Bank of Hawaii (BOH) Stock Rises 6.6% on Q2 Earnings Beat

Bank of Hawaii Corporation BOH reported second-quarter 2023 earnings per share of $1.12, beating the Zacks Consensus Estimate of $1.11 by a penny. The bottom line declined 18.8% from the year-ago quarter’s number.

Investors have been bullish on the stock, as the share price gained 6.6% in yesterday’s trading session on higher fee income and decent loan demand. However, a fall in net interest income (NII) and a rise in operating expenses and provisions was a significant drag.

The company’s net income came in at $46.1 million, down 19% year over year. Our estimate for net income was $44.6 million.

Revenues Decline & Expenses Rise

BOH’s total revenues fell 4.3% year over year to $167.6 million in the second quarter, missing the Zacks Consensus Estimate of $170.52 million.

The bank’s NII was $124.3 million, down 6.4% year over year, primarily due to higher funding costs, partially offset by higher earning asset yields. Our estimate for the metric was $129.6 million. Net interest margin decreased 25 basis points (bps) to 2.22%.

Non-interest income came in at $43.3 million, up 2.6% year over year. The rise primarily resulted from an increase in service charges on deposit accounts, annuity and insurance, bank-owned life insurance and other income. Our estimate for the same was $40.7 million.

Non-interest expenses increased 1.1% to $104 million. The upswing mainly resulted from a rise in net occupancy, net equipment, professional fees and FDIC insurance expenses. Our estimate for non-interest expenses was $104.7 million.

The efficiency ratio was 62.07% compared with 58.80% recorded in the year-ago period. A rise in the efficiency ratio reflects lower profitability.

As of Jun 30, 2023, total loans and leases balance and total deposits marginally increased from the prior-quarter end to $13.9 billion and $20.5 billion, respectively. Our estimates for total loans and leases and total deposits were $13.7 billion and $21.4 billion, respectively.

Credit Quality: Mixed Bag

As of Jun 30, 2023, non-performing assets and allowance for credit losses decreased 25.9% and 2.1% year over year to $11.5 million and $145.4 million, respectively.

The company recorded a provision for credit losses of $2.5 million against a benefit of $2.5 million in the year-ago quarter. Moreover, $1.38 million was recorded in net loans and lease charge-offs compared with $0.63 million in the prior-year quarter.

Capital and Profitability Ratios Deteriorate

As of Jun 30, 2023, the Tier 1 capital ratio was 12.21%, down from 13.01% as of Jun 30, 2022. The total capital ratio was 13.24%, down from 14.14%. The ratio of tangible common equity to risk-weighted assets was 7.97%, down from 8.72% reported at the end of the year-ago quarter.

Return on average assets shrunk 23 bps year over year to 0.77%. Return on average shareholders' equity was 13.55% compared with 16.40% as of Jun 30, 2022.

Share Repurchase Update

During the reported quarter, Bank of Hawaii did not repurchase any shares.

Conclusion

The company’s strong balance-sheet position, higher interest rates and a rise in non-interest income will continue to support financials. However, persistently increasing operating expenses and rising provisions are near-term concerns.

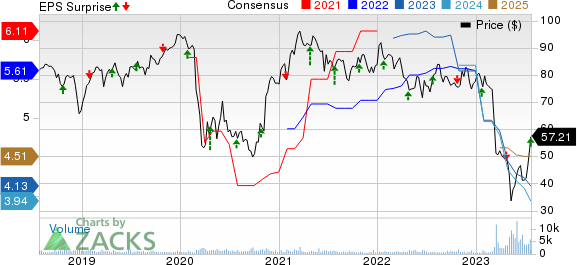

Bank of Hawaii Corporation Price, Consensus and EPS Surprise

Bank of Hawaii Corporation price-consensus-eps-surprise-chart | Bank of Hawaii Corporation Quote

Currently, BOH carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Other Banks

Bank OZK’s OZK second-quarter 2023 earnings per share of $1.47 missed the Zacks Consensus Estimate by a penny. However, the bottom line reflected a rise of 33.6% from the year-earlier quarter.

Results were positively impacted by an improvement in NII, driven by higher rates and loan balances. However, rising expenses and a rise in provision for credit losses on a challenging economic backdrop were concerns for OZK.

East West Bancorp’s EWBC earnings per share of $2.20 in the quarter met the Zacks Consensus Estimate. The bottom line jumped 21.5% from the prior-year quarter.

EWBC's results were primarily aided by higher NII and reflected an improvement in profitability ratios. The company also witnessed a rise in loan and deposit balances during the quarter. However, an increase in non-interest expenses and higher provisions were the undermining factors.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank of Hawaii Corporation (BOH) : Free Stock Analysis Report

East West Bancorp, Inc. (EWBC) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report