BAKER BROS. ADVISORS LP Reduces Stake in Atreca Inc

BAKER BROS. ADVISORS LP (Trades, Portfolio), a New York-based private hedge fund sponsor, recently executed a significant transaction involving Atreca Inc. This article provides an in-depth analysis of the transaction, the profiles of both the guru and the traded company, and the potential implications of this move on the stock market.

Details of the Transaction

On October 19, 2023, BAKER BROS. ADVISORS LP (Trades, Portfolio) reduced its stake in Atreca Inc by 15.90%, selling 561,632 shares at a trade price of $0.4 per share. This transaction left the firm with a total of 2,971,128 shares in Atreca Inc, representing 0.01% of its portfolio and 7.56% of Atreca Inc's total shares.

Profile of BAKER BROS. ADVISORS LP (Trades, Portfolio)

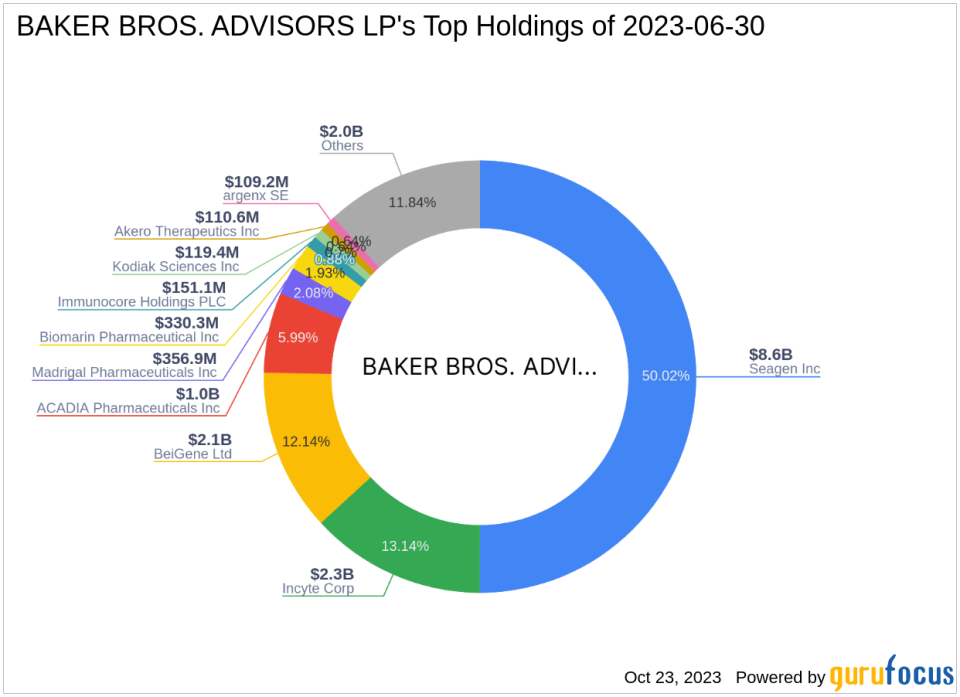

Established in 2000 by Julian Baker and Felix Baker, BAKER BROS. ADVISORS LP (Trades, Portfolio) is a private hedge fund sponsor based in New York City. The firm primarily invests in the healthcare sector, with a smaller allocation of assets in the industrials sector. Its top holdings include ACADIA Pharmaceuticals Inc, BeiGene Ltd, Incyte Corp, Madrigal Pharmaceuticals Inc, and Seagen Inc. The firm's market value has grown significantly over the years, reaching over $17.14 billion as of the date of this article. The firm currently holds 106 stocks in its portfolio.

