Ballard Power Systems (TSE:BLDP) shareholders have endured a 87% loss from investing in the stock three years ago

As every investor would know, not every swing hits the sweet spot. But really bad investments should be rare. So spare a thought for the long term shareholders of Ballard Power Systems Inc. (TSE:BLDP); the share price is down a whopping 87% in the last three years. That would certainly shake our confidence in the decision to own the stock. And the ride hasn't got any smoother in recent times over the last year, with the price 32% lower in that time. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

See our latest analysis for Ballard Power Systems

Ballard Power Systems isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years, Ballard Power Systems' revenue dropped 12% per year. That's not what investors generally want to see. Having said that the 23% annualized share price decline highlights the risk of investing in unprofitable companies. This business clearly needs to grow revenues if it is to perform as investors hope. There's no more than a snowball's chance in hell that share price will head back to its old highs, in the short term.

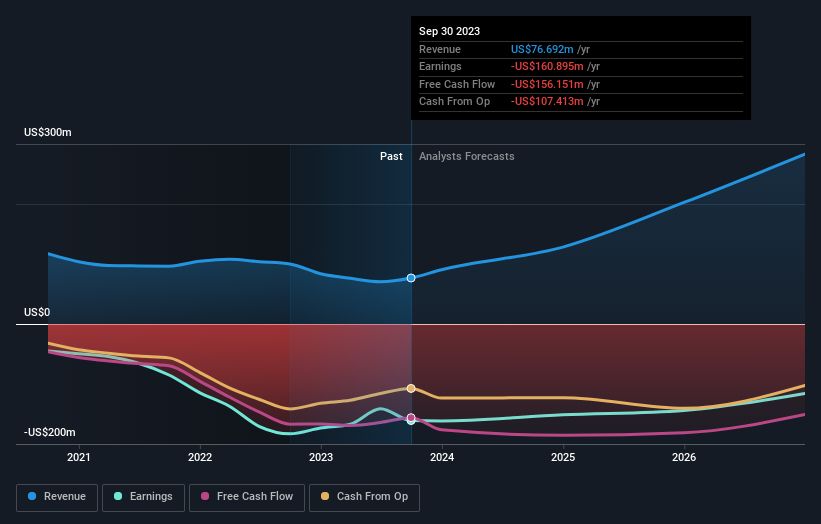

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Ballard Power Systems is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think Ballard Power Systems will earn in the future (free analyst consensus estimates)

A Different Perspective

Investors in Ballard Power Systems had a tough year, with a total loss of 32%, against a market gain of about 6.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 2% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. It's always interesting to track share price performance over the longer term. But to understand Ballard Power Systems better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Ballard Power Systems you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.