Bank of America Is Great. Here's Why You Shouldn't Buy The Stock..

Bank of America (NYSE: BAC) is one of the largest financial institutions in the United States. It's also a core holding of the stock portfolio of Berkshire Hathaway, the conglomerate run by the great Warren Buffett.

The bank's profits are at record highs, and the stock is up by more than 10% over the past month. There are a lot of reasons to like Bank of America.

So, why should you not buy the stock today? Unfortunately, the party that Bank of America has enjoyed could soon stop.

Consumers could be struggling

Banks are sensitive to the economy. From consumer finances to auto loans and mortgages, banks touch the money that flows through the economy like oil in an engine, keeping it running smoothly. Consumers are vital to Bank of America -- that part of its business was responsible for roughly 40% of its third-quarter revenue (net of interest expenses) and 37% of its net income.

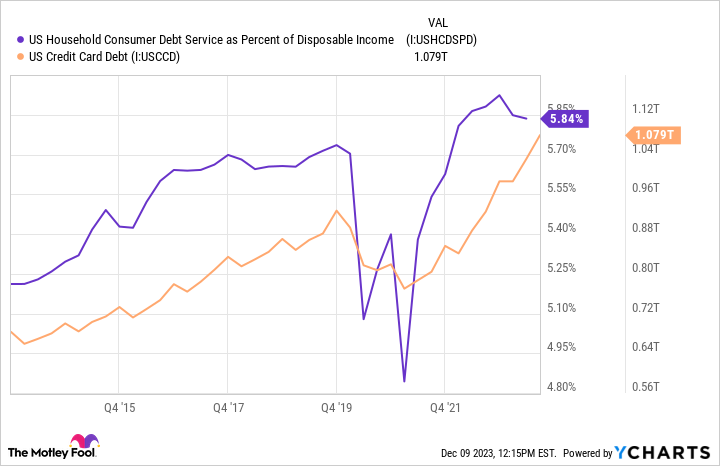

But there are signs that consumers are struggling. Consumer credit card debt is at an all-time high, and the amount they are spending on servicing those debts is the highest percentage of people's disposable income in years.

U.S. Household Consumer Debt Service as Percent of Disposable Income data by YCharts.

The impact of all that is trickling into Bank of America's finances. The bank increased its provisions for credit losses (bad loans) to $1.2 billion from $900 million a year ago, primarily due to rising credit card losses. Additionally, deposits fell by 8% year over year in Q3. Management noted that deposits are 36% above where they were at the end of 2019 (before the pandemic), but the amount of money in the U.S. economy has also increased by more than 35% over that time.

Should investors be concerned about what happens if the bank's deposits continue to slide? Household savings have plummeted from their pandemic levels, even though unemployment remains at historically low levels.

U.S. Unemployment Rate data by YCharts.

In short, there are indications that U.S. consumers are stretched thin financially. It's not yet a reason for panic, but the Federal Open Market Committee just spent the better part of two years rapidly raising rates to bring inflation back under control and slow down economic growth.

If unemployment starts to rise, the general state of consumer finances could get ugly quickly, which would surely have an impact on Bank of America's business.

Is the rate-hiking party over?

The Fed appears to be done with hiking the federal funds rate for this economic cycle. That rate determines the interest rates at which banks lend money to each other and is a key benchmark interest rate for the economy.

Bank of America generally loves higher interest rates. Because of its massive size and prominence, it doesn't have to pay premium interest rates to get people to deposit their money with it. The average rate it paid on deposits in Q3 was just 0.34%.

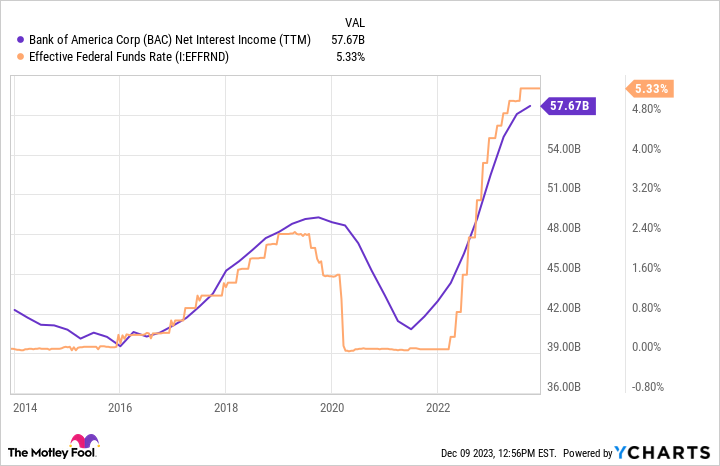

The bank's profit on those deposits -- its net interest income -- is the spread between what interest it pays on deposits and what it earns by lending funds. As the Fed has boosted interest rates back to more historically normal levels, the impact has permeated through the economy and led to all-time high levels of net interest income at Bank of America.

BAC Net Interest Income (TTM) data by YCharts.

But inflation has cooled off significantly, and it appears the Fed is done raising rates. Meanwhile, enough people remain concerned that an economic contraction -- aka, a recession -- might still occur that the market has begun pricing in the idea that the Fed will feel the need to make cuts to the federal funds rate by spring. Lower rates would likely mean lower spreads on loans, and therefore, lower bank profits.

Avoid Bank of America?

If those downbeat predictions of a recession prove true, then the operating climate could soon be less friendly for Bank of America.

Of course, you may not agree with that premise. The economy may continue to avoid recession, and consumer finances might rebound. Moreover, Bank of America stock isn't expensive at its current price, trading at just under its book value, though its valuation has risen notably since October.

Investing often requires you to make educated guesses based on a limited amount of facts. I predict Bank of America will face tougher conditions next year. And that's keeping me on the sidelines with its stock for now.

More From The Motley Fool

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bank of America and Berkshire Hathaway. The Motley Fool has a disclosure policy.

Bank of America Is Great. Here's Why You Shouldn't Buy The Stock.. was originally published by The Motley Fool