Bank of Montreal (BMO) Dips as Q1 Earnings Fall Y/Y, Costs Rise

Shares of Bank of Montreal BMO lost 3.7% following the release of its first-quarter fiscal 2024 (ended Jan 31) results. Adjusted earnings per share of C$2.56 declined 16.3% year over year.

A significant rise in provision for credit losses, along with higher adjusted expenses, primarily hurt the results. However, increases in net interest income (NII) and non-interest income were tailwinds.

After considering non-recurring items, net income was C$1.29 billion ($0.95 billion), which increased significantly from the year-ago quarter.

Revenues Improve, Expenses Rise

Total revenues (on an adjusted basis), net of insurance claims, commissions and changes in policy benefit liabilities (CCPB), were C$7.85 billion ($5.81 billion), up 10.3% year over year.

NII jumped 7.4% year over year to C$4.74 billion ($3.51 billion). Non-interest income came in at C$3.12 billion ($2.31 billion), up 15.1% year over year.

Adjusted non-interest expenses increased 15.7% year over year to C$4.78 billion ($3.54 billion).

The adjusted efficiency ratio (net of CCPB) was 60.9%, up from 58.1% as of Jan 31, 2023. A rise in the efficiency ratio indicates a deterioration in profitability.

Provision for credit losses was C$627 million ($464.1 million) in the reported quarter, up significantly from the year-ago quarter.

Loans & Deposits Robust

As of Jan 31, 2024, total assets were C$1.32 trillion ($984 billion), down 1.7% from the prior-quarter end.

Bank of Montreal’s total net loans declined 2.2% sequentially to C$642.05 billion ($478.6 billion). Total deposits grew marginally from the previous quarter to C$914.14 billion ($681.5 billion).

Profitability Ratios Mixed, Capital Ratios Deteriorate

Bank of Montreal’s return on common equity (as adjusted) was 10.6% in the fiscal first quarter compared with 12.9% on Jan 31, 2023. Adjusted return on tangible common equity was 14.3% compared with 14% in the year-ago quarter.

As of Jan 31, 2024, the Common Equity Tier-I ratio was 12.8%, down from 18.2% a year ago. The Tier-I capital ratio was 14.4% compared with the previous year’s 20.1%.

Our Take

Bank of Montreal’s focus and efforts align with its organic and business restructuring strategies, and are anticipated to support revenues in the upcoming period. However, elevated expenses and an uncertain macroeconomic backdrop are headwinds.

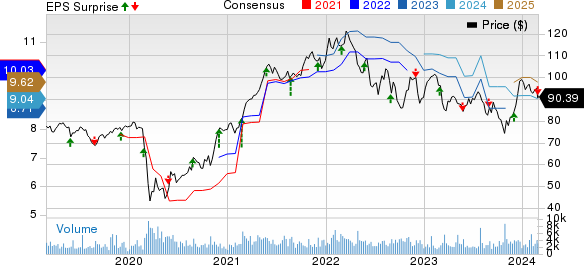

Bank Of Montreal Price, Consensus and EPS Surprise

Bank Of Montreal price-consensus-eps-surprise-chart | Bank Of Montreal Quote

Currently, BMO carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Earnings Release Dates of Other Canadian Banks

We now look forward to the quarterly earnings releases of Toronto-Dominion Bank TD and Canadian Imperial Bank of Commerce CM.

Both TD and CM are expected to release quarterly numbers on Feb 29.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Bank Of Montreal (BMO) : Free Stock Analysis Report

Toronto Dominion Bank (The) (TD) : Free Stock Analysis Report

Canadian Imperial Bank of Commerce (CM) : Free Stock Analysis Report