‘Stocks Are Still the Best Play’: Bank of America Sees Compelling Opportunity in These 2 Names — Here’s What Makes Them Attractive Buys

The macro backdrop offers a set of concerns that have weighed on investors recently. These have seemingly put the brakes on 2023’s bull market and include the prospect of interest rates staying elevated for the time being and oil prices on the up again, all while a workers’ strike rumbles on in the background.

However, Savita Subramanian, the head of U.S. equity & quantitative strategy at Bank of America, makes the case that the economy is strong enough so that none of that should get in the way of the bulls making further inroads.

“The Fed just told us the economy is still too hot to stop hiking, bad news for bonds but good news for cyclicals and stocks,” Subramanian opined. Moreover, Subramanian argues that even against a backdrop of high interest rates, stocks are still the best play out there.

Taking that mindset and running with it, Bank of America analysts have been seeking out the equites set to outperform, and they see a compelling opportunity in two specific names right now. As the firm’s analysts are forecasting at least 30% upside potential for each, we used TipRanks’ database to dig a bit deeper.

Visteon Corporation (VC)

Let’s kick off by delving into the automotive industry with a look at Visteon Corporation, a global electronics supplier that specializes in providing advanced technologies for the auto industry. Founded in 2000 as a spin-off from Ford, Visteon has since established itself as a leading player in the development of innovative cockpit electronics and connected car solutions. The company operates a diverse portfolio of products and services, including instrument clusters, infotainment systems, head-up displays, and advanced driver-assistance systems (ADAS).

Visteon’s expertise in vehicle electronics extends beyond hardware, as the company also offers software solutions that enable seamless connectivity, user-friendly interfaces, and enhanced vehicle intelligence. With a footprint in 17 countries, Visteon booked $6 billion in new business wins last year and generated revenue of ~$3.76 billion, remaining on track to exceed that figure in 2023.

That said, it hasn’t all been a smooth ride this year. In the most recent quarterly report, for 2Q23, revenue grew by 16% year-over-year to $983 million, although that figure missed expectations by $1.45 million. There was a miss on the bottom-line, too, as adj. EPS of $1.18 fell short of consensus by $0.42. Nevertheless, Visteon stuck to its full-year 2023 guidance, still calling for sales in the range between $3.95 – $4.15 billion.

For Bank of America analyst John Babcock it is the growth on tap that drives the bullish thesis. He writes, “VC is one of the fastest growing auto suppliers, with average growth-over-market of 13% since the start of 2020, and we expect it will grow at a similarly robust pace over the next three years. Its exposure to key mega-trends including the digitalization and electrification of vehicles should provide an ongoing base for growth. This will be further supported by its hardware and software offerings, specifically the SmartCore cockpit domain controller and battery management systems (BMS).”

“Revenues for these products on a combined basis are projected to grow from less than $0.5bn in 2022 to $1.5bn+ by 2026. VC should also benefit from growth in digital clusters, which have grown from an estimated 5% of total sales in 2017 to 30%+ in 2022. Ultimately, VC is on track to meet or exceed its target for $6bn+ in business wins in 2023, supporting its growth story,” the analyst further added.

These comments provide the foundation for Babcock’s Buy rating while his $180 price target suggests shares will climb 35% higher in the months ahead. (To watch Babcock’s track record, click here)

In total, over the past 3 months, 12 analysts have waded in with VC reviews and these break down into 8 Buys and 2 Holds and Sells, each, all culminating in a Moderate Buy consensus rating. At $164, the average target makes room for 12-month returns of 23%. (See VC stock forecast)

Anheuser-Busch Inbev (BUD)

Let’s now turn our attention to Anheuser-Busch, the world’s largest brewery, and a company with more than 500 brands amongst its portfolio.

