Baillie Gifford Bolsters Stake in Ryanair Holdings PLC

Investment management firm Baillie Gifford (Trades, Portfolio) has recently increased its investment in Ryanair Holdings PLC (NASDAQ:RYAAY), signaling confidence in the airline's growth prospects. On December 1, 2023, Baillie Gifford (Trades, Portfolio) added 63,240,240 shares to its position, bringing the total shares held to 71,431,664. This transaction had a 6.48% impact on their portfolio, with the trade executed at a price of $120.17 per share. The firm's position in Ryanair now represents 7.32% of its portfolio, with a 6.27% holding in the airline company.

Investment Firm Profile: Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of investment management experience, is known for its commitment to long-term, bottom-up investing and fundamental analysis. The firm manages assets for some of the world's largest professional investors, focusing on identifying companies with the potential for sustainable, above-average growth. Baillie Gifford (Trades, Portfolio)'s investment philosophy has been a cornerstone of its strategy, aiming to capitalize on global opportunities over extended periods.

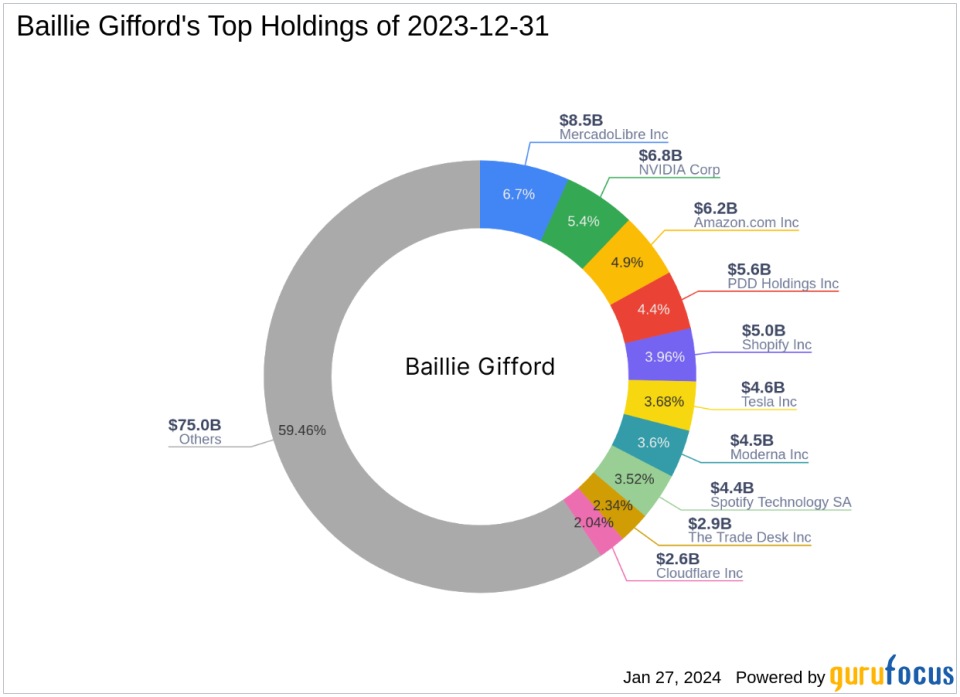

Portfolio Composition of Baillie Gifford (Trades, Portfolio)

With $126.19 billion in equity under management, Baillie Gifford (Trades, Portfolio)'s portfolio comprises 288 stocks. The firm's top holdings include prominent names such as Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), and NVIDIA Corp (NASDAQ:NVDA), with a significant focus on the Technology and Consumer Cyclical sectors. These sectors align with the firm's strategy of investing in high-growth potential companies.

Overview of Ryanair Holdings PLC

Ryanair Holdings PLC, based in Ireland, operates Europe's leading airline group by passenger numbers. The company's low-cost, no-frills model has been successful in offering competitive fares for short-haul flights within Europe. In the fiscal year 2020, Ryanair carried 149 million passengers and generated sales of EUR 8.5 billion. The company's market capitalization stands at $29.66 billion, with a diverse business model encompassing various segments such as Malta Air and Ryanair DAC.

