Ballard (BLDP) to Increase Bipolar Plates Production, Cut Costs

Ballard Power Systems BLDP announced its plans to increase the production volume of next-generation proprietary graphite bipolar plates and reduce production costs. It plans to reduce costs by introducing next-generation plate manufacturing processes and using new lower-cost material suppliers, resulting in cost savings of nearly 70%.

Bipolar plates are the next largest cost item in a fuel cell stack after membrane electrode assemblies (MEAs), so a drop in the cost of bipolar plates will bring down the cost of fuel cell modules. This project will increase Ballard's plate manufacturing capacity by nearly 10 times and the company plans to invest nearly $18 million in bipolar plate manufacturing from 2023 through 2025.

Rising Use of Hydrogen Fuel Cell

The increasing usage of hydrogen fuel cells across the globe will create fresh opportunities for Ballard Power and make room for the usage of more graphite bipolar plates over the long run. Recently, Ballard Power signed a deal with First Mode to supply the latter with 60 hydrogen fuel cell modules, totaling 6 megawatts, for delivery in 2024.

Last month, another operator in the fuel cell space, FuelCell Energy FCEL, announced that it had received an order from Exxon for long-lead fuel cell stack module equipment and engineering support that are required to equip a potential demonstration of modular point-source carbon capture at an ExxonMobil facility.

FuelCell Energy is among the global leaders in fuel cell technology development and nearly 100 of its fuel cell plants are in operation around the world. The company is developing the technology further and will install more fuel cell plants over the long term.

Recently, Plug Power PLUG was selected by Energy Vault to supply 8 megawatts (MW) of Hydrogen Fuel Cells as part of a hybrid microgrid back-up system for PG&E and the city of Calistoga.

Plug Power continues to receive orders for its 5MW electrolyzer system from both the United States and Europe, including multiple repeat orders. To meet the rising demand, Plug Power is operating a new production facility and has produced more 1MW stacks in Q1 2023 than all of 2022.

Bloom Energy Corporation BE and U.K. hydrocarbon producer Perenco have signed an agreement to install 2.5 megawatts (MWs) of BE's solid oxide fuel cells (SOFC) at a site in England. Bloom Energy’s solid oxide electrolyzer technology is paired with renewable energy sources to create clean, low-cost hydrogen with industry-leading efficiency. Bloom Energy is also working to improve fuel cell modules and lower product costs.

The implementation of the Inflation Reduction Act and a $370 billion bill, which includes significant investments in climate spending, will benefit Bloom Energy and other fuel cell operators.

Price Performance

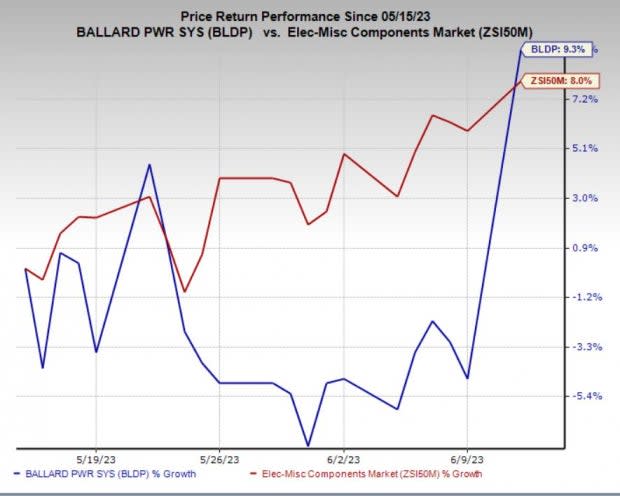

In the past month, shares of the company have gained 9.3% compared with the industry’s 8% growth.

Image Source: Zacks Investment Research

Zacks Rank

Ballard Power currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ballard Power Systems, Inc. (BLDP) : Free Stock Analysis Report

Plug Power, Inc. (PLUG) : Free Stock Analysis Report

FuelCell Energy, Inc. (FCEL) : Free Stock Analysis Report

Bloom Energy Corporation (BE) : Free Stock Analysis Report