Bank First Corp (BFC) Reports Substantial Net Income Growth in Q4 2023

Net Income: Q4 net income soared to $34.9 million, or $3.39 per share, from $12.8 million, or $1.43 per share, in Q4 2022.

Annual Earnings: Full-year net income reached $74.5 million, or $7.28 per share, up from $45.2 million, or $5.58 per share in 2022.

Adjusted Net Income: Excluding one-time items, adjusted net income for Q4 was $14.8 million, or $1.44 per share.

Net Interest Income (NII): NII for Q4 stood at $32.9 million, reflecting a one-time reduction due to accelerated fair value amortization.

Asset Quality: Nonperforming assets to total assets slightly increased to 0.21% from 0.18% year-over-year.

Dividend Increase: Quarterly cash dividend raised to $0.35 per share, marking a significant increase from previous periods.

Balance Sheet Growth: Total assets grew to $4.22 billion, with total loans and deposits also showing substantial increases.

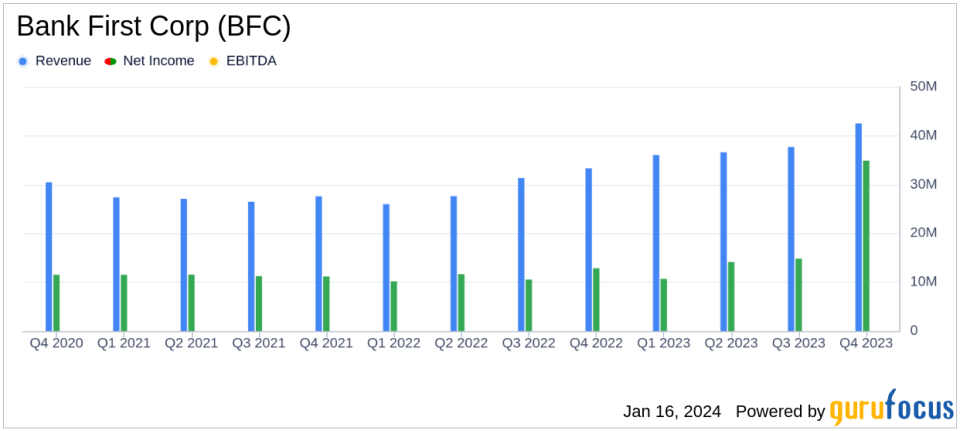

On January 16, 2024, Bank First Corp (NASDAQ:BFC) released its 8-K filing, detailing a robust financial performance for the fourth quarter and full year of 2023. The United States-based financial services provider, which offers a comprehensive suite of banking products and services in Wisconsin, reported a significant increase in net income, both for the quarter and the year.

Financial Highlights and Strategic Moves

Bank First's net income for Q4 2023 was $34.9 million, or $3.39 per common share, a substantial increase from the $12.8 million, or $1.43 per share, reported in the same quarter of the previous year. The full-year net income also showed a remarkable rise to $74.5 million, or $7.28 per common share, compared to $45.2 million, or $5.58 per share, in 2022.

The quarter's results included several significant one-time transactions, such as the gain on the sale of UFS totaling $38.9 million. Adjusting for these one-time items, the bank reported an adjusted net income of $14.8 million, or $1.44 per share, for Q4 2023, compared to $13.9 million, or $1.54 per share, in the prior-year quarter.

Income Statement and Balance Sheet Analysis

Net interest income for the quarter was $32.9 million, down from the previous quarter but up from Q4 2022. The net interest margin (NIM) stood at 3.53%, influenced by the accelerated fair value amortization related to the redemption of Trust I and Trust II. The bank recorded a provision for credit losses totaling $0.5 million, consistent with the same quarter in the previous year.

Noninterest income was significantly higher at $42.5 million, primarily due to the gain from the sale of UFS. Noninterest expense for Q4 was $28.9 million, which included one-time charges such as the loss on sale of available-for-sale US Treasury securities and valuation adjustments.

Bank First's balance sheet expanded, with total assets reaching $4.22 billion, driven by the acquisition of Hometown's loan portfolio. Total loans increased to $3.34 billion, and total deposits grew to $3.43 billion.

Asset Quality and Capital Position

Asset quality remained strong, with nonperforming assets comprising 0.21% of total assets, a slight uptick from 0.18% at the end of the previous year. Stockholders' equity increased to $619.8 million, bolstered by strong earnings and a reduction in unrealized losses in the bank's securities portfolio.

The bank's board approved a quarterly cash dividend of $0.35 per common share, representing a significant increase from previous dividends, underscoring the bank's commitment to shareholder returns.

Conclusion and Forward Outlook

Bank First's impressive financial results reflect its strategic initiatives and robust core banking operations. The bank's ability to navigate economic challenges while capitalizing on growth opportunities positions it well for sustained success. Investors and stakeholders can anticipate Bank First's continued focus on delivering value through prudent financial management and strategic growth initiatives.

For a detailed understanding of Bank First Corp's financial performance, readers are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Bank First Corp for further details.

This article first appeared on GuruFocus.