Baillie Gifford Bolsters Stake in Sana Biotechnology Inc

Baillie Gifford (Trades, Portfolio), the renowned investment management firm, has recently expanded its investment portfolio by adding a significant number of shares in Sana Biotechnology Inc (NASDAQ:SANA). This move underscores the firm's confidence in the biotechnology company's growth potential. On February 1, 2024, Baillie Gifford (Trades, Portfolio) acquired an additional 210,603 shares of Sana Biotechnology, reflecting a 2.07% change in their holdings and bringing the total shares owned to 10,360,620.

Investment Firm with a Century of Expertise

Baillie Gifford (Trades, Portfolio)'s legacy spans over a century, with a focus on prioritizing existing clients' interests and maintaining the integrity of its investment strategies. The firm is recognized for managing assets for some of the world's largest professional investors, including pension funds and financial institutions across various continents. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in a long-term, bottom-up approach, emphasizing fundamental analysis and proprietary research to identify companies with sustainable growth potential.

Transaction Details and Portfolio Impact

The transaction, dated February 1, 2024, saw Baillie Gifford (Trades, Portfolio) add 210,603 shares of Sana Biotechnology at a trade price of $5.83 per share. This addition has a modest impact on the firm's portfolio, with SANA now representing 0.05% of Baillie Gifford (Trades, Portfolio)'s holdings and the firm owning 4.70% of Sana Biotechnology's shares. Despite the seemingly small percentage, this trade reflects Baillie Gifford (Trades, Portfolio)'s strategic decision to increase its stake in the biotech sector.

Overview of Sana Biotechnology Inc

Sana Biotechnology Inc, a player in the biotechnology industry, focuses on developing engineered cells as medicines for a variety of diseases, including oncology, diabetes, and central nervous system disorders. Since its IPO on February 4, 2021, the company has been engaged in advancing its pipeline of product candidates. With a market capitalization of $2.13 billion, Sana Biotechnology is poised to address significant unmet treatment needs.

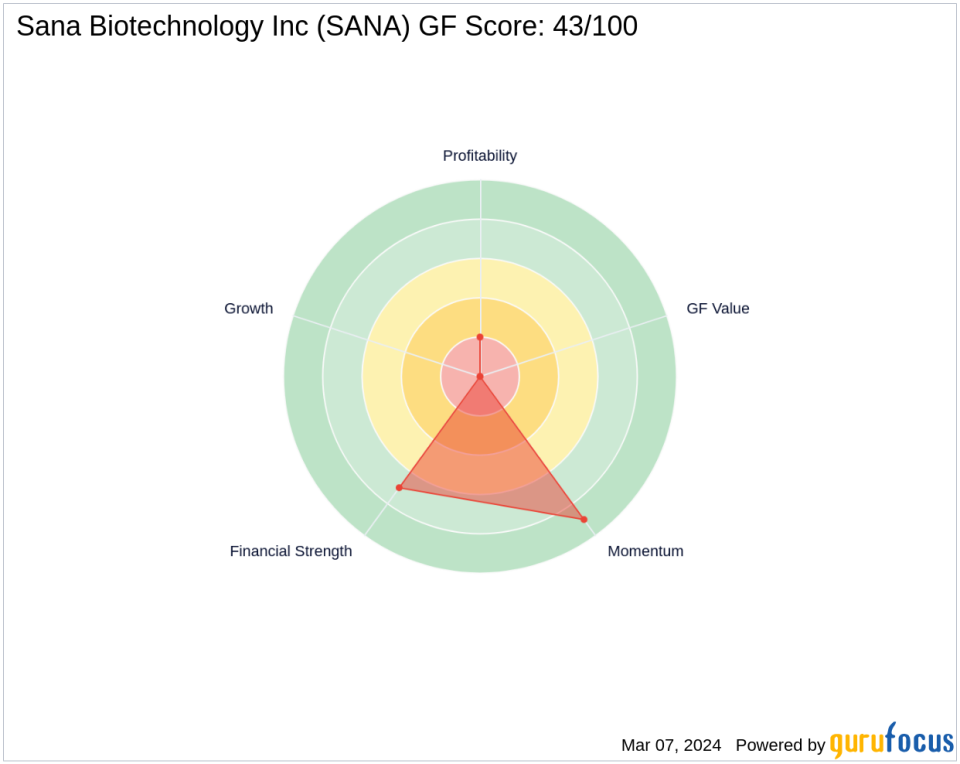

Financial Health and Market Performance of SANA

As of the latest data, Sana Biotechnology's stock price stands at $9.73, a substantial increase from the trade price of $5.83. However, the company's financial health remains a concern, with a Financial Strength rank of 7/10 and a Profitability Rank of 2/10. The GF Score of 43/100 indicates poor future performance potential, and the lack of a GF Value Rank suggests that the stock's intrinsic value cannot be evaluated at this time.

