Baillie Gifford Reduces Stake in Denali Therapeutics Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Stock Transaction

Baillie Gifford (Trades, Portfolio), a renowned investment management firm, has recently adjusted its investment in Denali Therapeutics Inc (NASDAQ:DNLI), a biotechnology company focused on defeating neurodegenerative diseases. On December 1, 2023, the firm executed a reduction in its holdings of Denali Therapeutics' shares, signaling a strategic shift in its investment portfolio.

Investment Firm Profile: Baillie Gifford (Trades, Portfolio)

With over a century of experience, Baillie Gifford (Trades, Portfolio) has established itself as a leading investment management partnership, prioritizing the interests of its clients. The firm is recognized for its commitment to professional excellence and managing investments for some of the world's largest professional investors. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in a rigorous process of fundamental analysis and proprietary research, focusing on long-term, bottom-up investing and identifying companies with sustainable growth potential.

Transaction Details: Baillie Gifford (Trades, Portfolio)'s Trade Action

The transaction, which took place on December 1, 2023, saw Baillie Gifford (Trades, Portfolio) reduce its position in Denali Therapeutics by 420,303 shares, resulting in a new total of 14,260,724 shares held. This trade action led to a slight portfolio impact of -0.01% and was conducted at a trade price of $18.97 per share. The firm's position in Denali now represents 0.25% of its portfolio and 10.32% of the company's outstanding shares.

Denali Therapeutics Inc: A Biotech Innovator

Denali Therapeutics Inc, founded in 2017, is at the forefront of developing treatments for neurodegenerative diseases. The company's pipeline includes promising candidates like the LRRK2 inhibitor for Parkinson's disease and various transport vehicle programs. Denali's approach combines scientific innovation with a commitment to addressing some of the most challenging medical conditions.

Denali's Financial and Market Position

As of the latest data, Denali Therapeutics Inc holds a market capitalization of $2.21 billion, with a current stock price of $15.99. The company's financial metrics and GF Value indicators suggest a possible value trap, urging investors to think twice. The stock is trading at a significant discount to its GF Value of $68.00, with a price to GF Value ratio of 0.24. However, the stock has experienced a decline of -15.71% since the transaction date and a -25.25% change year-to-date.

Baillie Gifford (Trades, Portfolio)'s Position After the Trade

Following the recent transaction, Baillie Gifford (Trades, Portfolio) remains a significant shareholder in Denali Therapeutics, holding over 14 million shares. This position size is substantial when compared to the largest guru shareholder in the company, Vanguard Health Care Fund (Trades, Portfolio). Baillie Gifford (Trades, Portfolio)'s continued investment reflects a strong belief in Denali's potential despite the recent reduction in shares.

Denali in the Broader Market Context

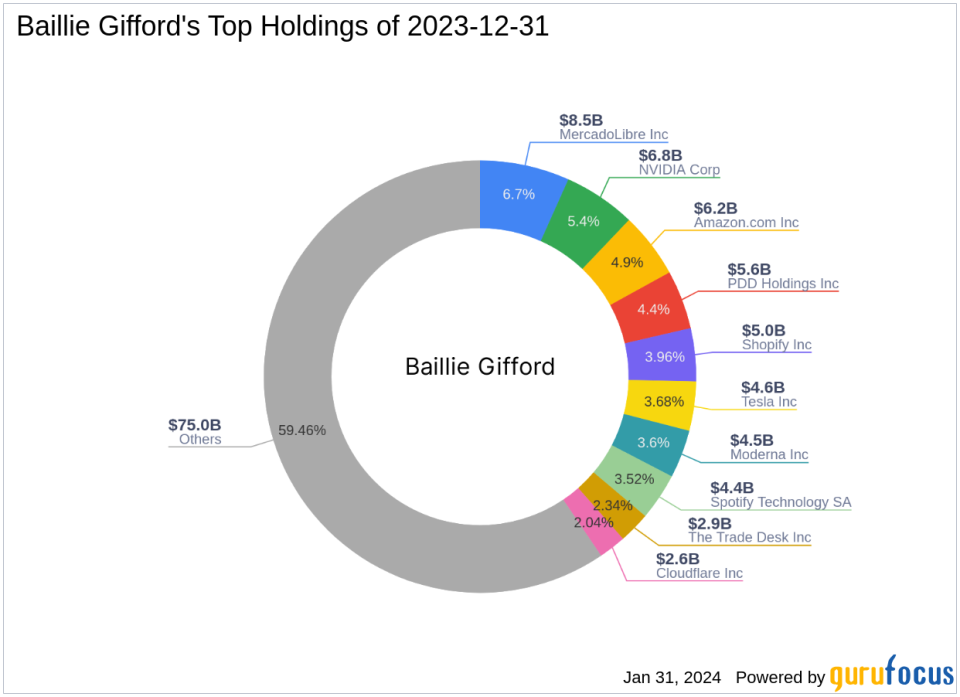

Baillie Gifford (Trades, Portfolio)'s top sectors include Technology and Consumer Cyclical, with leading holdings such as Amazon.com Inc (NASDAQ:AMZN) and NVIDIA Corp (NASDAQ:NVDA). Denali Therapeutics operates within the competitive biotechnology industry, where it must navigate alongside other innovators and market leaders to maintain its growth trajectory and market position.

Other Notable Investors in Denali Therapeutics

Apart from Baillie Gifford (Trades, Portfolio), other notable investors like Ron Baron (Trades, Portfolio), Joel Greenblatt (Trades, Portfolio), and Jefferies Group (Trades, Portfolio) have also taken positions in Denali Therapeutics. The comparative analysis of their shareholding changes and investment strategies provides a broader perspective on the company's investor appeal and market sentiment.

Transaction Influence Analysis

Baillie Gifford (Trades, Portfolio)'s decision to reduce its stake in Denali Therapeutics Inc reflects a strategic portfolio adjustment. While the firm maintains a significant position, the reduction aligns with its investment philosophy of focusing on long-term growth potential. The transaction's minor impact on Baillie Gifford (Trades, Portfolio)'s portfolio suggests a careful rebalancing rather than a shift in conviction about Denali's future prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.