Baillie Gifford Boosts Stake in Sweetgreen Inc

On July 1, 2023, investment management firm Baillie Gifford (Trades, Portfolio) added 3,025,022 shares of Sweetgreen Inc (NYSE:SG) to its portfolio. This acquisition, which represents a 33.23% change in shares, has a 0.03% impact on Baillie Gifford (Trades, Portfolio)'s portfolio. The shares were purchased at a price of $12.82 each, bringing Baillie Gifford (Trades, Portfolio)'s total holdings in Sweetgreen Inc to 12,127,202 shares, which constitutes 0.13% of their portfolio and 12.28% of Sweetgreen's total shares.

Profile of Baillie Gifford (Trades, Portfolio)

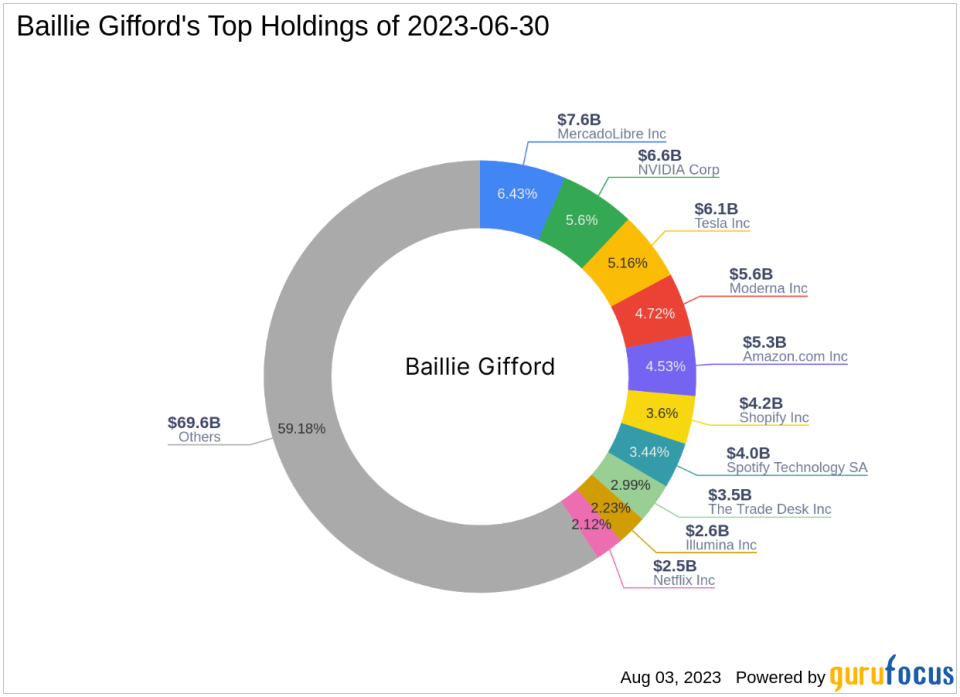

Established over a century ago, Baillie Gifford (Trades, Portfolio) is an investment management partnership that prioritizes the interests of its existing clients. The firm manages money for some of the world's largest professional investors, including clients in North America, Europe, Asia, the Middle East, and Africa. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in fundamental analysis and proprietary research, with a focus on identifying and investing in companies that have the potential for sustainable growth over periods of typically five years or more. As of the date of this article, Baillie Gifford (Trades, Portfolio) holds 297 stocks, with a total equity of $117.64 billion. The firm's top holdings include Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), NVIDIA Corp (NASDAQ:NVDA), Tesla Inc (NASDAQ:TSLA), and Moderna Inc (NASDAQ:MRNA). The technology and consumer cyclical sectors dominate their portfolio.

