Ball Corp (BALL) Q2 Earnings Beat, Sales Miss Estimates

Ball Corporation BALL has reported second-quarter 2023 adjusted earnings of 61 cents per share, beating the Zacks Consensus Estimate of 59 cents. The bottom line declined 26% year over year.

On a reported basis, the company posted earnings per share of 55 cents against the prior-year quarter’s loss per share of 55 cents. The results include the impacts of the 2022 business divestments.

Total sales were $3,566 million in the reported quarter, down 13.7% from the year-ago quarter’s levels and missing the Zacks Consensus Estimate of $3,811 million. Global beverage can shipments were down 4.9%, excluding the impacts of the 2022 Russia business divestment.

Operational Update

Cost of sales amounted to $2,916 million in second-quarter 2023, down 15.4% from the year-ago quarter. The gross profit totaled $650 million, down from the year-ago quarter’s $689 million. The gross margin came in at 18.2%, up from the prior-year quarter’s 16.7%.

Selling, general and administrative expenses increased 2.5% year over year to $165 million. Adjusted operating profit was $349 million compared with the prior-year quarter’s $392 million. The adjusted operating margin came in at 9.8%, up from the prior-year quarter’s 9.5%.

Ball Corporation Price, Consensus and EPS Surprise

Ball Corporation price-consensus-eps-surprise-chart | Ball Corporation Quote

Segmental Performance

The Beverage packaging , North and Central America segment’s revenues decreased 13.4% year over year to $1,537 million in the second quarter. We predicted sales to be $1,598 million. Operating earnings amounted to $175 million, up 6.7% year over year. Our estimate for the segment's operating earnings was $185 million.

Sales at the Beverage packaging , EMEA segment were $920 million in the quarter, down 18.8% year over year. The reported figure missed our estimated sales of $1,007 million. Operating earnings were $98 million, down 24% year over year. We had projected operating earnings of $114 million.

The Beverage packaging , South America segment’s revenues were $405 million in the reported quarter, down 24.2% year over year. Our projection for the segment’s sales was $486 million. Operating earnings slumped 42.3% to $30 million. The reported figure missed our estimate of $47 million.

The Aerospace segment’s sales were up 1.8% year over year to $499 million. We projected sales of $500 million for the segment. Operating earnings increased 50% to $36 million. Our estimate for its operating earnings was $46 million.

At the end of the quarter, the segment’s contracted backlog was $2.6 billion. Contracts already won but not yet booked into the current contracted backlog were $6 billion.

Financial Condition

The company reported cash and cash equivalents of $955 million at the end of second-quarter 2023, down from $480 million at the end of the prior-year quarter. Cash generated from operating activities amounted to $361 million in the first half of 2023 against a cash utilization of $398 million in the last-year comparable period.

The company’s long-term debt decreased to $7.5 billion at the end of the second quarter from $8.4 billion at the end of the year-ago quarter.

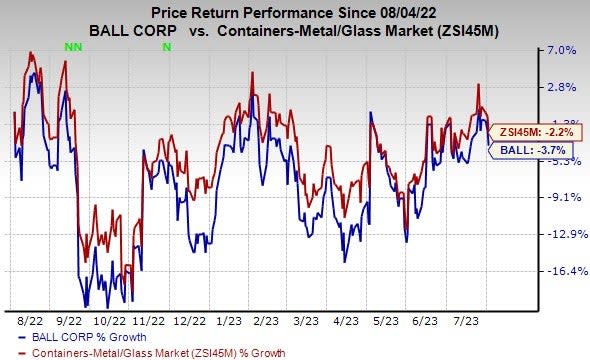

Price Performance

The company’s shares have lost 3.7% over the past year compared with the industry’s decline of 2.2%.

Image Source: Zacks Investment Research

Zacks Rank and Key Picks

Ball Corp currently carries a Zacks #3 Rank (Hold).

Some better-ranked stocks from the Industrial Products sector are Worthington Industries, Inc. WOR, The Manitowoc Company, Inc. MTW and Terex Corporation TEX. WOR and MTW sport a Zacks Rank #1 (Strong Buy) at present, and TEX has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Worthington Industries has an average trailing four-quarter earnings surprise of 14.9%. The Zacks Consensus Estimate for WOR’s fiscal 2023 earnings is pegged at $5.65 per share. The consensus estimate for 2023 earnings has moved north by 22.6% in the past 60 days. Its shares gained 43.4% in the last year.

Manitowoc has an average trailing four-quarter earnings surprise of 256.3%. The Zacks Consensus Estimate for MTW’s 2023 earnings is pegged at $1.12 per share. The consensus estimate for 2023 earnings has moved 7.8% north in the past 60 days. MTW’s shares gained 54.8% in the last year.

The Zacks Consensus Estimate for Terex’s 2023 earnings per share is pegged at $1.61. Estimates were unchanged in the last 60 days. It has a trailing four-quarter average earnings surprise of 27.1%. TEX gained 84.7% in the last year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Manitowoc Company, Inc. (MTW) : Free Stock Analysis Report

Worthington Industries, Inc. (WOR) : Free Stock Analysis Report

Terex Corporation (TEX) : Free Stock Analysis Report

Ball Corporation (BALL) : Free Stock Analysis Report