Baillie Gifford Bolsters Stake in YETI Holdings Inc

Baillie Gifford (Trades, Portfolio), a renowned investment management firm, has recently increased its investment in YETI Holdings Inc (NYSE:YETI), a company known for its premium outdoor and recreation products. On December 1, 2023, Baillie Gifford (Trades, Portfolio) added 3,260,704 shares to its position, bringing the total share count to 9,416,441. This transaction impacted the firm's portfolio by 0.13% and represented a 10.84% ownership in YETI Holdings Inc. The shares were acquired at a price of $44.43, and since the trade, the stock has seen a gain of 4.3%.

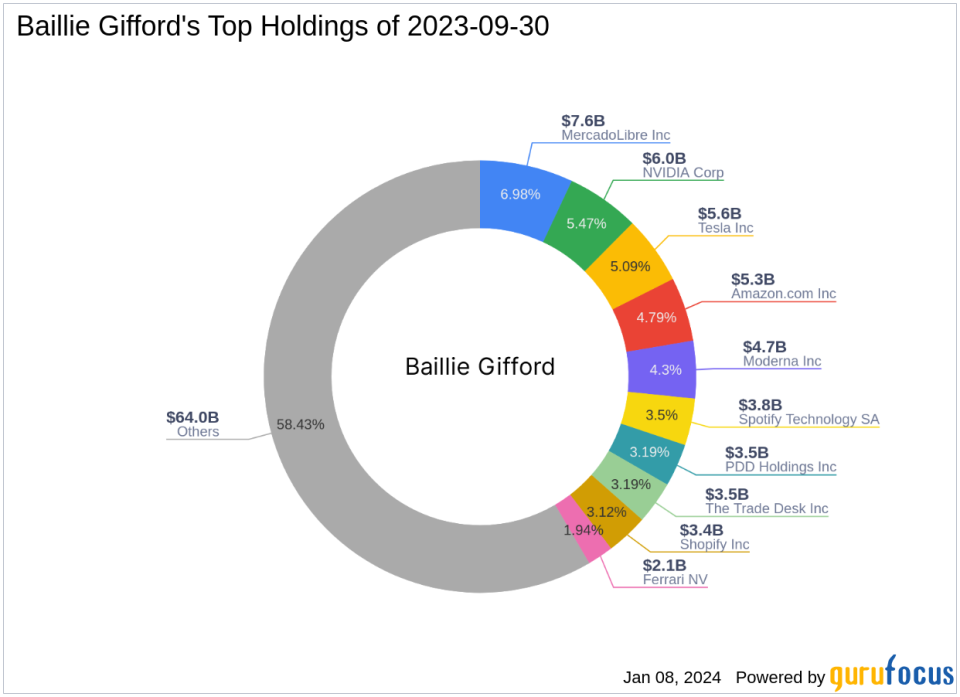

Investment Firm Profile: Baillie Gifford (Trades, Portfolio)

With over a century of experience, Baillie Gifford (Trades, Portfolio) stands as a testament to investment excellence, managing assets for some of the world's largest professional investors. The firm is committed to a long-term, bottom-up investing approach, focusing on identifying companies with the potential for sustainable, above-average growth. Baillie Gifford (Trades, Portfolio)'s portfolio is diverse, with a current equity under management of $109.6 billion, and a strong presence in the Consumer Cyclical and Technology sectors.

YETI Holdings Inc: A Market Leader in Outdoor Products

YETI Holdings Inc, established in 2018, has quickly become a leader in the outdoor and recreation market. The company's product line includes high-quality coolers, drinkware, and other accessories, which have garnered a loyal customer base. With a market capitalization of $4.02 billion and a stock price of $46.34, YETI continues to show promise in the industry. The stock is currently deemed modestly undervalued with a GF Value of $58.35, indicating potential for growth.

