Baillie Gifford Reduces Stake in Wayfair Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Transaction

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a prominent investment management firm, executed a reduction in its holdings of Wayfair Inc (NYSE:W), an e-commerce giant in the home goods sector. The transaction saw the firm decrease its position by 277,940 shares, resulting in a trade impact of -0.01% on its portfolio. Following the trade, Baillie Gifford (Trades, Portfolio)'s remaining stake in Wayfair Inc amounts to 7,428,995 shares, which represents 0.4% of its portfolio and 8.05% of the company's shares. The shares were sold at a price of $58.53 each.

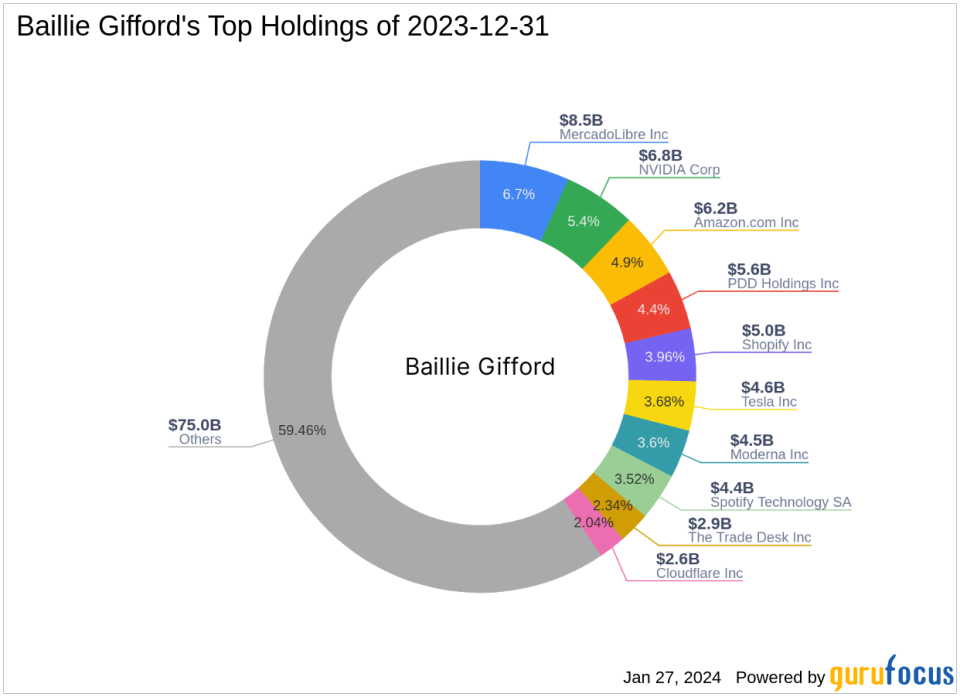

Profile of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of investment management experience, is known for its commitment to long-term, bottom-up investing. The firm's investment philosophy centers on fundamental analysis and proprietary research, aiming to identify companies with the potential for sustainable, above-average growth. Baillie Gifford (Trades, Portfolio) manages assets for some of the world's largest professional investors, emphasizing the quality of service and the integrity of investment strategies.

Wayfair Inc's Business Model

Wayfair Inc operates a vast e-commerce platform, primarily in the United States, offering over 40 million products from more than 20,000 suppliers. Since its IPO on October 2, 2014, Wayfair has expanded its reach to include various brands and a wide range of home furnishings and decor. Despite its extensive product offerings, the company's financial performance has been challenging, with a market capitalization of $6.63 billion and a current stock price of $56.17, indicating a modest undervaluation according to the GF Value.

Trade Analysis and Portfolio Impact

Baillie Gifford (Trades, Portfolio)'s recent sale of Wayfair shares took place at $58.53, which is now above the current market price of $56.17, suggesting a timely decision. The trade has slightly decreased the firm's exposure to Wayfair, which now constitutes a smaller portion of its diverse portfolio. This move aligns with Baillie Gifford (Trades, Portfolio)'s strategy of maintaining a focus on long-term growth potential and portfolio optimization.

