BAKER BROS. ADVISORS LP Reduces Stake in Neoleukin Therapeutics Inc

BAKER BROS. ADVISORS LP, a renowned hedge fund sponsor, recently executed a significant transaction involving Neoleukin Therapeutics Inc. (NTLX). This article provides an in-depth analysis of the transaction, the firm's profile, and the traded company's basic information. All data and rankings are accurate as of August 18, 2023.

Details of the Transaction

On August 15, 2023, BAKER BROS. ADVISORS LP reduced its stake in Neoleukin Therapeutics Inc by 570,979 shares, representing a change of -5.69%. The transaction was executed at a price of $0.67 per share. Following the transaction, the firm holds a total of 9,472,098 shares in Neoleukin Therapeutics Inc, accounting for 0.04% of its portfolio. The firm's current holdings represent 19.99% of the traded stock.

Profile of the Firm: BAKER BROS. ADVISORS LP

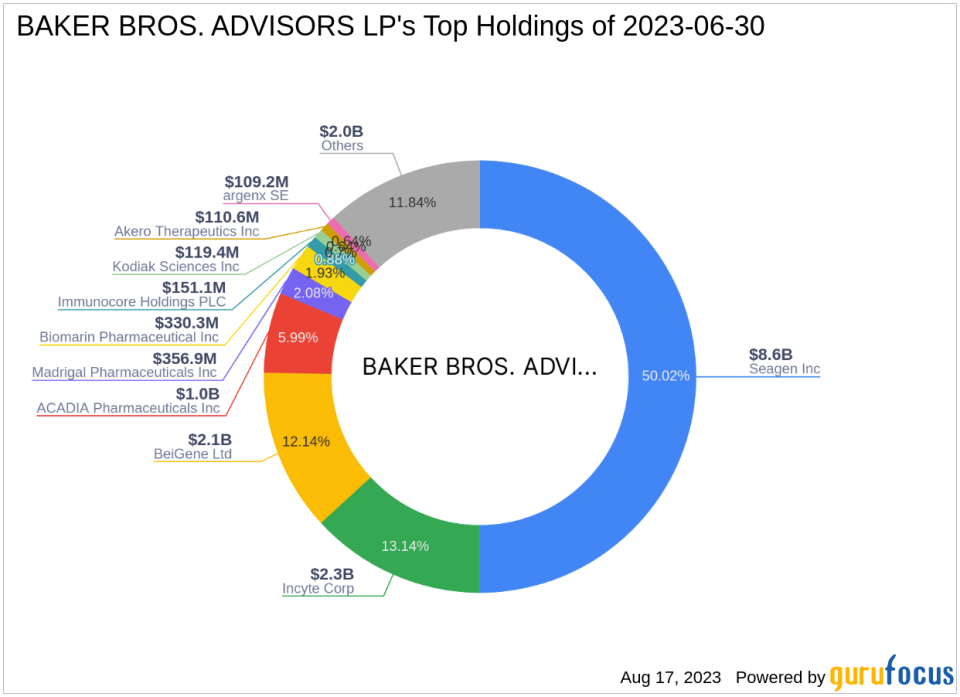

Established in 2000 by Julian Baker and Felix Baker, BAKER BROS. ADVISORS LP is a private hedge fund sponsor based in New York City. The firm primarily invests in the healthcare sector, with a smaller allocation in the industrials sector. The firm's top holdings include ACADIA Pharmaceuticals Inc, BeiGene Ltd, Incyte Corp, Madrigal Pharmaceuticals Inc, and Seagen Inc. The firm's current market value exceeds $17.14 billion.

Overview of the Traded Stock: Neoleukin Therapeutics Inc

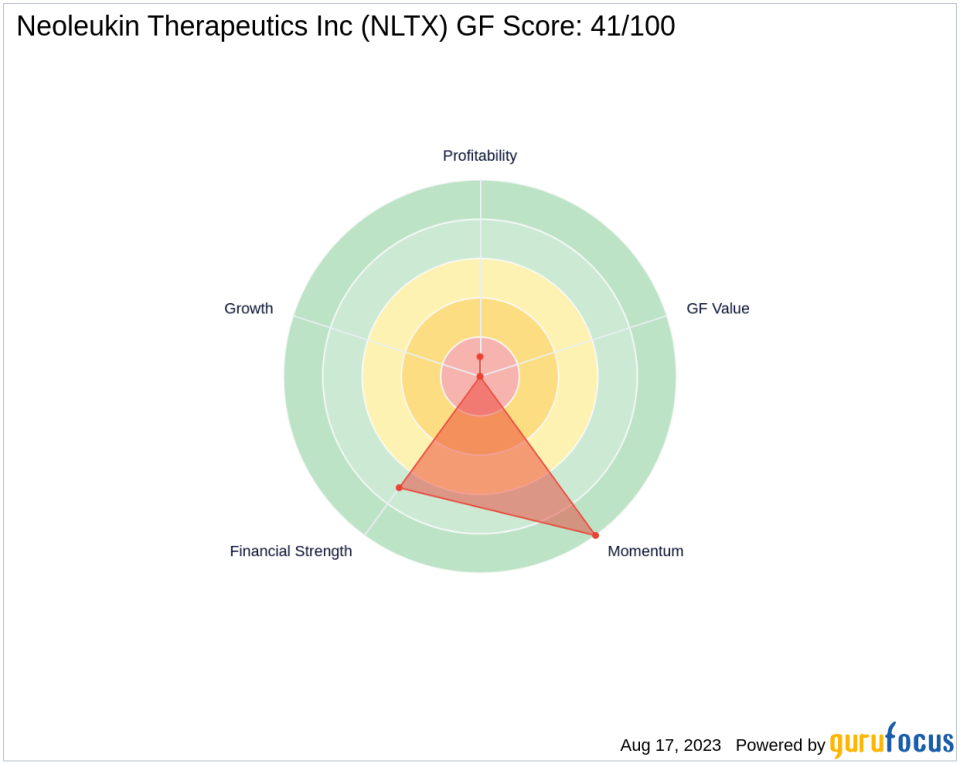

Neoleukin Therapeutics Inc is a biopharmaceutical company that designs proteins for the treatment of serious diseases, including cancer, inflammatory, and autoimmune disorders. The company, which went public on March 7, 2014, has a market capitalization of $31.87 million. As of August 18, 2023, the company's stock price stands at $0.724. The company's GF Score is 41/100, indicating poor future performance potential.

Analysis of the Transaction

The transaction aligns with BAKER BROS. ADVISORS LP's investment philosophy of focusing on specific companies in the healthcare sector. The firm's reduction in its stake in Neoleukin Therapeutics Inc could be attributed to various factors, including the company's performance metrics and rankings. The company's Profitability Rank is 1/10, and its Growth Rank is 0/10, indicating the lack of growth data. Furthermore, the company's Piotroski F-Score is 3, suggesting a weak financial situation.

Since the transaction, the stock price has increased by 8.06%, indicating a positive short-term impact on the stock. However, the transaction's long-term impact on the guru's portfolio and the traded company's stock remains to be seen.

Conclusion

In conclusion, BAKER BROS. ADVISORS LP's recent transaction involving Neoleukin Therapeutics Inc reflects the firm's strategic investment decisions. While the transaction has had a positive short-term impact on the stock, the company's poor performance metrics and rankings suggest potential challenges ahead. Value investors should closely monitor the situation and consider these factors when making investment decisions.

This article first appeared on GuruFocus.