The Bancorp Inc (TBBK) Reports Q4 and Full Year 2023 Results; Updates 2024 Guidance

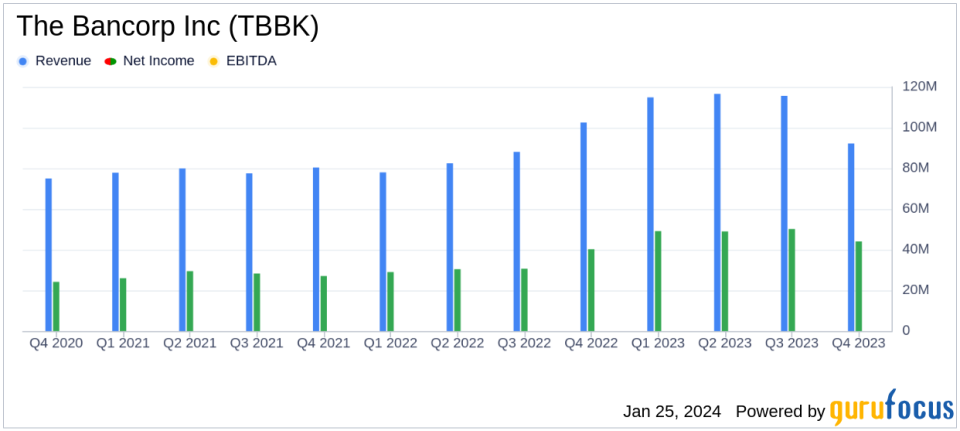

Net Income: Reported $44.03 million for Q4 and $192.3 million for the full year 2023.

Earnings Per Share (EPS): Q4 GAAP EPS at $0.81, adjusted non-GAAP EPS at $0.95 after excluding a one-time charge.

Net Interest Income: Increased to $92.16 million in Q4, up from $76.76 million in the same quarter last year.

Non-Interest Income: Rose to $26.99 million in Q4, with significant contributions from prepaid, debit card, and related fees.

Provision for Credit Losses: Took a $10 million charge for a trust preferred security in Q4.

2024 Guidance: Confirms EPS guidance of $4.25, excluding the impact of planned $200 million share buybacks.

Balance Sheet Strength: Total assets stood at $7.71 billion as of December 31, 2023.

On January 25, 2024, The Bancorp Inc (NASDAQ:TBBK) released its 8-K filing, detailing the financial results for the fourth quarter and the full year of 2023. The financial holding company, which specializes in specialty lending and payment processing services, demonstrated resilience in a challenging market environment characterized by interest rate hikes and economic dislocations.

Company Overview

The Bancorp Inc, through its subsidiary, engages in a variety of financial services including securities-backed lines of credit, vehicle fleet and equipment leasing, Small Business Administration lending, and commercial mortgage-backed loans. The company's deposits and non-interest income are primarily derived from its payments business, which includes issuing, acquiring, and automated clearing house accounts. The Bancorp is also a significant player in the prepaid card market.

Financial Performance and Challenges

The Bancorp's performance in 2023 reflected the strength of its business model and risk management practices. Despite taking a $10 million charge for a trust preferred security, the company reported a net income of $44.03 million for the fourth quarter and $192.3 million for the full year. This performance is significant as it underscores the company's ability to navigate market volatility and maintain profitability. However, the charge for the trust preferred security highlights the potential risks associated with investment holdings and the need for vigilant credit risk management.

Financial Achievements

The Bancorp's increase in net interest income to $92.16 million in the fourth quarter, up from $76.76 million in the same period last year, is a testament to its strong interest-earning asset base and effective interest income strategies. The rise in non-interest income, particularly from prepaid and debit card fees, further emphasizes the company's diversified revenue streams and its leading position in the prepaid card industry, which is crucial for growth in the banking sector.

Key Financial Metrics

The company's balance sheet remains robust with total assets amounting to $7.71 billion as of December 31, 2023. The Bancorp's adjusted non-GAAP EPS of $0.95 for the fourth quarter, after accounting for the one-time charge, reflects a solid earnings capacity. The confirmation of the 2024 EPS guidance at $4.25, excluding the impact of a substantial share buyback program, indicates management's confidence in the company's future performance.

Management Commentary

CEO and President Damian Kozlowski commented, In 2023, we rode the waves of market turmoil and interest rate hikes and demonstrated the superiority of our rigorous commitment to our business partners, safety and soundness and shareholder advocacy. The strength of our business model and our comprehensive and integrated risk management showed that sound fundamental banking can reduce event risk and create opportunities for exemplar performance even in times of economic dislocations. We are confirming 2024 guidance of $4.25 a share without including the impact of share buybacks of $200 million for the year, or $50 million a quarter.

Analysis of Performance

The Bancorp's performance in the fourth quarter and full year 2023 is indicative of a well-managed financial institution capable of adapting to economic pressures. The company's focus on specialty lending and payment processing continues to yield positive results, with a notable increase in net interest income and non-interest income. The proactive approach to credit loss provisioning demonstrates a prudent risk management strategy, essential for maintaining investor confidence.

For more detailed information and analysis on The Bancorp Inc (NASDAQ:TBBK)'s financial results, visit GuruFocus.com.

The Bancorp, Inc. ContactAndres ViroslavDirector, Investor Relations215-861-7990andres.viroslav@thebancorp.com

Source: The Bancorp, Inc.

Explore the complete 8-K earnings release (here) from The Bancorp Inc for further details.

This article first appeared on GuruFocus.