Bandwidth's (BAND) Q1 Earnings Beat on Higher Revenues

Bandwidth Inc. BAND reported solid first-quarter 2023 results, beating both the top-line and bottom-line estimates and well exceeding its guided range. The strong performance was backed by enterprises increasingly relying on Bandwidth’s platform for communications in the cloud. In order to drive growth, the company plans to focus on winning large enterprises and becoming the best global CPaaS platform for scaling digital engagement.

Quarter Details

On a GAAP basis, net income during the quarter was $3.6 million or 14 cents per share against a loss of $6.8 million or a loss of 27 cents per share in the prior-year quarter. Non-GAAP net income during the reported quarter was $1.2 million or 5 cents per share compared with $2.5 million or 9 cents per share in the prior-year quarter. Non-GAAP earnings beat the Zacks Consensus Estimate by 3 cents.

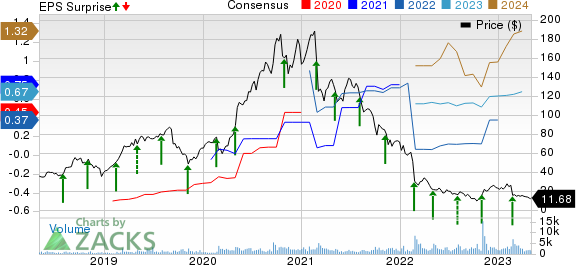

Bandwidth Inc. Price, Consensus and EPS Surprise

Bandwidth Inc. price-consensus-eps-surprise-chart | Bandwidth Inc. Quote

Quarterly revenues improved to $137.8 million from $131.4 million in the prior-year quarter and exceeded the consensus estimate of $133 million. The growth was backed by high demand for digital engagement and strong contributions from messaging services across a variety of use cases, including health care, retail and e-commerce shopping, fintech and civic engagement.

Operating Details

Non-GAAP gross margin during the quarter was 54%, reflecting growth of 1 percentage point, primarily due to efficient pricing and product mix, global coverage, economies of scale and diligent execution of operational plans within the cloud operations and service groups. Adjusted EBITDA was $5.1 million – well within the guidance but down from $8.4 million in the prior-year period.

Cash Flow & Liquidity

In the first quarter of 2023, net cash utilized for operating activities was $6.4 million compared with $6.7 million in the prior year. Cash and cash equivalents as of Mar 31, 2023, were $85.3 million, with convertible senior notes of $417.1 million.

Guidance

For 2023, Bandwidth reiterated its earlier guidance and expects revenues in the band of $576 million to $584 million. Adjusted EBITDA is expected in the range of $43 million to $47 million.

For the second quarter, revenues are expected to be within 140 million to $142 million. Adjusted EBITDA is expected in the band of $4 million to $6 million.

Zacks Rank & Stocks to Consider

Bandwidth currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Arista Networks, Inc. ANET, carrying a Zacks Rank #2, is likely to benefit from the strong momentum and diversification across its top verticals and product lines. The company has a software-driven, data-centric approach to help customers build their cloud architecture and enhance their cloud experience. Arista has a long-term earnings growth expectation of 14.2% and delivered an earnings surprise of 14.7%, on average, in the trailing four quarters.

It holds a leadership position in 100-gigabit Ethernet switching share in port for the high-speed datacenter segment. Arista is increasingly gaining market traction in 200- and 400-gig high-performance switching products and remains well-positioned for healthy growth in data-driven cloud networking business with proactive platforms and predictive operations.

Comtech Telecommunications Corp. CMTL, carrying a Zacks Rank #2, is a solid pick. Headquartered in Melville, NY, the company is a leading global provider of next-generation 911 emergency systems and secure wireless communications technologies to commercial and government customers.

Comtech’s key satellite earth station modems incorporate forward error correction and bandwidth compression technologies, which enable its customers to optimize their satellite networks by either reducing their satellite transponder lease costs or increasing data throughput. It holds leadership positions in the market for high-throughput modems used in cellular backhaul.

IHS Holding Limited IHS, carrying a Zacks Rank #2, is another key pick. Based in London, the United Kingdom, it is one of the largest independent owners, operators, and developers of shared communications infrastructure in the world by tower count.

IHS Holding has more than 39,000 towers across its 11 markets: Brazil, Cameroon, Colombia, Egypt, Kuwait, Nigeria, Peru, Rwanda, South Africa and Zambia. The stock has gained 59.5% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Comtech Telecommunications Corp. (CMTL) : Free Stock Analysis Report

IHS Holding Limited (IHS) : Free Stock Analysis Report

Arista Networks, Inc. (ANET) : Free Stock Analysis Report

Bandwidth Inc. (BAND) : Free Stock Analysis Report