Financial and Market Analysis of Ryanair Holdings PLC

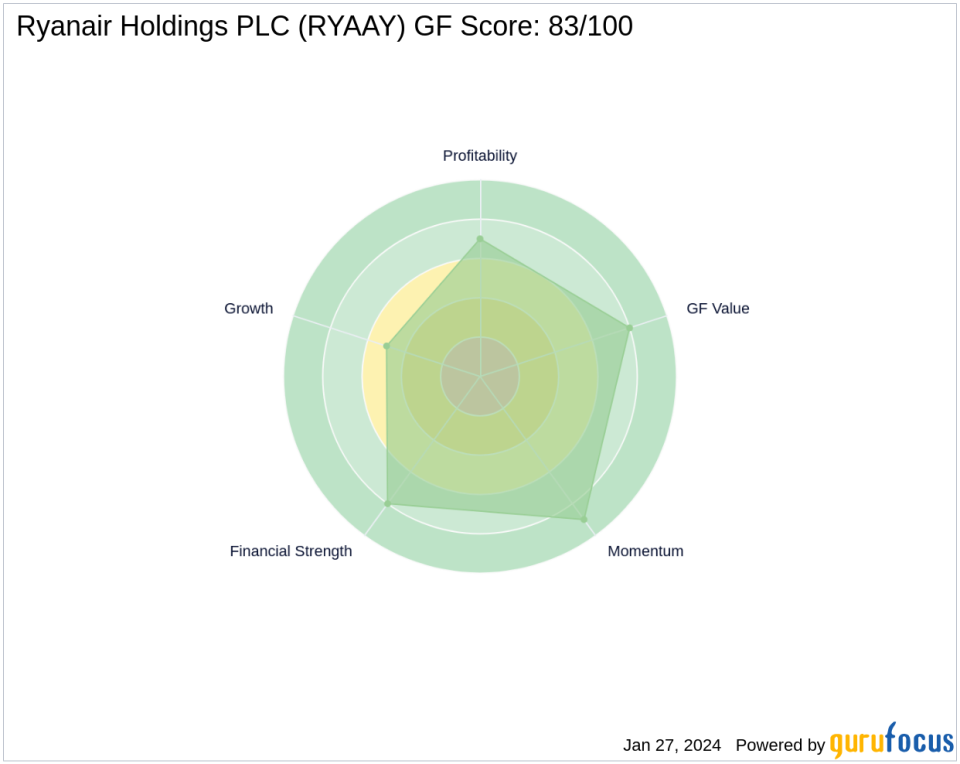

Since its IPO in 1997, Ryanair's stock has seen a staggering 3,878.9% increase. The year-to-date percentage change is a modest 0.61%. According to GuruFocus valuation metrics, Ryanair is currently "Significantly Undervalued" with a GF Value of $232.07 and a Price to GF Value ratio of 0.56. The stock's GF Score stands at an impressive 83/100, indicating good outperformance potential.

Ryanair's Financial Health Indicators

Ryanair's financial health is robust, with a Financial Strength rank of 8/10 and a Profitability Rank of 7/10. The company's Growth Rank is 5/10, reflecting steady progress. Key financial ratios such as ROE and ROA are strong at 23.17% and 9.61%, respectively. The airline's cash to debt ratio is 1.29, and it boasts an interest coverage ratio of 40.19, indicating a solid ability to cover financial obligations.

Market Reaction and Future Outlook

Since Baillie Gifford (Trades, Portfolio)'s trade, Ryanair's stock price has gained 8.27%. The firm's future performance potential remains promising, as reflected by its high GF Score and other financial indicators. The airline's commitment to maintaining low costs and expanding its route network could continue to drive profitability and shareholder value.

Comparative Analysis of Ryanair Holdings PLC

Ryanair's Momentum Rank is 9/10, showcasing its strong market performance. The stock's RSI values indicate a positive trend, with a 14-day RSI of 61.00. When compared to industry peers and historical growth metrics, Ryanair's consistent growth in EBITDA and revenue over the past three years positions it favorably within the transportation industry.

Transaction Analysis: Baillie Gifford (Trades, Portfolio)'s Increased Stake in Ryanair

The recent acquisition by Baillie Gifford (Trades, Portfolio) reflects a strategic move to capitalize on Ryanair's undervalued status and its potential for long-term growth. The addition of over 63 million shares not only demonstrates the firm's confidence in Ryanair's business model but also significantly impacts its portfolio composition. As Ryanair continues to navigate the competitive airline industry, Baillie Gifford (Trades, Portfolio)'s increased stake could yield substantial returns if the company's growth trajectory remains on course.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.