Baillie Gifford Bolsters Stake in Nanobiotix SA

Baillie Gifford (Trades, Portfolio), the renowned investment management firm, has recently increased its investment in Nanobiotix SA, a company at the forefront of nanotechnology in cancer treatment. On December 1, 2023, Baillie Gifford (Trades, Portfolio) added 932,835 shares to its position, bringing the total number of shares held to 2,869,030. This transaction was executed at a trade price of $5.81 per share, reflecting a 48.18% change in the firm's holdings and a 6.21% ownership in Nanobiotix SA. Despite the significant addition, the trade had a negligible impact on Baillie Gifford (Trades, Portfolio)'s portfolio, with the position accounting for just 0.02% of its total investments.

Investment Management with a Century of Expertise

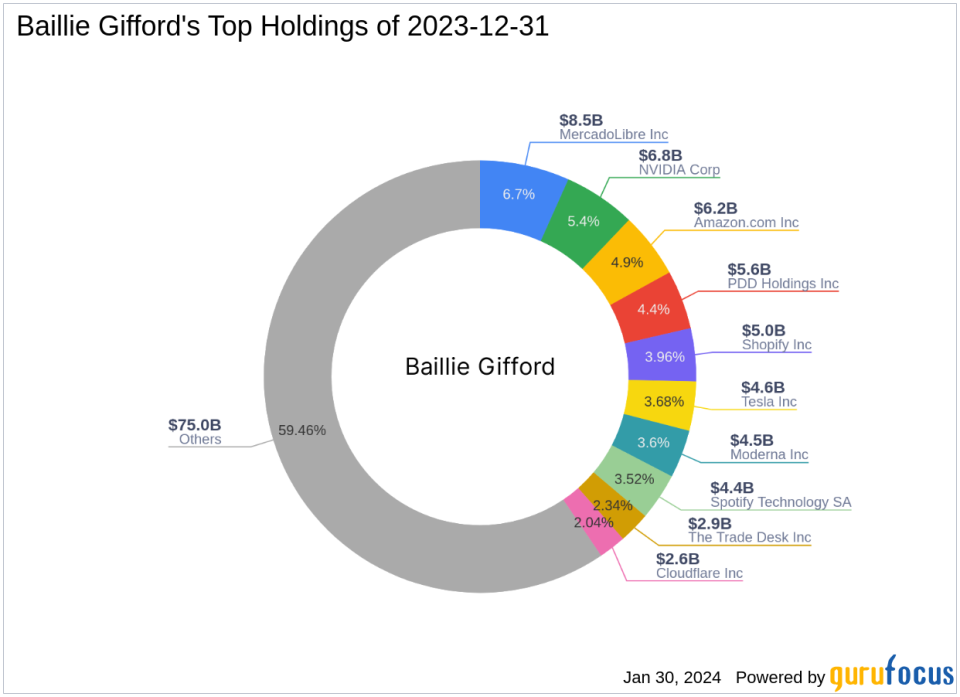

Baillie Gifford (Trades, Portfolio)'s legacy spans over a century, with a focus on prioritizing existing clients' interests and maintaining the integrity of its investment strategies. The firm manages assets for some of the world's largest professional investors, including pension funds and financial institutions across various continents. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in a long-term, bottom-up approach, emphasizing fundamental analysis and proprietary research to identify companies with sustainable growth potential. The firm's top holdings include prominent names such as Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), and NVIDIA Corp (NASDAQ:NVDA), with a significant equity of $126.19 billion predominantly invested in the Technology and Consumer Cyclical sectors.

Nanobiotix SA: Pioneering Nanotechnology in Cancer Treatment

Nanobiotix SA, listed under the stock symbol NBTX and headquartered in France, made its public debut on December 11, 2020. The company is dedicated to revolutionizing cancer treatment by enhancing the efficacy of radiotherapy. Its flagship product candidate, NBTXR3, is designed to amplify the impact of radiotherapy on tumor cells while sparing healthy tissues. Nanobiotix operates primarily in the biotechnology industry, with a market capitalization of $385.36 million.

