Bank OZK (OZK) Rides on Loan Growth & High Rates Amid Cost Woes

Bank OZK’s OZK branch consolidation initiatives, along with robust loan balances, are expected to continue supporting top-line growth. Driven by higher interest rates, the company’s margins are expected to improve in the near term.

However, operating expenses are likely to remain elevated on the back of the company’s efforts to expand organically and inflationary pressure. Further, huge exposure to real estate loans makes us apprehensive.

Bank OZK’s revenues witnessed a compound annual growth rate (CAGR) of 8.2% over the last three years (2019-2022), mainly driven by steady loan growth and a rise in fee income. Its total loans witnessed a CAGR of 5.8% over the three-year period ended 2022. The uptrend in revenues and total loans continued in the first six months of 2023. We expect the company’s total net revenues to increase 20.2% in 2023.

With the Federal Reserve expected to keep interest rates high in the near term, Bank OZK's net interest margin is anticipated to witness an improvement in the quarters ahead, but the pace is likely to slow down somewhat. We project net interest margin to be 5.22% in 2023.

As the operating environment changed in 2020, banks began to realign their businesses based on customer needs, with a greater focus on digital transformation. As a result, Bank OZK evaluated its branch network. It exited Alabama and South Carolina while closing branches in Arkansas, Florida, Georgia and New York.

Given a robust capital position, as well as lower debt-equity and dividend payout ratios compared with peers, the company is expected to sustain its capital distribution activities. Its regular dividend payments and share repurchases bode well for enhancing shareholder wealth.

Analysts seem optimistic regarding OZK’s earnings growth prospects. The Zacks Consensus Estimate for the company's 2023 earnings has been revised marginally upward over the past seven days. The company currently carries a Zacks Rank #3 (Hold).

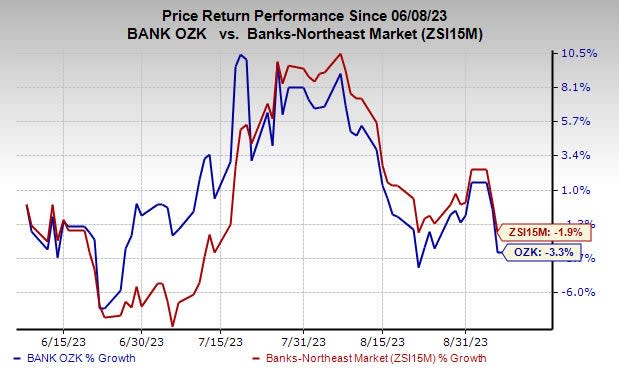

Over the past three months, shares of OZK have declined 3.3% compared with the industry's fall of 1.9%.

Image Source: Zacks Investment Research

However, Bank OZK continues to record an increase in expenses, with non-interest expenses experiencing a CAGR of 4% over the 2019-2022 period. The rise was mainly due to an increase in salaries and employee-benefit costs. The rising trend continued in the first six months of 2023. This rise in expenses is expected to impede bottom-line growth. We project non-interest expenses to rise 16.7%, 13.9% and 7.7% in 2023, 2024 and 2025, respectively.

Bank OZK’s asset quality has been deteriorating over the past few years. In 2021, the company reported a provision benefit, but in 2020 and 2022, provisions for credit losses increased significantly as the company continued to build reserves to combat the challenging operating environment. The uptrend continued in the first six months of 2023. We project provisions for credit losses to surge 79.9% this year.

Bank OZK’s substantial exposure to real estate loans is another headwind. Its exposure to these loans was 74.5% of total loans as of Jun 30, 2023. Though the housing and real estate sectors are holding up well amid the current economic slowdown, any deterioration in real estate prices is likely to pose a threat to the company’s financials.

Bank Stocks Worth a Look

A couple of better-ranked stocks from the banking space are JPMorgan Chase & Co. JPM and The Bancorp TBBK.

JPMorgan Chase currently sports a Zacks Rank #1 (Strong Buy). Its earnings estimates for 2023 have been revised marginally upward over the past 30 days. In the past three months, JPM’s shares have rallied 3%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for The Bancorp’s current-year earnings has been revised 1.7% upward over the past 60 days. Its shares have gained 5.8% in the past six months. Currently, TBBK carries a Zacks Rank #2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

The Bancorp, Inc. (TBBK) : Free Stock Analysis Report

Bank OZK (OZK) : Free Stock Analysis Report