Baillie Gifford Reduces Stake in SiteOne Landscape Supply Inc

Edinburgh-based investment management firm, Baillie Gifford (Trades, Portfolio), has recently reduced its stake in SiteOne Landscape Supply Inc (NYSE:SITE). This article will delve into the details of this transaction, provide an overview of Baillie Gifford (Trades, Portfolio) and SiteOne Landscape Supply Inc, and analyze the potential implications of this move.

Profile of Baillie Gifford (Trades, Portfolio)

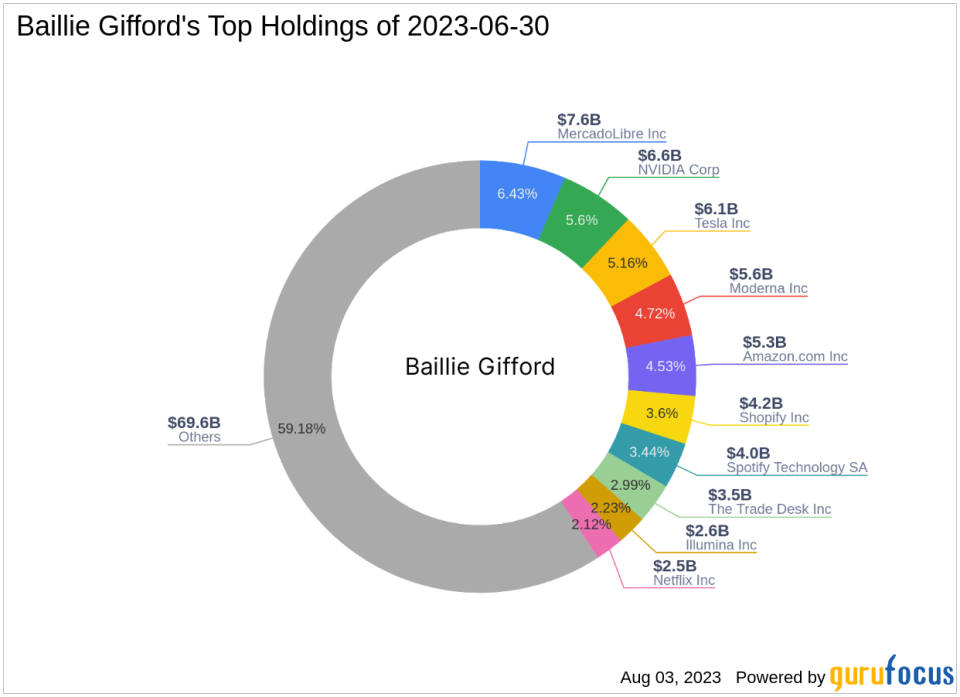

Established over a century ago, Baillie Gifford (Trades, Portfolio) is a renowned investment management partnership that prioritizes the interests of its existing clients. The firm manages funds for some of the world's largest professional investors, including clients from North America, Europe, Asia, the Middle East, and Africa. Baillie Gifford (Trades, Portfolio)'s investment philosophy is rooted in fundamental analysis and proprietary research, focusing on identifying and investing in companies with the potential for faster and more sustainable growth than their peers. The firm's top holdings include Amazon.com Inc (NASDAQ:AMZN), MercadoLibre Inc (NASDAQ:MELI), NVIDIA Corp (NASDAQ:NVDA), Tesla Inc (NASDAQ:TSLA), and Moderna Inc (NASDAQ:MRNA). With an equity of $117.64 billion, Baillie Gifford (Trades, Portfolio)'s portfolio is heavily invested in the Technology and Consumer Cyclical sectors.

Details of the Transaction

On July 1, 2023, Baillie Gifford (Trades, Portfolio) reduced its stake in SiteOne Landscape Supply Inc by 1.06%, selling 24,042 shares at a trade price of $167.36. Following this transaction, Baillie Gifford (Trades, Portfolio) holds 2,234,985 shares of SiteOne Landscape Supply Inc, representing 0.32% of its portfolio and 4.97% of the company's total shares.

