Baillie Gifford Trims Stake in The Trade Desk Inc

Overview of Baillie Gifford (Trades, Portfolio)'s Recent Transaction

On December 1, 2023, Baillie Gifford (Trades, Portfolio), a renowned investment management firm, reduced its holdings in The Trade Desk Inc (NASDAQ:TTD) by 3,710,749 shares, marking a significant change of -8.30% in its investment. The transaction had a -0.24% impact on Baillie Gifford (Trades, Portfolio)'s portfolio, adjusting the firm's total share count in TTD to 40,984,017 and altering its position in the company to 2.68% of the portfolio and 9.18% of the company's shares. The shares were sold at a price of $71.6 each.

Profile of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio), with over a century of experience, stands as a testament to investment management excellence. The firm prioritizes existing clients' interests, often closing products to new business to maintain strategy integrity and service quality. Baillie Gifford (Trades, Portfolio) manages assets for some of the world's largest professional investors, including pension funds and financial institutions across various continents. The firm's investment philosophy is rooted in fundamental analysis and proprietary research, focusing on long-term, bottom-up investing. Baillie Gifford (Trades, Portfolio) seeks to identify companies with the potential for sustainable, above-average growth over a typical five-year horizon or more.

Company Overview of The Trade Desk Inc

The Trade Desk Inc operates a self-service platform that revolutionizes how advertisers and ad agencies buy digital ad inventory across various devices. Since its IPO in 2016, the company has demonstrated impressive financial performance, with an average annual revenue growth rate of 43%. The Trade Desk has maintained profitability with operating margins ranging from 10% to 28%. The firm's demand-side platform is a key player in the digital advertising industry, generating revenue from ad spend fees.

Analysis of Baillie Gifford (Trades, Portfolio)'s Trade

Baillie Gifford (Trades, Portfolio)'s sale price of $71.6 for TTD shares stands above the current market price of $67.98, indicating a timely decision as the stock has since declined by -5.06%. The Trade Desk is currently deemed "Significantly Undervalued" with a GF Value of $98.86, suggesting a potential upside. The trade has slightly decreased Baillie Gifford (Trades, Portfolio)'s exposure to TTD, yet the firm remains a significant shareholder with a 9.18% stake in the company.

The Trade Desk's Market Performance and Valuation

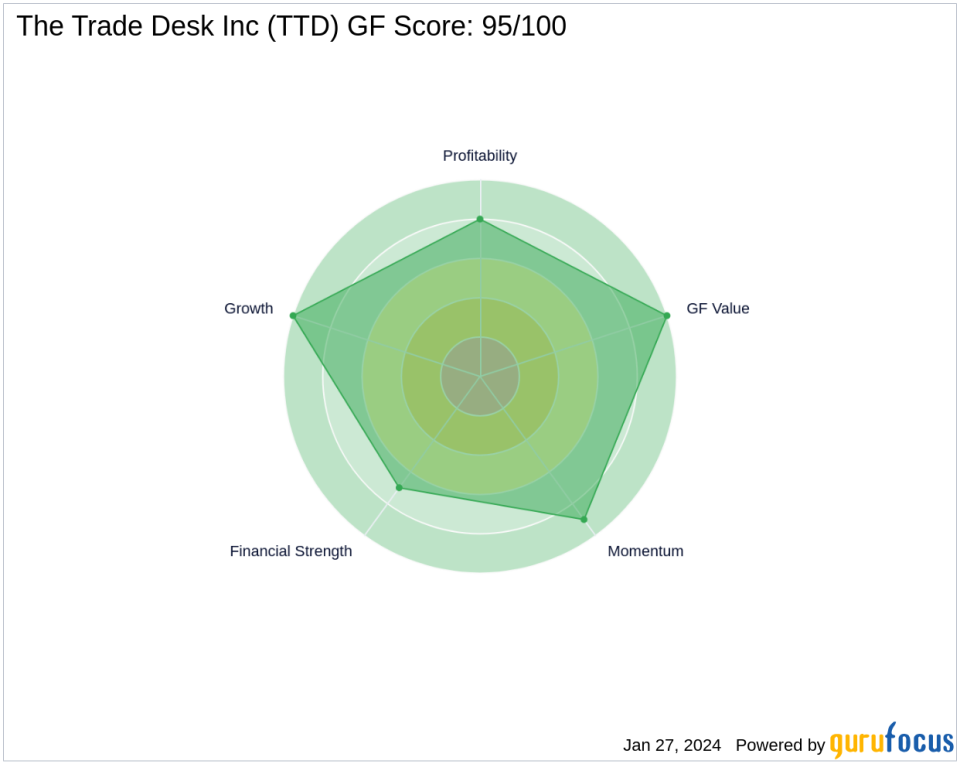

The Trade Desk boasts a market capitalization of $33.33 billion and a high PE ratio of 219.29, reflecting its growth potential and market confidence. The company's GF Score of 98/100, found through GF-Score, indicates a strong likelihood of outperforming the market. The Trade Desk also holds high ranks in Financial Strength (8/10), Profitability Rank (9/10), Growth Rank (10/10), GF Value Rank (10/10), and Momentum Rank (9/10).

Sector Focus and Top Holdings of Baillie Gifford (Trades, Portfolio)

Baillie Gifford (Trades, Portfolio)'s portfolio is heavily weighted towards the Technology and Consumer Cyclical sectors, reflecting its focus on innovation and market trends. The firm's top holdings include industry giants such as Amazon.com Inc (NASDAQ:AMZN) and NVIDIA Corp (NASDAQ:NVDA), showcasing its strategy of investing in high-growth potential companies.

Other Notable Investors in The Trade Desk

Baron Funds holds the largest share percentage in The Trade Desk, while other notable investors include Jefferies Group (Trades, Portfolio) and Joel Greenblatt (Trades, Portfolio). Each investor's strategy and share percentage vary, providing a diverse range of insights into TTD's investment attractiveness.

Market Context and Future Outlook

The Trade Desk operates within the competitive Software sector, where it has established a strong industry position. Looking ahead, the company faces both growth opportunities and challenges. Baillie Gifford (Trades, Portfolio)'s recent trade reflects a strategic adjustment in its investment approach, balancing long-term growth prospects with portfolio management considerations.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.