Founded all the way back in 1852 in St. Louis, Missouri, the company has grown to become a global beverage giant. Anheuser-Busch is perhaps best known for its flagship brand, Budweiser, which has been a staple in American beer culture for over a century. The company’s diverse portfolio also includes other popular brands such as Michelob Ultra, Stella Artois, and Beck’s. Along with a wide range of craft and import beers, the company also has a non-beer segment that includes hard seltzers, canned wines and canned cocktails.

It’s impossible to talk about BUD without mentioning Bud Light, until recently the US’s best-selling beer. “Until recently” being the key phrase here, as earlier this year, Bud Light’s US sales went into a tailspin after a promotional push fronted by transgender ‘influencer’ Dylan Mulvaney went horribly wrong. Outraged by the use of Mulvaney, conservatives decided to boycott the beer, thereby knocking it off the top selling spot.

Nevertheless, the decline is primarily limited to the domestic market. An impressive performance in other international markets helped mitigate some of the sales decrease in the US. Overall, during the second quarter, there was a 1.4% year-over-year reduction in organic volume, with the 14% drop in North America balanced out by strong growth in the Asia Pacific region.

In total, Q2 revenue reached $15.12 billion, amounting to a 2.2% year-over-year increase, but falling shy of expectations by $260 million. That said, the profitability profile remained strong, with adj. EPS of $0.72 outpacing the forecast by $0.03.

Profits are looking good but have still taken a hit, partly on account of the Bud Light controversy. But now, says Bank of America analyst Andrea Pistacchi, they are set to push higher.

“ABI’s margins are at an inflection point, in our view,” says the analyst, “as cost of goods sold (COGS) pressures have started to ease, >$1bn profit hit from Bud Light is in the base and a higher cost of doing business, which has weighed on margins in recent years, is now largely in the base too, we believe. Following a 750bps organic EBITDA margin decline in 2018-23, we expect a +300bps increase in the next 3 years (versus consensus +200bps), resulting in much-improved profit growth: +7.4% organic EBITDA CAGR in 2023-26E (excluding LatAm South/ Argentina), top quartile in global staples, and +15% EPS CAGR.”

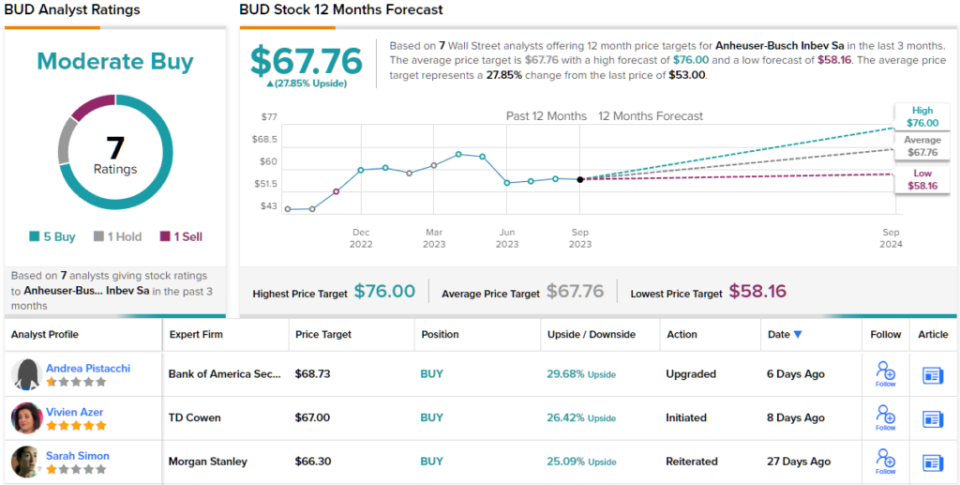

In anticipation of such growth, Pistacchi rates BUD shares as a Buy with a $68 price target, allowing for a potential upside of 30% from current levels. (To watch Pistacchi’s track record, click here)

Elsewhere on the Street, the stock garners an additional 4 Buys and 1 Hold and Sell, each, making the consensus view here a Moderate Buy. The $67.76 average target is roughly the same as Pistacchi’s objective. (See BUD stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.