Baillie Gifford Bolsters Stake in Elastic NV

On January 1, 2024, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, made a significant addition to its investment portfolio by acquiring 2,400,870 shares of Elastic NV (NYSE:ESTC). This transaction increased the firm's total holdings in the company to 10,165,240 shares, marking a substantial vote of confidence in the software company's future prospects. The trade, which had a 0.21% impact on Baillie Gifford (Trades, Portfolio)'s portfolio, was executed at a price of $112.7 per share. As of the trade date, Elastic NV represented 0.91% of Baillie Gifford (Trades, Portfolio)'s portfolio, with the firm holding a 10.20% stake in the traded company.

Baillie Gifford (Trades, Portfolio)'s Investment Approach

Baillie Gifford (Trades, Portfolio) has established itself as a prominent player in the investment management industry, with a history spanning over a century. The firm is known for prioritizing the interests of existing clients and often limits new business to maintain the quality of its strategies and services. With a client base that includes some of the world's largest professional investors, Baillie Gifford (Trades, Portfolio) manages a diverse range of international portfolios. The firm's investment philosophy is rooted in a rigorous process of fundamental analysis and proprietary research, focusing on long-term, bottom-up investing. Baillie Gifford (Trades, Portfolio) seeks to identify companies with the potential for sustainable, above-average growth over periods of five years or more.

About Elastic NV

Elastic NV, headquartered in the Netherlands, is a software company that specializes in search-adjacent products. Since its IPO on October 5, 2018, Elastic has been at the forefront of enterprise search, observability, and security. The company's search engine is adept at processing both structured and unstructured data, providing valuable insights. Elastic NV operates through segments such as Elastic Cloud, Other subscription, and Services. With a market capitalization of $12.46 billion and a current stock price of $125.04, Elastic NV is considered modestly overvalued according to the GF Value, with a price to GF Value ratio of 1.16.

Trade Analysis and Portfolio Impact

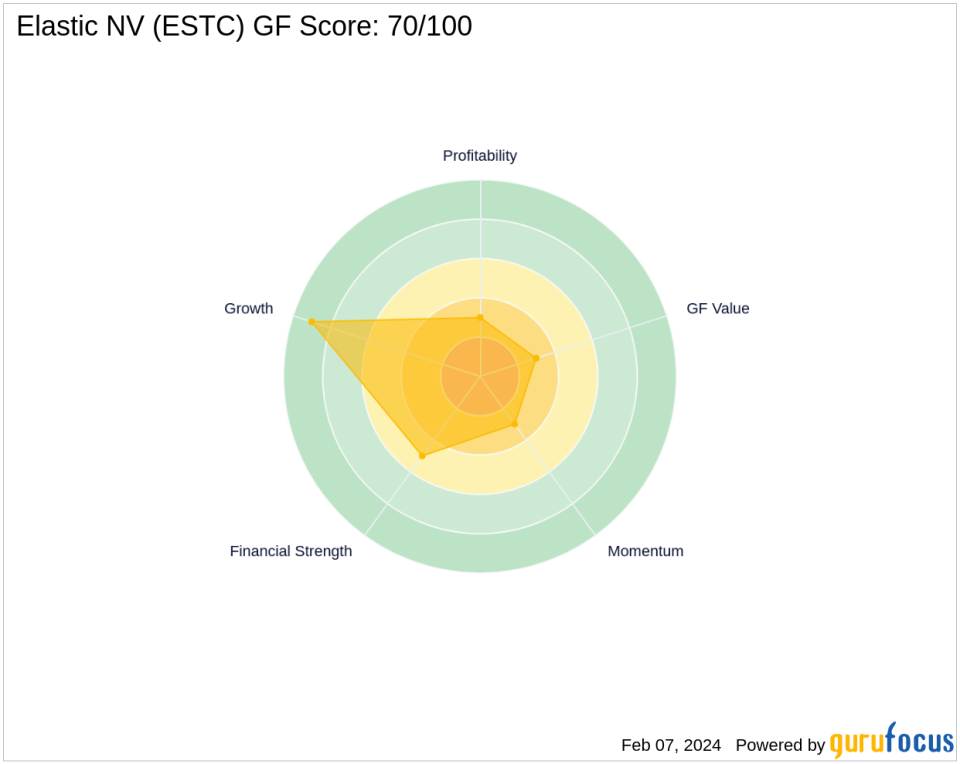

Baillie Gifford (Trades, Portfolio)'s recent acquisition of Elastic NV shares has positioned the stock as a notable component of the firm's portfolio. The trade price of $112.7 is now overshadowed by the current stock price of $125.04, reflecting a gain of 10.95% since the transaction. This gain indicates a positive trajectory for Elastic NV, which has also seen a year-to-date price increase of 17.36%. The stock's GF Score of 70/100 suggests that while there may be some concerns, there is still potential for future performance.

Market Performance and Elastic NV's Position

Elastic NV has experienced a 78.63% increase in stock price since its IPO, demonstrating strong market performance. The company's financial health, as indicated by its Financial Strength rank of 5/10 and a Piotroski F-Score of 6, suggests a stable foundation. However, its Profitability Rank of 3/10 and Growth Rank of 9/10 present a mixed picture, with strong growth prospects but current profitability challenges.

Conclusion

Baillie Gifford (Trades, Portfolio)'s strategic move to increase its stake in Elastic NV underscores the firm's confidence in the software company's growth potential. This transaction not only reflects Baillie Gifford (Trades, Portfolio)'s commitment to long-term, bottom-up investing but also highlights Elastic NV's promising position within the technology sector. As Baillie Gifford (Trades, Portfolio) continues to manage a diverse and robust portfolio, with top holdings in sectors like Technology and Consumer Cyclical, the addition of Elastic NV shares could prove to be a valuable asset in the firm's investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.