Baillie Gifford Increases Stake in Adaptimmune Therapeutics PLC

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, expanded its investment portfolio by adding a significant number of shares in Adaptimmune Therapeutics PLC (NASDAQ:ADAP). The transaction involved the acquisition of 78,325,431 shares at a trade price of $0.5422 per share, resulting in a trade impact of 0.04% on the firm's portfolio. Following this addition, Baillie Gifford (Trades, Portfolio)'s total shareholding in Adaptimmune stands at 95,472,840 shares, representing a 7.01% ownership stake in the company and a 0.05% position in the firm's portfolio.

Investment Firm Profile: Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio) has established itself as a prominent investment management partnership with over a century of experience. The firm prioritizes the interests of existing clients, often closing products to new business to maintain the integrity of its strategies and the quality of service. With a client base that includes some of the world's largest professional investors, Baillie Gifford (Trades, Portfolio) manages a diverse international portfolio. The firm's investment philosophy is rooted in a rigorous process of fundamental analysis and proprietary research, focusing on long-term, bottom-up investing. Baillie Gifford (Trades, Portfolio) seeks to identify companies with the potential for sustainable, above-average growth over periods typically extending beyond five years.

Adaptimmune Therapeutics PLC: A Biotech Innovator

Adaptimmune Therapeutics PLC, based in the UK, is a clinical-stage biopharmaceutical company dedicated to developing novel cell therapies for patients, particularly those with solid tumors. Since its IPO on May 6, 2015, the company has been at the forefront of T-cell receptor (TCR) therapeutic candidate development. Despite its innovative approach, Adaptimmune's stock performance has been volatile, with a market capitalization of $179.198 million and a current stock price of $0.789. The company's stock has experienced a significant decline of 95.95% since its IPO, although it has seen a recent gain of 45.52% since the reported transaction.

Trade Impact and Strategic Positioning

Baillie Gifford (Trades, Portfolio)'s recent acquisition of Adaptimmune shares has a modest yet strategic impact on its portfolio. The firm's 0.05% position in Adaptimmune aligns with its philosophy of investing in companies with long-term growth potential. This move suggests Baillie Gifford (Trades, Portfolio)'s confidence in Adaptimmune's future prospects and its potential to contribute to the firm's overall investment strategy.

Adaptimmune's Financial Metrics and Market Performance

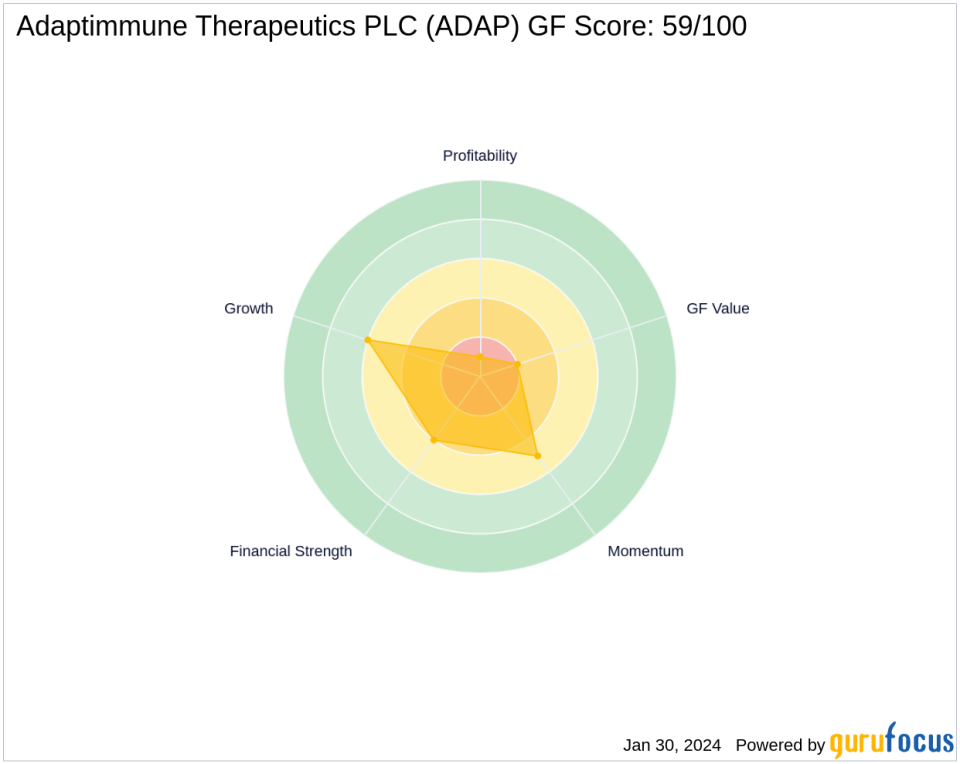

Adaptimmune's financial health is a mixed picture. The company's PE ratio is not applicable due to its lack of profitability, reflected in its Profitability Rank of 1/10. Its GF Value suggests it may be a possible value trap, with a stock price to GF Value ratio of 0.23. However, the company's Growth Rank stands at 6/10, indicating some potential in this area. Adaptimmune's Financial Strength, as indicated by its Balance Sheet Rank of 4/10, and its Piotroski F-Score of 2, suggest caution is warranted. The firm's Altman Z score of -4.33 also raises concerns about its financial stability.

Biotechnology Sector and Market Trends

The biotechnology sector, where Adaptimmune operates, is a significant area of interest for Baillie Gifford (Trades, Portfolio), although it is not among the firm's top sectors, which are Technology and Consumer Cyclical. The industry faces unique challenges and trends, including regulatory hurdles, research and development costs, and the need for continuous innovation. Adaptimmune's role in Baillie Gifford (Trades, Portfolio)'s portfolio reflects a calculated bet on the high-risk, high-reward nature of the biotech industry.

Comparative Performance and Rankings

When compared to Baillie Gifford (Trades, Portfolio)'s top holdings, Adaptimmune's performance and rankings present a contrasting picture. The company's GF Score of 59/100, while not indicative of the highest outperformance potential, suggests some level of future performance potential. In comparison to industry peers, Adaptimmune's rankings in Growth, Momentum, and GF Value are areas of concern, necessitating a careful analysis of its long-term viability.

Concluding Thoughts on Baillie Gifford (Trades, Portfolio)'s Investment

Baillie Gifford (Trades, Portfolio)'s increased stake in Adaptimmune Therapeutics PLC is a strategic move that aligns with the firm's long-term investment philosophy. Despite the company's current financial metrics and market performance, Baillie Gifford (Trades, Portfolio)'s decision to bolster its position in Adaptimmune may be predicated on the company's growth potential and the dynamic nature of the biotechnology sector. Investors will be watching closely to see if this investment aligns with Baillie Gifford (Trades, Portfolio)'s track record of identifying sustainable growth opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.