Bank of Hawaii (BOH) Gains From Loans & Rates, Fee Income a Woe

Bank of Hawaii Corporation BOH continues to record solid loan and deposit balances, which along with rising rates, are expected to keep supporting financials. However, elevated expenses and challenges in improving fee income are major headwinds. Also, the company’s liquidity position is quite fragile.

Bank of Hawaii has a strong balance sheet. The company’s deposits witnessed a compound annual growth rate (CAGR) of 8.1% over a five-year period (2017-2021) whereas loans recorded a CAGR of 5.8% during the same time frame. The company is well-positioned to withstand the anticipated higher rate environment given its low cost, long-duration core deposit base and healthy variable mix.

Bank of Hawaii’s organic growth is its key strength. While revenues declined in 2020 and 2021 as the COVID-19 pandemic interrupted the flow of business activities, it witnessed a five-year CAGR of 1% (2017-2021). The same trend persisted in the first half of 2022 as well. Moreover, low-cost funding sources, growth in loans and higher interest rates will assist the Bank of Hawaii in bolstering its net interest income and net interest margin in the upcoming period.

The Bank of Hawaii has always been committed to enhancing shareholder value, which is reflected in its capital deployment activities. In July 2021, the company hiked its quarterly dividend by 4.5% to 70 cents per share. It also executes various share repurchase plans. Its strong capital levels and income-generation capacity will help to undertake various capital deployment activities.

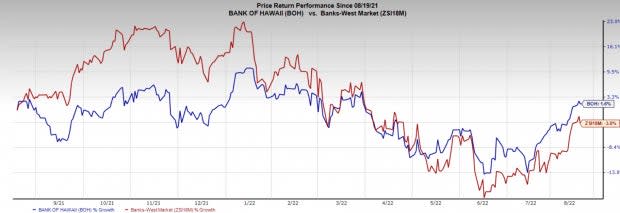

Shares of this Zacks Rank #3 (Hold) company have gained 1.6% against a 3% decline recorded by the industry over the past year.

Image Source: Zacks Investment Research

However, mounting expenses are a matter of concern. As the company continues to make investments in technology and innovation, its cost base is likely to remain elevated. Furthermore, management anticipates expenses in 2022 will rise approximately 5.4% year over year. Thus, this will likely keep the bottom line under pressure in the near term.

Also, Bank of Hawaii’s fee income declined at a CAGR of 2.6% over the past three years. The decline was mainly due to the underperformance of mortgage banking income and trust and assets management income. Hence, the unimpressive fee income will be a matter of concern for the company.

BOH might face problems repaying its debt if the economic situation worsens, as it has high debt and low cash balance. This is worrisome and makes us apprehensive.

Banks to Consider

A couple of better-ranked bank stocks are Civista Bancshares, Inc. CIVB and Prosperity Bancshares, Inc. PB. Currently, both CIVB and PB carry a Zacks Rank # 2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Civista Bancshares’s current-year earnings estimates have been revised 3% upward over the past 30 days. CIVB’s shares have lost 3.6% over the past year.

The consensus estimate for Prosperity Bancshares’s current-year earnings has increased marginally over the past 30 days. Over the past year, PB’s shares have gained 12%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of Hawaii Corporation (BOH) : Free Stock Analysis Report

Prosperity Bancshares, Inc. (PB) : Free Stock Analysis Report

Civista Bancshares, Inc. (CIVB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research