BAKER BROS. ADVISORS LP Bolsters Position in BeiGene Ltd

Significant Addition to BeiGene Holdings

BAKER BROS. ADVISORS LP (Trades, Portfolio), a prominent investment firm, has recently expanded its investment in BeiGene Ltd (NASDAQ:BGNE) with a substantial acquisition of shares. On November 14, 2023, the firm added 127,009,140 shares to its portfolio, which resulted in a significant trade impact of 59.89%. This transaction has increased BAKER BROS. ADVISORS LP (Trades, Portfolio)'s total shareholding in BeiGene to 138,678,037 shares, reflecting a commanding position ratio of 65.39% in the firm's portfolio and 10.20% of BeiGene's outstanding shares. The trade was executed at a price of $201.55 per share.

BAKER BROS. ADVISORS LP (Trades, Portfolio)'s Investment Strategy

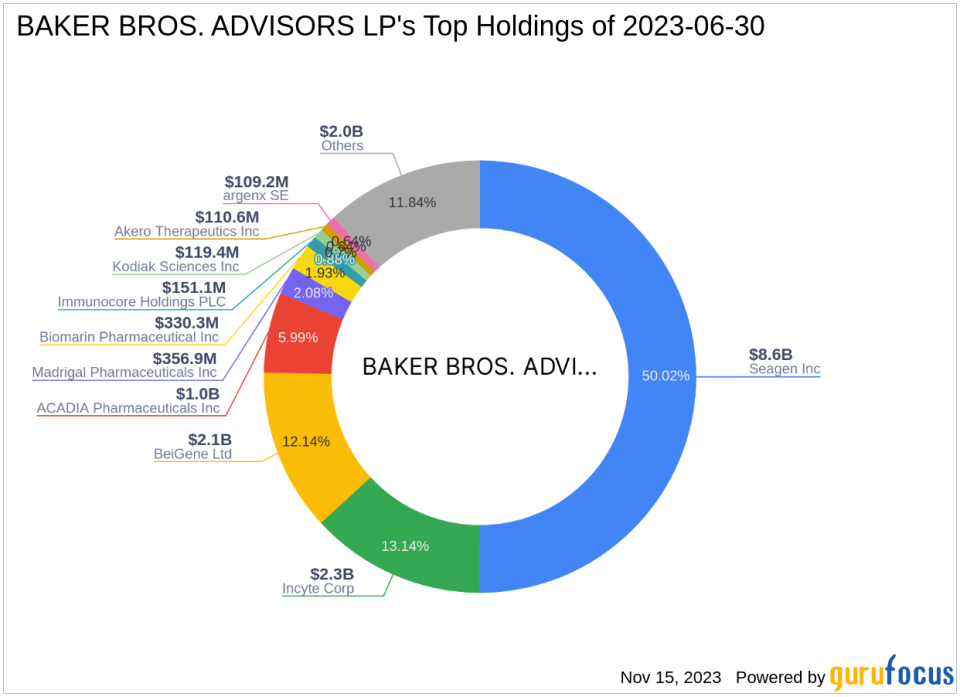

Founded by Julian and Felix Baker, BAKER BROS. ADVISORS LP (Trades, Portfolio) is a New York City-based hedge fund sponsor with a strong focus on the healthcare sector. The firm, established in 2000, employs a fundamental-driven investment approach, often holding investments for an average of three years or longer if they prove successful. With a portfolio heavily weighted towards life sciences, BAKER BROS. ADVISORS LP (Trades, Portfolio)'s top holdings include ACADIA Pharmaceuticals Inc (NASDAQ:ACAD), BeiGene Ltd (NASDAQ:BGNE), Incyte Corp (NASDAQ:INCY), and several others, with a market value exceeding $17.14 billion. The firm's concentrated investment strategy has been a hallmark of its success, eschewing diversification in favor of significant positions in select companies.

BeiGene Ltd at a Glance

BeiGene Ltd is a commercial-stage biotechnology company based in the Cayman Islands, specializing in the discovery and development of molecularly targeted and immuno-oncology drugs for cancer treatment. Since its IPO on February 3, 2016, BeiGene has made significant strides in the biotech industry, with key products like BRUKINSA and Tislelizumab. The company operates across various geographical segments, including China, the United States, and other global markets. BeiGene's commitment to addressing tumor-immune system interactions and leveraging primary biopsies for drug discovery has positioned it as a notable player in the biotechnology sector.

