Bank OZK (OZK) Announces a 2.9% Hike in Quarterly Dividend

Bank OZK OZK announces a dividend hike yet again. OZK declared a quarterly cash dividend of 36 cents per share, reflecting a rise of nearly 2.9% from the prior payout. The dividend will be paid out on Jul 21 to shareholders of record as of Jul 14.

This marks the 52nd consecutive quarter of dividend hike by Bank OZK. Prior to this, OZK raised its dividend by 2.9% to 35 cents per share in April 2023. We believe that such disbursements highlight the company’s operational strength and commitment toward enhancing shareholders' wealth.

Considering the last day’s closing price of $40.46, Bank OZK’s dividend yield currently stands at 3.49%, which is above the industry average of 3.25%. The yield, representing a steady income stream, attracts investor.

Apart from regular dividend increases, OZK has a share repurchase program in place. In 2022 and first-quarter 2023, it repurchased nearly 8.37 million and 2.35 million shares worth $350 million and $85.34 million, respectively.

Further, in November 2022, the bank announced a new buyback program under which it is authorized to repurchase up to $300 million worth of shares. As of Mar 31, 2023, the plan (set to expire on Nov 9, 2023) had $199.6 million authorization remaining.

As of Mar 31, 2023, the company had total debt of $1.46 billion and cash and cash equivalents of $1.04 billion. Thus, given a robust liquidity position and decent earnings strength, OZK is expected to continue with efficient capital deployment activities, thereby enhancing shareholders' value.

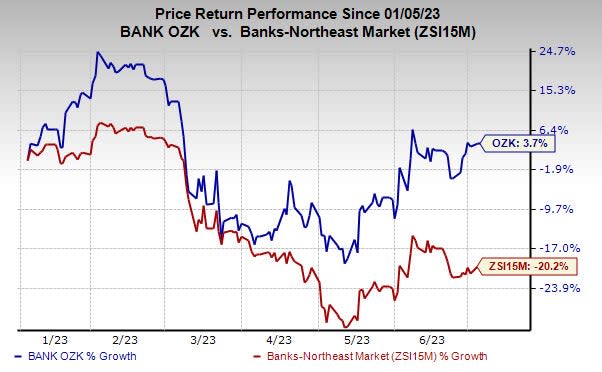

Over the past six months, shares of OZK have gained 3.7% against the industry's fall of 20.2%.

Image Source: Zacks Investment Research

Bank OZK currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Other Banks Taking Similar Steps

Over the past month, Fulton Financial Corporation FULT and Investar Holding Corporation ISTR announced an increase in their quarterly dividend payouts.

Fulton Financial Corporation declared a quarterly cash dividend of 16 cents per share, making a rise of 6.7% from the prior payout. The dividend will be paid out on Jul 14, to shareholders of record as of Jul 3.

Prior to the current hike, the company increased its dividend by 7.1% to 15 cents per share in March 2022. FULT raised its quarterly dividend eight times in the last five years. Also, it has a five-year annualized dividend growth of 5.1%. Currently, the company's payout ratio is 34% of earnings.

Investar Holding Corporation announced a quarterly cash dividend of 10 cents per share, reflecting an increase of 5% from the prior payout. The dividend will be paid out on Jul 31, to shareholders of record as of Jul 3.

Prior to the present hike, ISTR's dividend was improved by 5.6% to 9.5 cents per share in September 2022. ISTR raised its quarterly dividend 13 times in the last five years. Also, it has a five-year annualized dividend growth of 21.1%. Currently, the company's payout ratio is 15% of earnings.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fulton Financial Corporation (FULT) : Free Stock Analysis Report

Investar Holding Corporation (ISTR) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report