Overview of SiteOne Landscape Supply Inc

SiteOne Landscape Supply Inc, based in the USA, is one of the largest suppliers of tools and equipment in the green industry. The company serves various businesses, including wholesale irrigation, outdoor lighting, nursery, landscape supplies, grass seeds, and fertilizers, turf protection products, turf care equipment, and golf course accessories. Its product portfolio includes irrigation supplies, fertilizer and herbicides, landscape accessories, nursery goods, natural stones and blocks, outdoor lighting, and ice melt products. The company's market capitalization stands at $7.23 billion, with a current stock price of $160.73.

Performance and Rankings of SiteOne Landscape Supply Inc

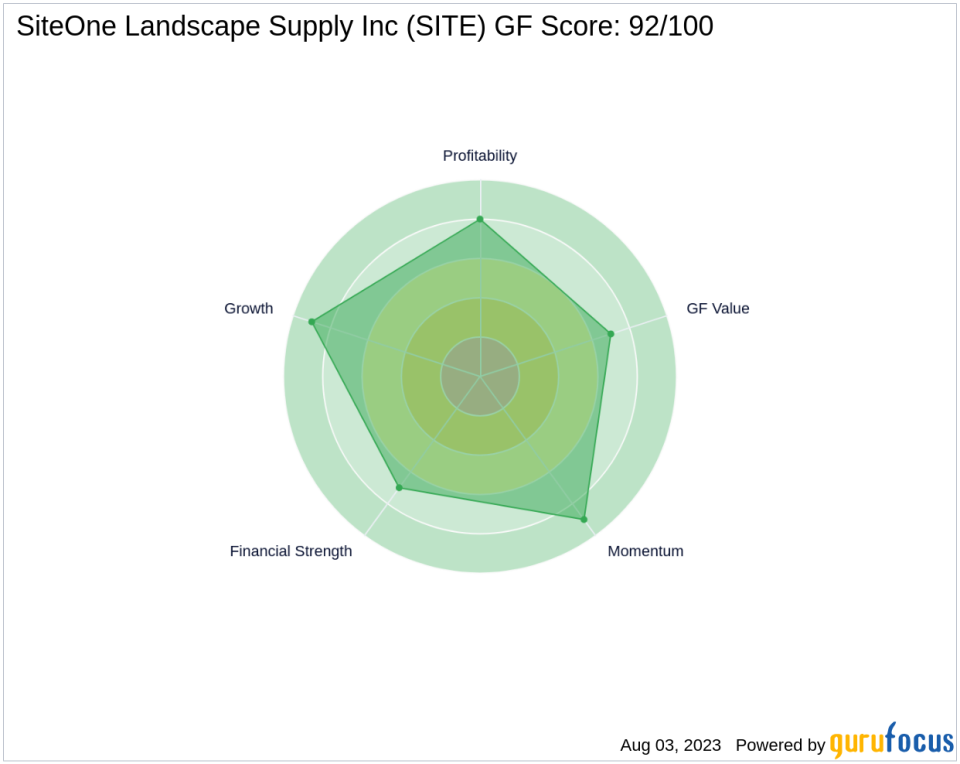

SiteOne Landscape Supply Inc has a GF Score of 92/100, indicating a high outperformance potential. The company's Financial Strength is ranked 7/10, while its Profitability Rank is 8/10. The company's Growth Rank is 9/10, indicating strong growth potential. The company's GF Value Rank is 7/10, suggesting that the stock is modestly undervalued. The company's Momentum Rank is 9/10, indicating strong momentum.

Other Gurus' Involvement

Other notable gurus who hold shares in SiteOne Landscape Supply Inc include Ken Fisher (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio). The largest guru holder of the stock is Baron Funds.

Conclusion

In conclusion, Baillie Gifford (Trades, Portfolio)'s recent reduction in its stake in SiteOne Landscape Supply Inc is a significant move that could have implications for both the firm's portfolio and the performance of the stock. With a strong GF Score and high rankings in Financial Strength, Profitability, Growth, GF Value, and Momentum, SiteOne Landscape Supply Inc remains a promising investment. However, the impact of this transaction on the stock and Baillie Gifford (Trades, Portfolio)'s portfolio remains to be seen.

This article first appeared on GuruFocus.