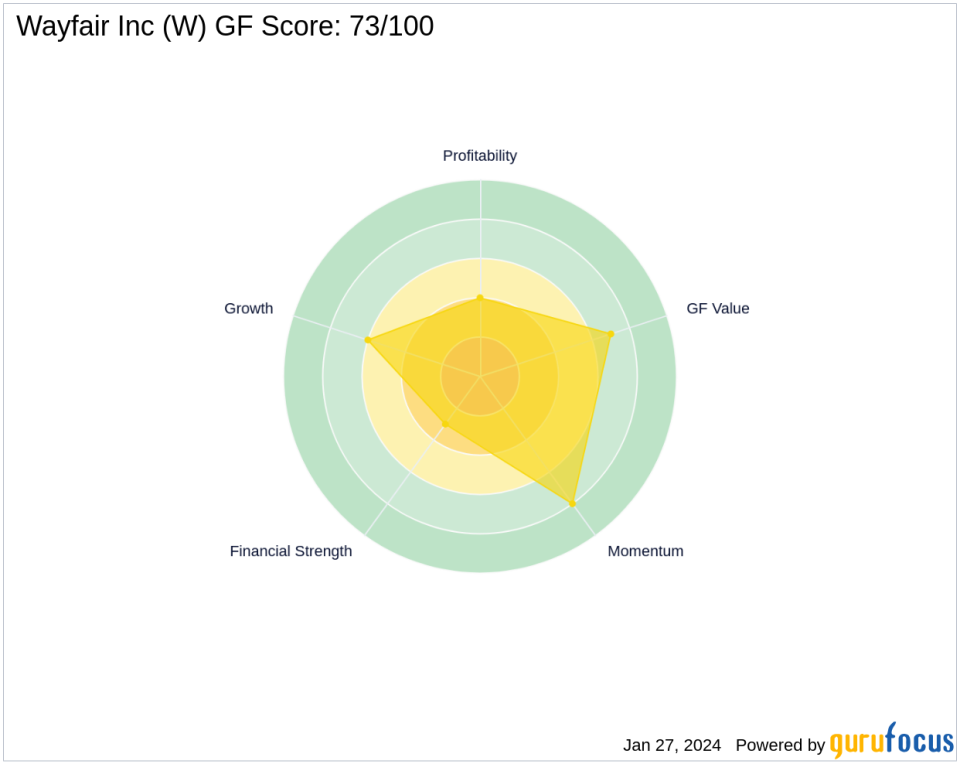

Wayfair's Stock Metrics and Valuation

Wayfair's stock is currently rated as "Modestly Undervalued" with a GF Value of $68.06 and a price to GF Value ratio of 0.83. The stock has experienced a -4.03% price change since the transaction and a -4.46% change year-to-date. Wayfair's GF Score stands at 73/100, indicating a potential for average performance. The company's financial strength and profitability are areas of concern, with a Financial Strength rank of 3/10 and a Profitability Rank of 4/10. However, its Growth Rank and GF Value Rank are more favorable at 6/10 and 7/10, respectively.

Sector and Market Context

Baillie Gifford (Trades, Portfolio)'s top sectors include Technology and Consumer Cyclical, with leading holdings such as Amazon.com Inc (NASDAQ:AMZN) and NVIDIA Corp (NASDAQ:NVDA). Wayfair operates within the competitive Retail - Cyclical industry, where it must continuously innovate to maintain its market position.

Other Notable Investors in Wayfair

Leucadia National is currently the largest guru shareholder in Wayfair, while other notable investors include Joel Greenblatt (Trades, Portfolio). These investments reflect a continued interest in the e-commerce space among savvy market players.

Conclusion

Baillie Gifford (Trades, Portfolio)'s recent reduction in Wayfair Inc shares is a strategic move that reflects the firm's investment philosophy and market outlook. While Wayfair's current market position shows some challenges, its modest undervaluation and growth prospects may still offer opportunities for value investors. The future outlook for Wayfair will depend on its ability to improve profitability and maintain its competitive edge in the dynamic e-commerce industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.