s top sector focus is on Technology and Consumer Cyclical, aligning with its investment in Coupang Inc. The firm's top holdings include Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), NVIDIA Corp (NASDAQ:NVDA), Shopify Inc (NYSE:SHOP), and PDD Holdings Inc (NASDAQ:PDD), showcasing a preference for innovative and market-leading companies.

Market Sentiment and Other Gurus' Positions

The market sentiment towards Coupang Inc is mixed, with various indicators and ranks reflecting cautious optimism. Other notable gurus holding positions in Coupang Inc include Ron Baron (Trades, Portfolio), Chris Davis (Trades, Portfolio), and Jefferies Group (Trades, Portfolio), with the Bill & Melinda Gates Foundation Trust being the largest guru shareholder.

Conclusion

Baillie Gifford (Trades, Portfolio)'s recent trade in Coupang Inc underscores the firm's strategy of investing in companies with long-term growth potential. Despite the current undervaluation and mixed market sentiment, Baillie Gifford (Trades, Portfolio)'s increased stake may signal confidence in Coupang Inc's future prospects. Value investors considering Coupang Inc should weigh the firm's financial health, market position, and the implications of Baillie Gifford (Trades, Portfolio)'s investment decision.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.