Bank of New York Mellon Corp Reports Mixed Q4 Results Amid Economic Headwinds

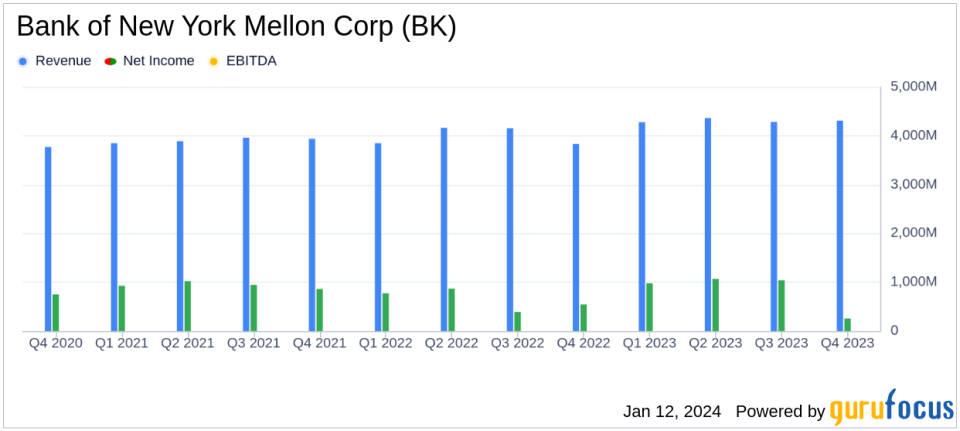

Revenue: Q4 total revenue increased by 10% year-over-year to $4.3 billion.

Net Income: Net income applicable to common shareholders fell by 50% year-over-year to $256 million.

Earnings Per Share (EPS): Reported Q4 EPS of $0.33, a decrease of 47% from the same period last year.

Assets Under Management (AUM): AUM rose to $2.0 trillion, an 8% increase compared to the previous year.

Capital Return: Returned $778 million to shareholders in Q4; $3.9 billion, or 123% of earnings, for the full year.

Adjusted Metrics: Adjusted EPS for Q4 at $1.28; adjusted pre-tax margin at 28%; adjusted ROTCE at 20.9%.

On January 12, 2024, Bank of New York Mellon Corp (NYSE:BK) released its 8-K filing, detailing the financial results for the fourth quarter of 2023. Amidst a challenging economic environment characterized by macro-economic uncertainty, evolving monetary policies, and geopolitical tensions, the company reported a mixed set of financial figures.

BNY Mellon, a global leader in investment management and investment services, is the world's largest global custody bank with approximately $44.3 trillion in assets under custody and administration as of December 31, 2022. The company's asset-management division manages about $1.8 trillion in assets, serving as a crucial player in the financial services industry for institutions, corporations, and individual investors across 35 countries.

Financial Performance and Challenges

For the fourth quarter, BNY Mellon reported a total revenue of $4.3 billion, marking a 10% increase from the same period last year. However, net income applicable to common shareholders saw a significant decline, falling 50% to $256 million. Diluted earnings per share (EPS) also decreased by 47% to $0.33. Despite these challenges, the company's assets under management (AUM) grew by 8% to $2.0 trillion, reflecting higher market values and the favorable impact of a weaker U.S. dollar, partially offset by cumulative net outflows.

BNY Mellon's CEO, Robin Vince, commented on the resilience of the company, noting that they exceeded the financial outlook communicated at the beginning of the year and have set improved financial targets for the future. The company's ability to perform in difficult operating environments was also highlighted, with a year-over-year increase of 38% in reported EPS and a 10% increase on an adjusted basis.

Financial Achievements and Industry Significance

The bank's financial achievements are particularly significant given the current economic climate. The adjusted figures, which exclude notable items such as a $752 million noninterest expense related to the FDIC special assessment and severance and litigation reserves, paint a more favorable picture of the company's performance. Adjusted EPS for the quarter stood at $1.28, with an adjusted pre-tax margin of 28% and an adjusted return on tangible common equity (ROTCE) of 20.9%. These metrics are important as they demonstrate the company's underlying profitability and efficiency in generating returns on tangible assets.

"The fourth quarter marked the close to a year in which we clarified our strategic priorities and laid a foundation for a multi-year transformation. In 2023 we started to show early evidence that we can deliver stronger financial performance," said Robin Vince, President and Chief Executive Officer of BNY Mellon.

Key Financial Details

Bank of New York Mellon Corp's balance sheet remained robust, with average deposits of $273 billion, reflecting a 4% decrease year-over-year but a 4% increase sequentially. The company's capital distribution was strong, with $778 million returned to common shareholders in the fourth quarter, including $328 million in dividends and $450 million in share repurchases. For the full year, the total payout ratio was 123% of earnings.

The company's capital ratios also improved, with the Common Equity Tier 1 (CET1) ratio increasing to 11.6% and the Tier 1 leverage ratio at 6.0%. These ratios are crucial as they measure the bank's financial strength and its ability to withstand potential losses.

Analysis of Performance

While the reported EPS and net income figures for Q4 2023 indicate a downturn, the adjusted metrics suggest a more resilient underlying performance. The bank's strategic initiatives and transformation efforts appear to be yielding early positive results, as evidenced by the improved financial targets and the robust growth in AUM. The capital returns to shareholders underscore the company's commitment to delivering value, despite the pressures of a challenging macroeconomic landscape.

Bank of New York Mellon Corp's performance in Q4 2023 reflects the dual nature of the current financial environment, with headwinds impacting reported figures but strategic adjustments revealing a stronger core business. Investors and analysts will likely watch closely to see if the company can maintain its momentum and continue to deliver on its improved financial targets in the coming year.

For a more detailed analysis of BNY Mellon's financial results, please visit the 8-K filing.

Explore the complete 8-K earnings release (here) from Bank of New York Mellon Corp for further details.

This article first appeared on GuruFocus.