Baillie Gifford Trims Position in Codexis Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Transaction

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, made a significant adjustment to its investment portfolio by reducing its stake in Codexis Inc (NASDAQ:CDXS). The firm sold 630,474 shares at a trade price of $2.47. Following this transaction, Baillie Gifford (Trades, Portfolio)'s remaining holding in Codexis Inc totals 3,419,093 shares, which represents a 4.90% ownership in the company and a 0.01% position in Baillie Gifford (Trades, Portfolio)'s portfolio.

Profile of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of experience in investment management, operates with a client-first philosophy, often closing products to new business to maintain the quality of service and strategy integrity. The firm manages assets for some of the world's largest professional investors, including pension funds and financial institutions across various continents. Baillie Gifford (Trades, Portfolio)'s investment approach is rooted in fundamental analysis and proprietary research, aiming to identify companies with the potential for sustainable, above-average growth over a minimum of five years.

Introduction to Codexis Inc

Codexis Inc, based in the USA, specializes in enzyme optimization services and the development of biocatalyst products. Since its IPO on April 22, 2010, the company has focused on two main business segments: Performance Enzymes and Novel Biotherapeutics. Codexis Inc has established a significant presence in the APAC region, which contributes the majority of its revenue. The company's innovative platforms, such as Codeevolver and various enzyme classes, have positioned it as a key player in the biotechnology industry.

Impact of Baillie Gifford (Trades, Portfolio)'s Trade on Its Portfolio

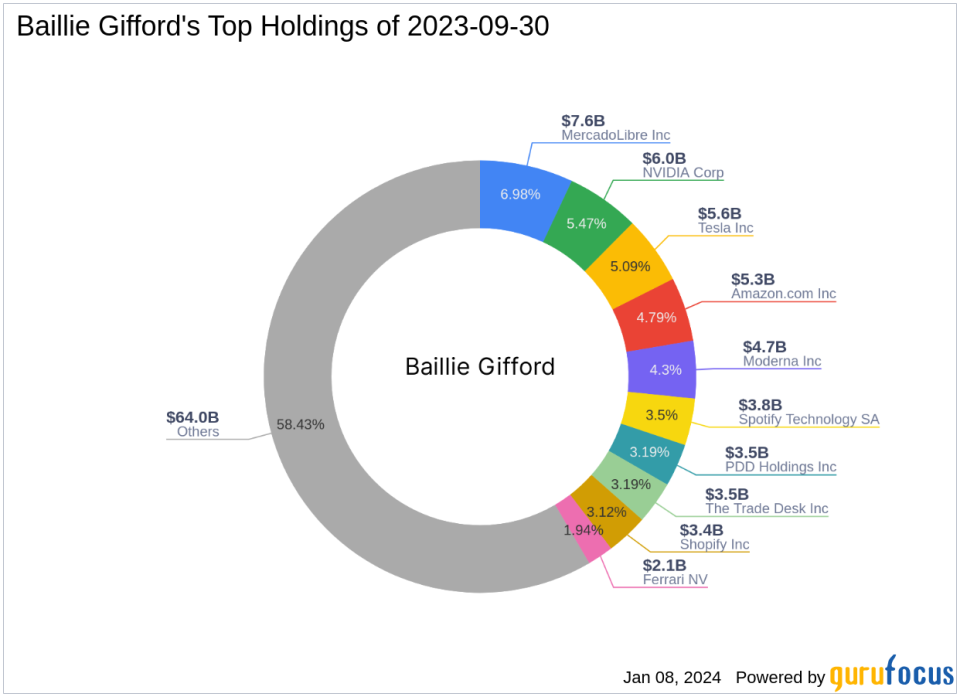

The recent reduction in Codexis Inc shares by Baillie Gifford (Trades, Portfolio), although minor in terms of portfolio impact, reflects a strategic decision by the firm. With a trade impact of 0, the transaction is not expected to significantly alter the composition of Baillie Gifford (Trades, Portfolio)'s investment portfolio, which includes top holdings in sectors such as Consumer Cyclical and Technology.

Codexis Inc's Financial Health and Market Performance

Codexis Inc currently holds a market capitalization of $197.621 million, with a stock price of $2.83, reflecting a 14.57% gain since the trade date. However, the company's PE Percentage stands at 0.00, indicating it is not profitable at the moment. The GF Value suggests a possible value trap, urging investors to think twice with a stock price to GF Value ratio of 0.35. Year-to-date, the stock has seen a decline of 9.29%, and since its IPO, the price has dropped by 78.23%.

Evaluation of Codexis Inc's Stock Metrics

Codexis Inc's GF Score is 72 out of 100, indicating potential for average performance. The company's Financial Strength is ranked at 6/10, with a Profitability Rank of 3/10 and a Growth Rank of 7/10. However, the GF Value Rank and Momentum Rank are lower at 4/10 and 5/10, respectively. The company's Piotroski F-Score is 3, and the Altman Z-Score is a concerning -3.35, indicating financial distress.

Biotechnology Industry Context

The biotechnology industry is known for its high volatility and potential for significant returns. Codexis Inc, as a part of this industry, faces both opportunities and challenges. The company's innovative approach to enzyme optimization and biocatalyst development positions it to capitalize on the growing demand for such technologies. However, the financial metrics suggest caution is warranted when evaluating the company's stock.

Conclusion: Baillie Gifford (Trades, Portfolio)'s Strategic Move

In summary, Baillie Gifford (Trades, Portfolio)'s recent reduction in Codexis Inc shares is a tactical decision that aligns with the firm's long-term investment philosophy. While the trade does not significantly impact Baillie Gifford (Trades, Portfolio)'s portfolio, it does reflect the firm's ongoing assessment of Codexis Inc's financial health and market performance. Investors should consider the broader industry context and Codexis Inc's financial metrics when evaluating the potential of this biotechnology stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.