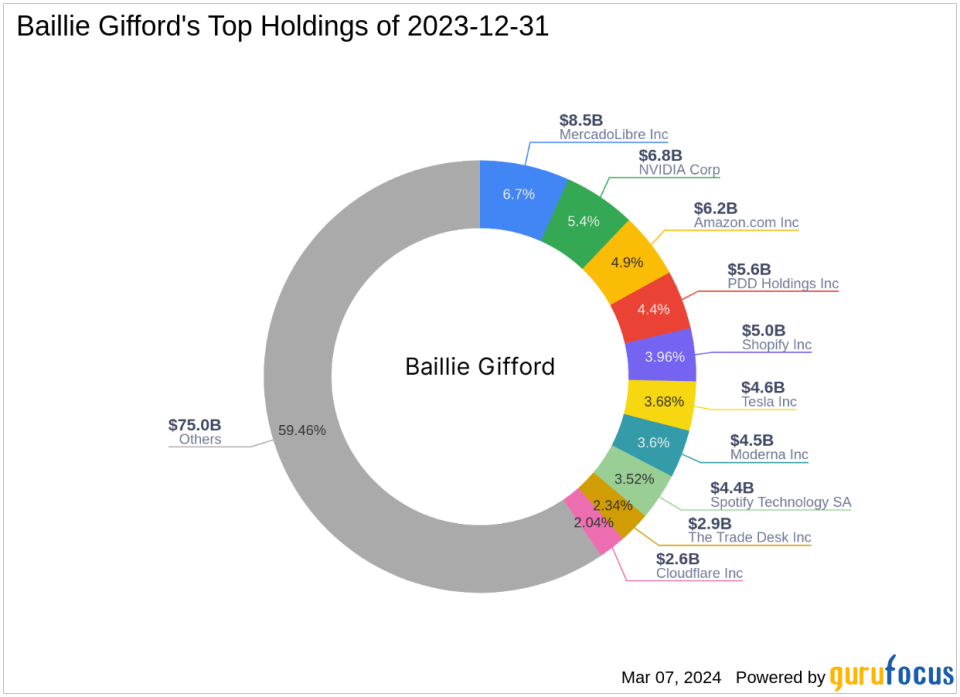

Strategic Holdings and Investment Strategy

Baillie Gifford (Trades, Portfolio)'s portfolio is heavily weighted in the Technology and Consumer Cyclical sectors, with top holdings including Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), and NVIDIA Corp (NASDAQ:NVDA). With an equity value of $126.19 billion, the addition of SANA aligns with the firm's strategy of investing in companies with long-term growth prospects, despite the current financial metrics of Sana Biotechnology.

Biotechnology Industry Context and Baillie Gifford (Trades, Portfolio)'s Move

The biotechnology industry is known for its high volatility and potential for significant returns. Sana Biotechnology's stock performance, with a year-to-date increase of 131.67%, reflects the dynamic nature of the sector. Baillie Gifford (Trades, Portfolio)'s increased stake in SANA may be driven by the firm's confidence in the company's long-term pipeline and the broader growth prospects of the biotech industry.

Concluding Insights on Baillie Gifford (Trades, Portfolio)'s Trade

Baillie Gifford (Trades, Portfolio)'s recent acquisition of additional shares in Sana Biotechnology Inc represents a strategic move to capitalize on the potential of the biotech sector. While SANA's current financial indicators suggest challenges, the firm's long-term investment philosophy may see beyond the immediate metrics, betting on the company's future success. As SANA continues to develop its product pipeline, its role in Baillie Gifford (Trades, Portfolio)'s portfolio could become increasingly significant, especially if the biotech firm achieves its ambitious goals.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.