Financial Health and Market Position of BeiGene

BeiGene Ltd currently boasts a market capitalization of $21.27 billion, with a stock price of $201.55. Despite a PE Percentage of 0.00, indicating the company is not profitable at the moment, BeiGene's GF Value stands at $393.41, with a Price to GF Value ratio of 0.51. This suggests that the stock may be undervalued, although it is labeled as a "Possible Value Trap" by GuruFocus, advising investors to think twice. The company's stock has experienced a year-to-date decline of 11.07%, yet it has grown by 595.72% since its IPO.

Impact of BAKER BROS. ADVISORS LP (Trades, Portfolio)'s Investment in BeiGene

The recent transaction by BAKER BROS. ADVISORS LP (Trades, Portfolio) underscores the firm's confidence in BeiGene's potential. BeiGene constitutes a significant portion of the firm's portfolio, reflecting its strategic importance. The investment aligns with BAKER BROS. ADVISORS LP (Trades, Portfolio)'s philosophy of making concentrated bets on high-conviction stocks within the healthcare sector. This move could signal a bullish outlook on BeiGene's future performance and its role in the biotechnology industry.

Performance and Prospects of BeiGene

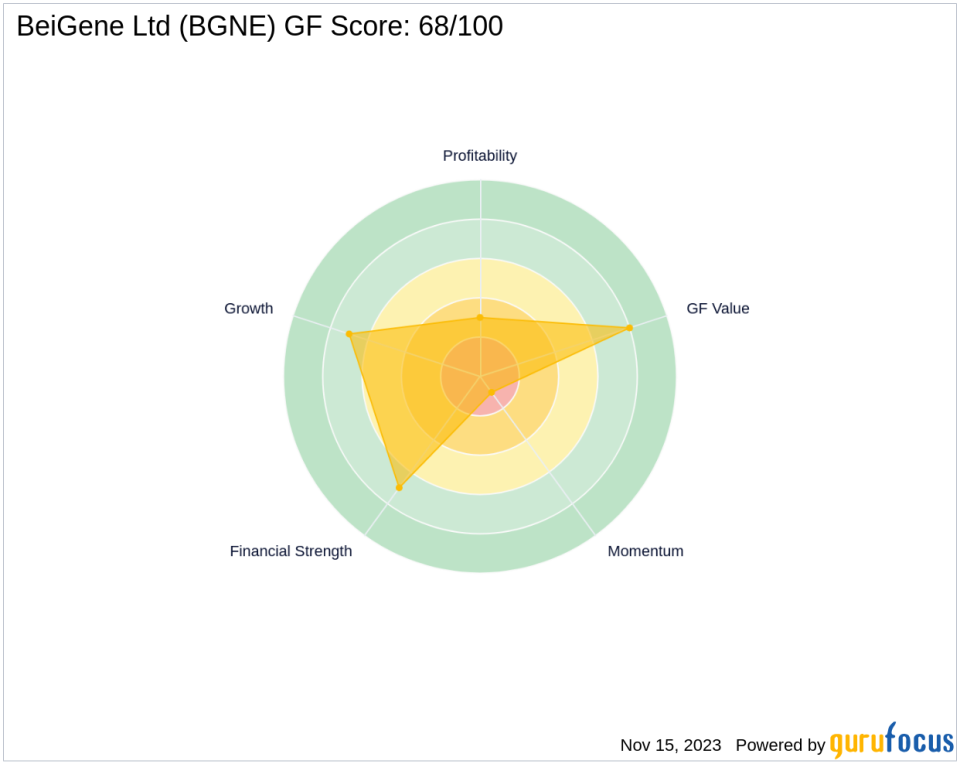

BeiGene's stock performance is backed by a GF Score of 68/100, indicating moderate future performance potential. The company's financial strength and profitability are areas of concern, with a Profitability Rank of 3/10 and a Financial Strength Rank of 7/10. However, its Growth Rank and GF Value Rank are more promising at 7/10 and 8/10, respectively. The stock's momentum indicators, such as the RSI and Momentum Index, suggest caution, with a 14-day RSI of 62.13 and a negative momentum index over the past month.

Biotechnology Sector Dynamics and BeiGene's Role

The biotechnology sector is known for its volatility and high potential for innovation-driven growth. BeiGene, with its focus on cancer therapeutics, is well-positioned to capitalize on industry trends such as personalized medicine and immuno-oncology. BAKER BROS. ADVISORS LP (Trades, Portfolio)'s increased stake in BeiGene may be indicative of a broader strategy to leverage these trends for long-term gains. As the industry evolves, BeiGene's role in developing novel cancer treatments could significantly influence its valuation and the success of BAKER BROS. ADVISORS LP (Trades, Portfolio)'s investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.