Market Performance and Valuation of Nanobiotix SA

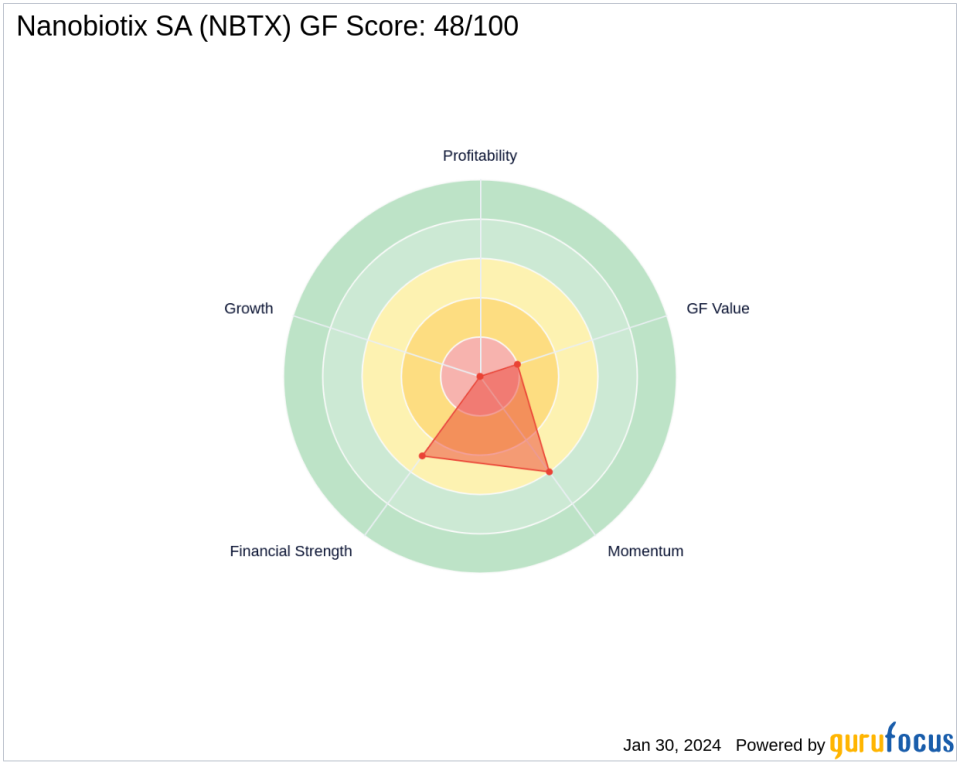

Since its IPO, Nanobiotix SA's stock price has experienced a decline of 56.12%, but it has shown signs of recovery with a year-to-date increase of 11.37% and a significant gain of 40.79% since Baillie Gifford (Trades, Portfolio)'s trade date. Despite the recent uptick, the stock is currently labeled as a "Possible Value Trap" by GuruFocus, urging investors to think twice before investing. The GF Value of the stock stands at $4,267.07, but with a current stock price of $8.18, the price to GF Value ratio is not applicable, indicating that the company may not be undervalued. The GF Score of Nanobiotix SA is 48/100, suggesting poor future performance potential.

Strategic Alignment with Baillie Gifford (Trades, Portfolio)'s Investment Philosophy

The addition of Nanobiotix SA to Baillie Gifford (Trades, Portfolio)'s portfolio aligns with the firm's strategy of investing in companies with the potential for sustainable, long-term growth. Baillie Gifford (Trades, Portfolio)'s expertise in identifying such opportunities is evident in its diverse portfolio, which includes a mix of high-growth technology and consumer cyclical companies. The firm's decision to increase its stake in Nanobiotix may signal confidence in the company's innovative approach to cancer treatment and its growth prospects.

Assessing the Impact of Baillie Gifford (Trades, Portfolio)'s Trade

Baillie Gifford (Trades, Portfolio)'s recent acquisition of additional shares in Nanobiotix SA could have several implications for its portfolio. Although the trade represents a small fraction of the firm's total investments, it may indicate a strategic move to capitalize on the potential upside of Nanobiotix's innovative cancer treatment solutions. The timing of the trade, amidst a recovering stock price, could also suggest that Baillie Gifford (Trades, Portfolio) sees a favorable risk-reward scenario unfolding for Nanobiotix.

Financial Health and Future Prospects of Nanobiotix SA

Nanobiotix SA's financial health, as indicated by its Financial Strength and Profitability Ranks, presents a mixed picture. The company's balance sheet receives a moderate score of 5/10, while its profitability and growth ranks are currently at 0/10, reflecting challenges in these areas. The GF Value Rank is also low at 2/10, suggesting that the stock may not be undervalued relative to its intrinsic value. However, with a Momentum Rank of 6/10, there could be short-term trading opportunities based on recent price movements.

Conclusion: Baillie Gifford (Trades, Portfolio)'s Calculated Bet on Nanobiotix SA

Baillie Gifford (Trades, Portfolio)'s increased stake in Nanobiotix SA is a noteworthy development for investors tracking the firm's moves. While the trade's impact on the overall portfolio is minimal, it underscores Baillie Gifford (Trades, Portfolio)'s confidence in Nanobiotix's potential to disrupt the cancer treatment landscape. Investors following this transaction should consider the company's innovative approach, current market performance, and Baillie Gifford (Trades, Portfolio)'s long-term investment philosophy when evaluating the prospects of Nanobiotix SA.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.