Overview of Atreca Inc

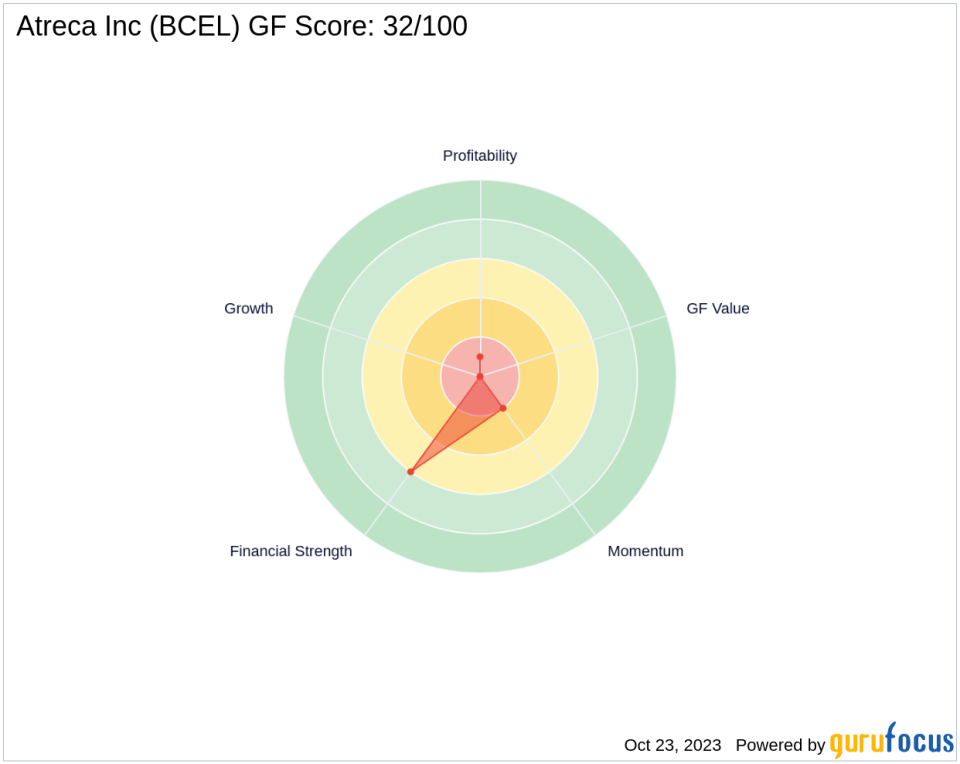

Atreca Inc is a biopharmaceutical company based in the USA. The company, which went public on June 20, 2019, focuses on the discovery and development of novel antibody-based immunotherapeutics to treat a range of solid tumor types. As of the date of this article, Atreca Inc has a market capitalization of $9.266 million and a current stock price of $0.2358. The company's GF Score is 32/100, indicating a poor future performance potential.

Atreca Inc's Financial Performance

Atreca Inc's financial performance has been less than stellar, with a PE percentage of 0.00, indicating that the company is currently operating at a loss. The company's Financial Strength is ranked 6/10, while its Profitability Rank is 1/10. The company's Growth Rank is 0/10, indicating a lack of growth in recent years.

Atreca Inc's Stock Performance

Since its IPO, Atreca Inc's stock has declined by 98.82%. The stock's year-to-date performance is also negative, with a decline of 74.23%. The company's Momentum Rank is 2/10, and its Piotroski F-Score is 2, both indicating poor momentum and financial health.

Atreca Inc's Industry Position

In the biotechnology industry, Atreca Inc's ROE and ROA are -106.95 and -55.12, respectively, placing it at ranks 1115 and 1060. The company's cash to debt ratio is 0.62, ranking it at 1278 in the industry. The company's gross margin growth and operating margin growth are both 0.00, indicating no growth in these areas.

Conclusion

In conclusion, BAKER BROS. ADVISORS LP (Trades, Portfolio)'s recent transaction has reduced its stake in Atreca Inc, a company with poor financial and stock performance. This move may have implications for both the firm's portfolio and Atreca Inc's stock. However, given the firm's investment philosophy and the current state of Atreca Inc, this transaction seems to align with the firm's strategy. As always, investors are advised to conduct their own thorough research before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.