Bank7's (NASDAQ:BSVN) Shareholders Will Receive A Bigger Dividend Than Last Year

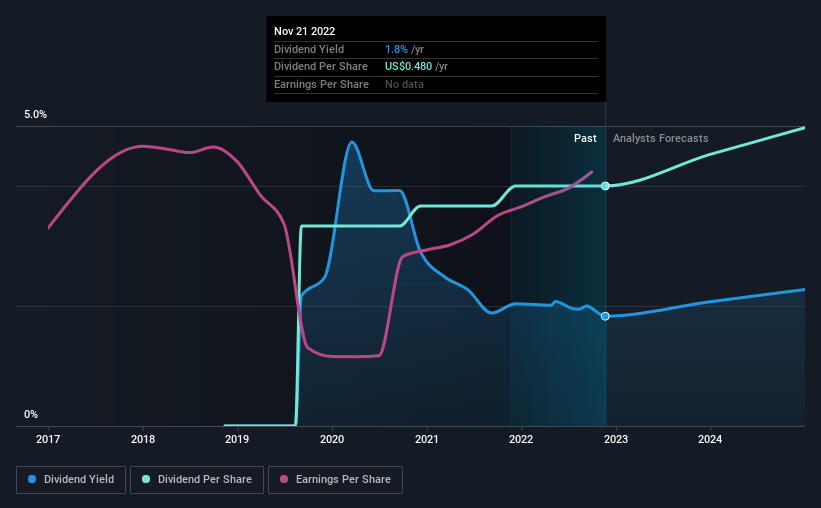

Bank7 Corp.'s (NASDAQ:BSVN) periodic dividend will be increasing on the 5th of January to $0.16, with investors receiving 33% more than last year's $0.12. Despite this raise, the dividend yield of 1.8% is only a modest boost to shareholder returns.

Check out our latest analysis for Bank7

Bank7's Dividend Forecasted To Be Well Covered By Earnings

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible.

Having paid out dividends for only 3 years, Bank7 does not have much of a history being a dividend paying company. Based on its last earnings report however, the payout ratio is at a comfortable 16%, meaning that Bank7 may be able to sustain this dividend for future years if it continues on this earnings trend.

The next 3 years are set to see EPS grow by 32.3%. Analysts forecast the future payout ratio could be 15% over the same time horizon, which is a number we think the company can maintain.

Bank7 Is Still Building Its Track Record

The dividend hasn't seen any major cuts in the past, but the company has only been paying a dividend for 3 years, which isn't that long in the grand scheme of things. The annual payment during the last 3 years was $0.40 in 2019, and the most recent fiscal year payment was $0.48. This means that it has been growing its distributions at 6.3% per annum over that time. Investors will likely want to see a longer track record of growth before making decision to add this to their income portfolio.

Bank7 May Find It Hard To Grow The Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. Although it's important to note that Bank7's earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

In Summary

Overall, this is probably not a great income stock, even though the dividend is being raised at the moment. The low payout ratio is a redeeming feature, but generally we are not too happy with the payments Bank7 has been making. This company is not in the top tier of income providing stocks.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 2 warning signs for Bank7 that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here