Trade Analysis: Baillie Gifford (Trades, Portfolio)'s Increased Confidence in YETI

Baillie Gifford (Trades, Portfolio)'s recent acquisition of YETI shares at $44.43, which is below the current price and GF Value, suggests confidence in the company's future performance. Since its IPO, YETI's stock has surged by 176.66%, despite a year-to-date dip of 8%. The firm's increased stake in YETI, now accounting for 0.38% of its portfolio, reflects a strategic move to capitalize on the stock's potential.

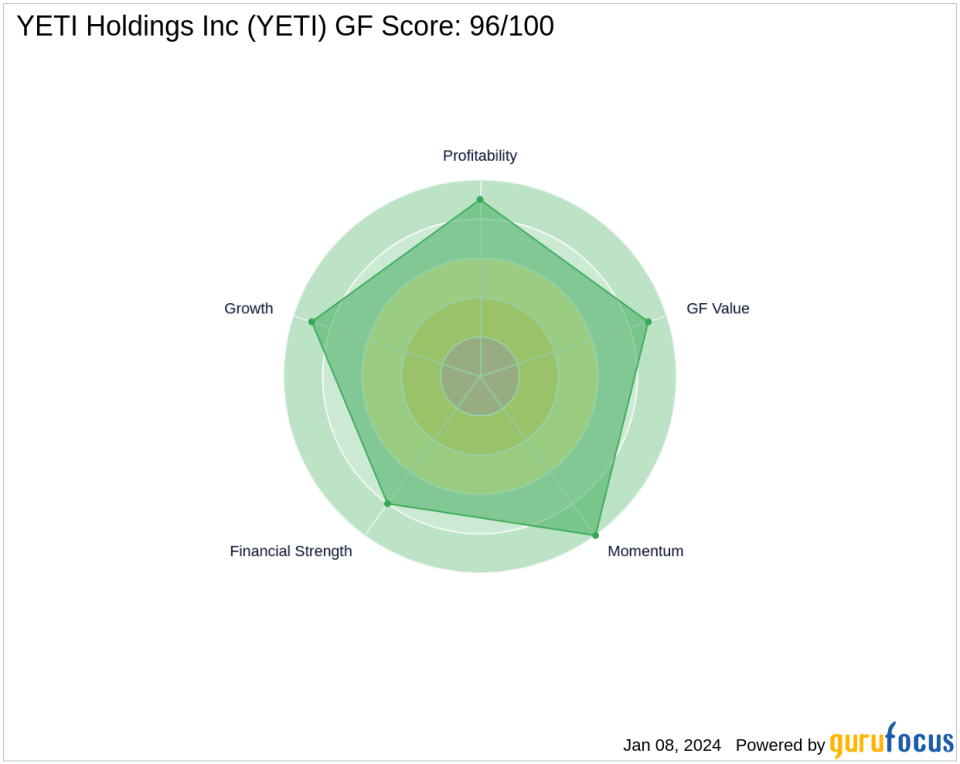

Financial Health and Growth Prospects of YETI Holdings Inc

YETI Holdings Inc boasts a robust GF Score of 96/100, indicating a high potential for outperformance. The company's Financial Strength is solid with a Balance Sheet Rank of 8/10, and its Profitability Rank stands at an impressive 9/10. Growth metrics are equally promising, with a Growth Rank of 9/10 and a GF Value Rank of 9/10. The stock's Momentum Rank is at the top with 10/10, further underscoring its potential for future gains.

Market Context and Other Investors

Gotham Asset Management, LLC is currently the largest guru shareholder in YETI, while other notable investors like Jefferies Group (Trades, Portfolio) also maintain positions in the company. This collective interest from savvy investors adds to the stock's credibility and attractiveness in the market.

Conclusion: Baillie Gifford (Trades, Portfolio)'s Strategic Move

Baillie Gifford (Trades, Portfolio)'s recent trade action in YETI Holdings Inc reflects a strategic decision based on the company's strong financial health, growth prospects, and market position. With the stock's current performance and potential for future gains, YETI Holdings Inc remains an attractive investment opportunity for value investors seeking long-term growth.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.