About Sweetgreen Inc

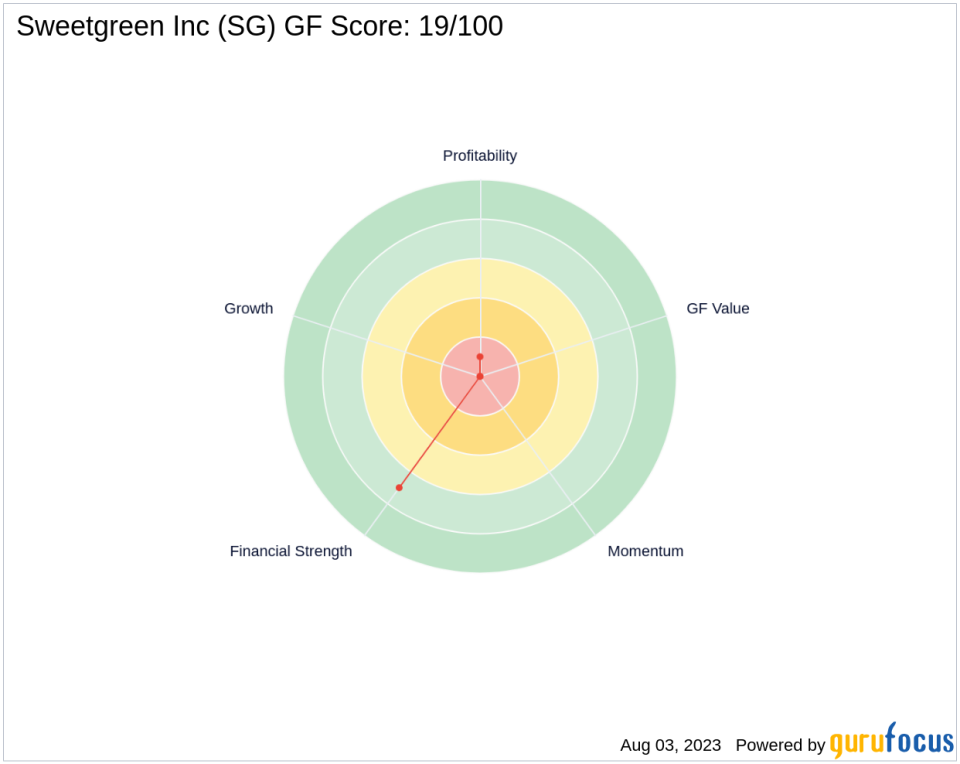

Sweetgreen Inc (NYSE:SG), a next-generation restaurant and lifestyle brand, is committed to serving healthy food at scale. The company, which operates in a single segment, prioritizes organic, regenerative, and local sourcing for its plant-forward, seasonal, and earth-friendly meals. Sweetgreen Inc, which went public on November 18, 2021, has a market capitalization of $1.62 billion. As of the date of this article, the company's stock price stands at $14.51, representing a 13.18% gain since Baillie Gifford (Trades, Portfolio)'s acquisition and a 67.75% increase year-to-date. However, the stock has declined by 72.1% since its IPO. Sweetgreen Inc's GF Score is 19/100, indicating poor future performance potential.

Analysis of Sweetgreen Inc's Stock Performance

Sweetgreen Inc's financial performance and stock predictability are key factors to consider. The company's Financial Strength is ranked 7/10, while its Profitability Rank is 1/10. The company's Growth Rank is 0/10, indicating no growth. Sweetgreen Inc's Altman Z score is 1.79, and its cash to debt ratio is 0.93, ranking 97 in its industry. The company's interest coverage is 0.00, indicating that it is not generating enough earnings to cover its interest expenses. Sweetgreen Inc's return on equity (ROE) and return on assets (ROA) are -29.26% and -19.68%, respectively.

Comparison with Largest Guru

Lone Pine Capital holds the most shares in Sweetgreen Inc among the gurus. However, Baillie Gifford (Trades, Portfolio)'s recent acquisition has significantly increased its stake in the company, demonstrating its confidence in Sweetgreen Inc's potential for long-term growth.

Conclusion

Baillie Gifford (Trades, Portfolio)'s acquisition of Sweetgreen Inc shares is a strategic move that aligns with the firm's investment philosophy of identifying and investing in companies with sustainable growth potential. Despite Sweetgreen Inc's current financial performance and stock predictability, Baillie Gifford (Trades, Portfolio)'s investment could yield significant returns in the long run if the company's growth strategy proves successful. This transaction underscores the importance of thorough research and analysis in making informed investment decisions.

This article first appeared on GuruFocus.