Bain Capital Specialty Finance Inc. Reports Solid Q4 and Fiscal Year 2023 Results; Declares ...

Net Investment Income (NII): $0.54 per share in Q4, with an annualized NII yield on book value of 12.3%.

Net Income: $0.48 per share in Q4, translating to an annualized return on book value of 10.9%.

Net Asset Value (NAV): Increased to $17.60 per share as of December 31, 2023, from $17.54 as of September 30, 2023.

Dividends: Declared a regular quarterly dividend of $0.42 per share for Q1 2024 and additional dividends totaling $0.12 per share for 2024.

Investment Portfolio: Fair value of $2,298.3 million across 137 portfolio companies as of December 31, 2023.

Debt-to-Equity Ratio: Improved to 1.02x net debt-to-equity as of December 31, 2023, from 1.12x as of September 30, 2023.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

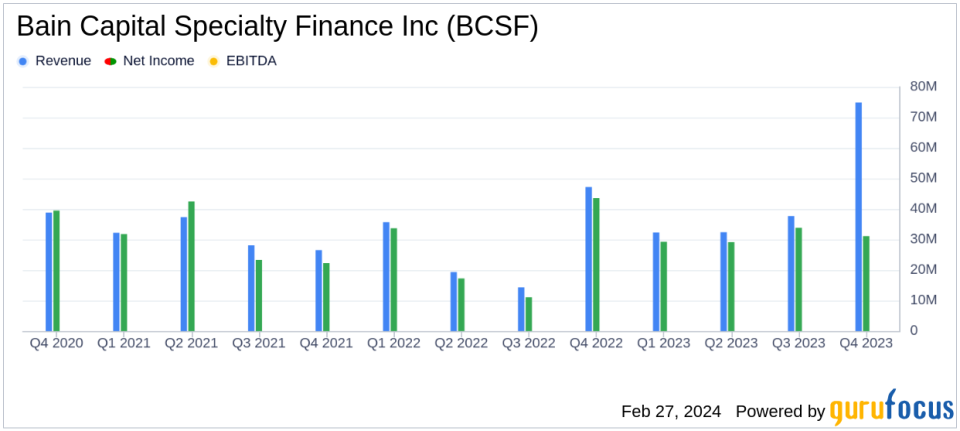

Bain Capital Specialty Finance Inc (NYSE:BCSF) released its 8-K filing on February 27, 2024, announcing its financial results for the fourth quarter and fiscal year ended December 31, 2023. BCSF, an externally managed specialty finance company focused on lending to middle market companies, reported a strong quarter and full year, underpinned by high levels of interest income and net asset value growth. The company's Board of Directors declared a first quarter 2024 dividend of $0.42 per share and additional dividends totaling $0.12 per share for the year.

Financial Performance and Portfolio Activity

BCSF's net investment income per share stood at $0.54 for the quarter, slightly down from $0.55 in the previous quarter. Net income per share was $0.48, compared to $0.52 in Q3 2023. The company's net asset value per share increased marginally to $17.60 from $17.54 quarter-over-quarter. Gross and net investment fundings were $206.4 million and $(101.8) million, respectively, reflecting active portfolio management and disciplined investment strategy.

The company's investment portfolio was valued at $2,298.3 million as of December 31, 2023, spread across 137 portfolio companies in 31 industries. The weighted average yield on the investment portfolio at amortized cost and fair value were 13.0% and 13.1%, respectively. Investments on non-accrual remained low, indicating stable credit performance.

Capital and Liquidity

BCSF's total principal debt outstanding was $1,263.5 million, with a weighted average interest rate on debt outstanding of 5.3%. The company had cash and cash equivalents of $49.4 million and an additional $343.3 million of capacity under its Sumitomo Credit Facility, showcasing a strong liquidity position. The net debt-to-equity ratio improved to 1.02x, down from 1.12x in the previous quarter.

Dividends and Shareholder Returns

Chief Executive Officer Michael Ewald commented on the company's performance, stating,

BCSF reported strong quarterly and full year 2023 results as we benefited from attractive levels of interest income, net asset value growth and continued stable credit performance across our primarily senior secured portfolio."

The additional dividends declared for 2024 reflect the company's commitment to delivering shareholder value and confidence in its financial stability.

Outlook and Conference Call

BCSF's investment grade rating was affirmed by Kroll Bond Rating Agency, LLC (KBRA) with a stable outlook, indicating a positive view of the company's financial health. A conference call to discuss the financial results was scheduled for February 28, 2024, providing investors with further insights into the company's performance and strategy.

Bain Capital Specialty Finance Inc's solid financial results and strategic portfolio management underscore its position as a robust player in the specialty finance industry. The company's ability to maintain a strong dividend yield and improve its debt-to-equity ratio demonstrates its commitment to prudent financial management and shareholder returns. For value investors, BCSF's performance and outlook offer a compelling case for consideration.

For more detailed information, investors and interested parties are encouraged to review the full earnings report and listen to the earnings conference call.

Explore the complete 8-K earnings release (here) from Bain Capital Specialty Finance Inc for further details.

This article first appeared on GuruFocus.