Balance-sheet blowup

This post originally appeared in the Insider Today newsletter.

You can sign up for Insider's daily newsletter here.

Welcome back! With the holidays right around the corner, a friendly reminder to catch up with your elderly family members. It can literally help save their lives, according to scientists.

In today's big story, we're looking at what the $650 billion in unrealized losses means for financial firms. (Hint: It's not as bad as it seems.)

What's on deck:

Markets: A famed short-seller talks about everything from crypto to Tesla.

Tech: Inside the secret deal between Apple and Amazon.

Business: How remote workers are "double dipping" and secretly working two full-time jobs.

But first, it's only a loss... if it's realized.

The big story

Unrealized losses, real fear

$650 billion.

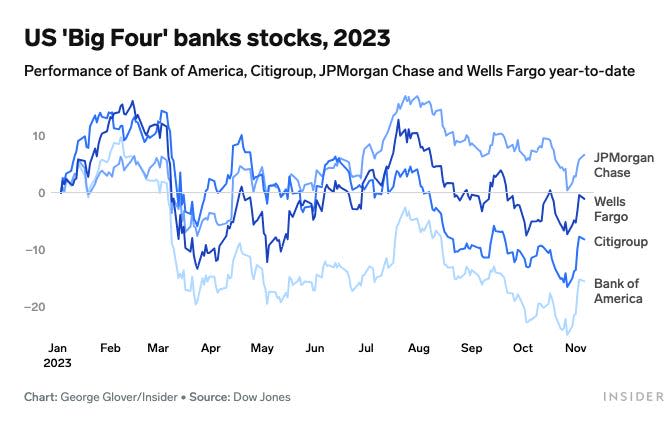

That's the unrealized losses US financial firms wracked up as of September 30, according to Moody's estimate. It's a 15% bump since the end of June, thanks in large part to the rout in the bond market. And with the sell-off continuing well into October, that figure is now likely even worse.

That's a pretty scary number! To put things in perspective, if those losses were a country's GDP, it'd be just shy of the top 20.

But the numbers also don't tell the entire story. Similar to my potential to become a star NFL quarterback, the losses are unrealized. That means there's a lot of wiggle room for how big banks can portray them on their balance sheet.

Insider's Matthew Fox has a full breakdown of why banks can easily diffuse these balance-sheet bombs. Whether it's simply holding them until maturity (meaning they won't suffer any losses) or cashing them out and reinvesting in higher-yielding bonds, banks have ways to navigate the paper losses.

Of course, just because something isn't realized doesn't mean it's completely risk-free.

They said the Titanic was unsinkable, and we all know how that ended.

I don't mean to be a fearmonger, but perception can quickly become a reality, especially with Wall Street's herd mentality. A firm could have no plans of selling its bonds for a loss. But if enough people fear they might do it, things can escalate quickly. Lest we forget Silicon Valley Bank.

To be sure, big banks are better capitalized than SVB. Bank of America, which is sitting on some $130 billion in paper losses, has been adamant about its intention to hold its government securities to maturity.

But circumstances change. While the bond sell-off has cooled, there's always a risk it could spike again, putting even more pressure on banks to eventually pull the trigger.

Even if things don't get so dire, those unrealized losses still feel pretty real to investors. Big banks' share prices noticeably dropped as bond prices sunk.

Therein lies the biggest issue. Regulations already limit banks' balance sheets. Having more capital tied up in these bonds only further hamstrings lenders. And it couldn't come at a worse time, as new players keep pushing into their territory.

News brief

Your Monday headline catchup

A quick recap of the top news from over the weekend:

Tim Scott drops out of GOP primary race after girlfriend reveal

13 of the best looks celebrities wore to the 2023 Baby2Baby Gala

The US is sending more Patriot defense systems to the Middle East. They cost $1.1 billion each

3 things in markets

Short-seller Jim Chanos sounds off. From crypto to Tesla and AI, Chanos touched on plenty of topics. "You have to understand that the crypto ecosystem is well-suited for the dark side of finance for a lot of reasons," Chanos said in a recent interview. Check out his four best quotes here.

How to tell if a deal is in the works. Bank of America detailed the key signs to look out for ahead of a company getting acquired. The bank's analysts also highlighted 10 stocks that are prime acquisition targets, including Ralph Lauren and Expedia.

Two recession indicators are flashing, but it's not as bad as it sounds. The bad news: Indicators tied to the unemployment rate and the yield curve are hinting the market is headed down. The good news: They're being driven by something different than usual, meaning a recession isn't as big of a concern.

3 things in tech

Leaked internal email: Apple privately asked Amazon to block rival ads. Product pages for other companies are cluttered with a mix of ads and product recommendations from competitors. Meanwhile, Apple doesn't have ads or recommendations until the very bottom.

Twitch CEO is somewhat living the van life. Dan Clancy is traveling the US in a van to meet top streamers and hear their concerns. Plus, he's reportedly even giving some of them his personal phone number.

Emails reveal how Amazon and Google tap friends in government to influence policies. Last year, more than 80% of Amazon and Alphabet lobbyists previously held government jobs. Critics say that this relationship lets Big Tech companies limit how they can be regulated.

3 things in business

Inside the strange, secretive lives of the "overemployed." Holding multiple jobs has long been the backbreaking way for low-wage workers to get by. But the pandemic has fueled a similar trend among higher earners. An Insider reporter spent several weeks hanging in the online communities of the overemployed.

Big firms are now eyeing Airbnb as a moneymaker. A major private-equity firm recently started buying Florida homes to rent on Airbnb. But making a profit can be challenging for individuals and major companies alike.

Why strikes are working and which industries could be next. Experts said the economy is ripe for workers to demand more — partially because of the record profits some companies have recorded recently. They also said healthcare and food service are among the next industries to join the wave.

In other news

What's happening today

Happy World Kindness Day! The day is meant to celebrate and spread kindness. It was created by the World Kindness Movement.

Professional hockey team Vegas Golden Knights visits the White House. The trip is to celebrate the team's 2023 Stanley Cup win.

Earnings today: Tyson Foods and other companies.

For your bookmarks

Early Black Friday deals

What to expect from Black Friday this year (plus, early offers). The guide covers TVs, laptops, fashion, mattresses, toys, and other hot categories.

The Insider Today team: Dan DeFrancesco, senior editor and anchor, in New York City. Diamond Naga Siu, senior reporter, in San Diego. Hallam Bullock, editor, in London. Lisa Ryan, executive editor, in New York.

Read the original article on Business Insider