Bandwidth (NASDAQ:BAND) Reports Upbeat Q4, Stock Jumps 23.3%

Communications platform as a service company Bandwidth (NASDAQ: BAND) reported Q4 FY2023 results topping analysts' expectations , with revenue up 5.4% year on year to $165.4 million. On top of that, next quarter's revenue guidance ($165 million at the midpoint) was surprisingly good and 7% above what analysts were expecting. It made a non-GAAP profit of $0.38 per share, improving from its profit of $0.19 per share in the same quarter last year.

Is now the time to buy Bandwidth? Find out by accessing our full research report, it's free.

Bandwidth (BAND) Q4 FY2023 Highlights:

Revenue: $165.4 million vs analyst estimates of $154.1 million (7.4% beat)

EPS (non-GAAP): $0.38 vs analyst estimates of $0.22 ($0.16 beat)

Revenue Guidance for Q1 2024 is $165 million at the midpoint, above analyst estimates of $154.2 million

Management's revenue guidance for the upcoming financial year 2024 is $700 million at the midpoint, beating analyst estimates by 3.7% and implying 16.4% growth (vs 4.9% in FY2023)

Free Cash Flow of $13.04 million, down 28.3% from the previous quarter

Gross Margin (GAAP): 37.5%, down from 41.1% in the same quarter last year

Market Capitalization: $311.5 million

"We are proud to conclude 2023 with outstanding results, reflecting our commitment to innovation in cloud communications and profitable growth. Thanks to the disciplined execution of the team in the fourth quarter we surpassed our guidance and set new records in profitability," said David Morken, Bandwidth's Chief Executive Officer.

Started in 1999 by David Morken who was later joined by Henry Kaestner as co-founder in 2001, Bandwidth (NASDAQ:BAND) provides thousands of customers with a software platform that uses its own global network to provide phone numbers, voice, and text connectivity.

Communications Platform

The first shift towards voice communication over the internet (VOIP), rather than traditional phone networks, happened when the enterprises started replacing business phones with the cheaper VOIP technology. Today, the rise of the consumer internet has increased the need for two way audio and video functionality in applications, driving demand for software tools and platforms that enable this utility.

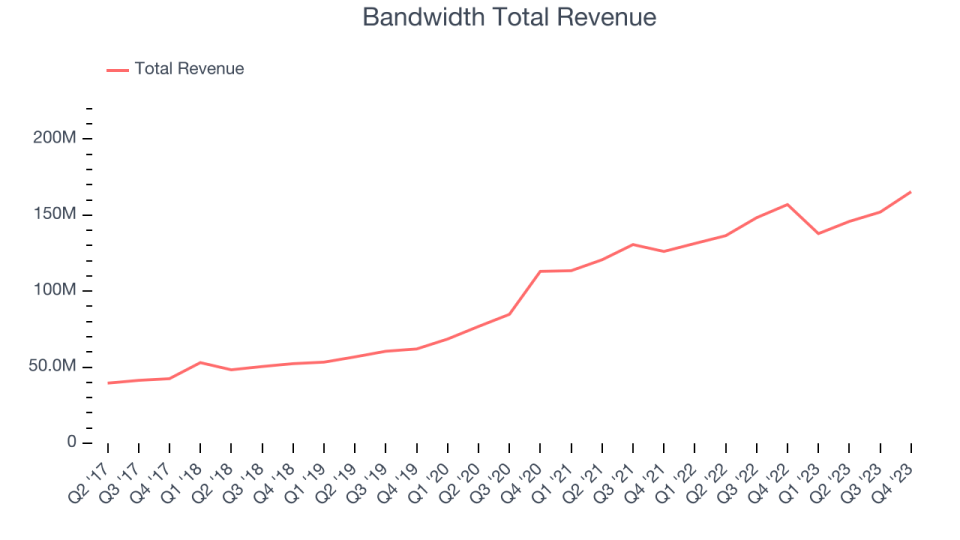

Sales Growth

As you can see below, Bandwidth's revenue growth has been unremarkable over the last two years, growing from $126.1 million in Q4 FY2021 to $165.4 million this quarter.

Bandwidth's quarterly revenue was only up 5.4% year on year, which might disappoint some shareholders. However, we can see that the company's revenue grew by $13.37 million quarter on quarter, accelerating from $6.14 million in Q3 2023.

Next quarter's guidance suggests that Bandwidth is expecting revenue to grow 19.7% year on year to $165 million, improving on the 4.9% year-on-year increase it recorded in the same quarter last year. For the upcoming financial year, management expects revenue to be $700 million at the midpoint, growing 16.4% year on year compared to the 4.9% increase in FY2023.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

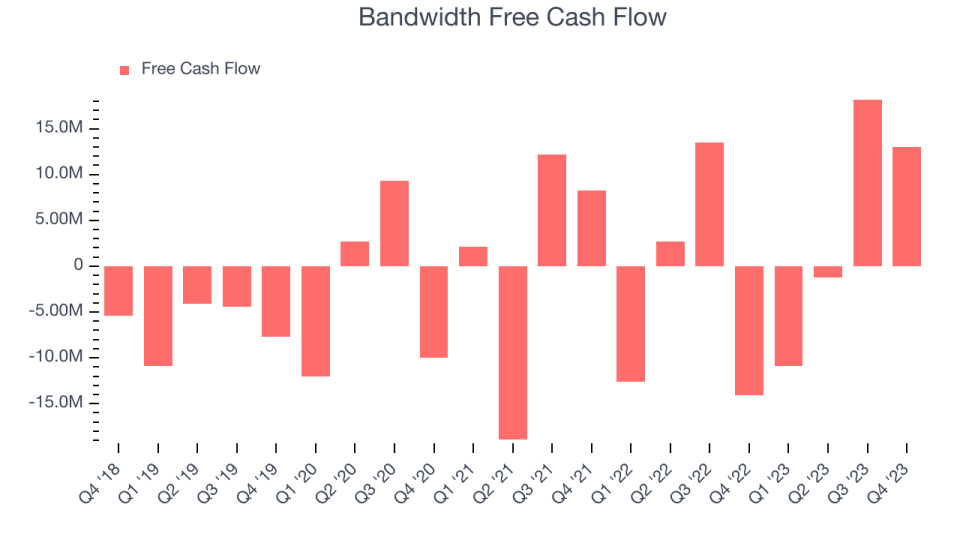

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Bandwidth's free cash flow came in at $13.04 million in Q4, turning positive over the last year.

Bandwidth has generated $19.1 million in free cash flow over the last 12 months, or 3.2% of revenue. This FCF margin enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Bandwidth's Q4 Results

We were impressed by Bandwidth's revenue guidance and rosy outlook for next quarter, which blew past analysts' expectations. We were also glad this quarter's revenue and EPS beat Wall Street's estimates. On the other hand, its gross margin declined, signaling the company's prices saw some pressure. Zooming out, we think this was an impressive quarter that should delight shareholders. The stock is up 23.3% after reporting and currently trades at $15 per share.

Bandwidth may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.