Bankwell Financial Group Inc (BWFG) Reports Mixed 2023 Results and Declares Dividend

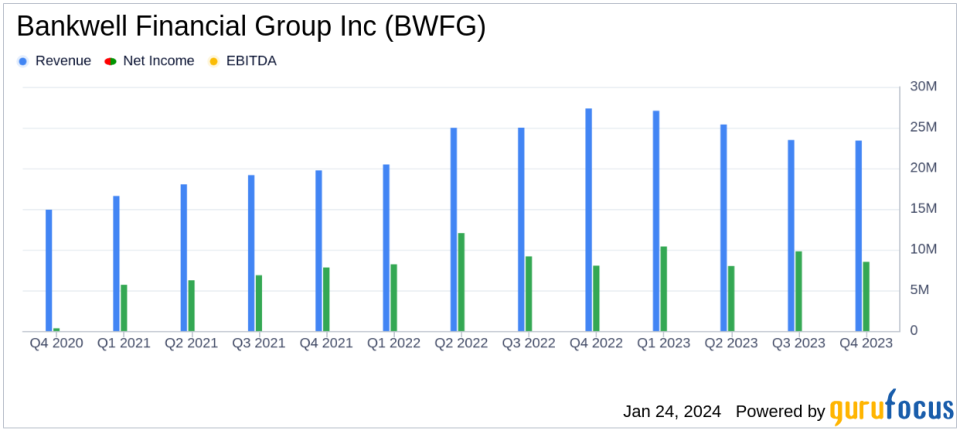

Q4 GAAP Net Income: $8.5 million, or $1.09 per share, up from $8.0 million, or $1.04 per share in Q4 2022.

Full-Year Net Income: $36.7 million, or $4.67 per share, down from $37.4 million, or $4.79 per share in 2022.

Dividend: Declared a $0.20 per share cash dividend, payable on February 23, 2024.

Net Interest Margin: Decreased to 2.81% in Q4 2023 from 3.70% in Q4 2022.

Loan Growth: Total gross loans grew by $43.2 million, or 1.6%, compared to December 31, 2022.

Noninterest Expense: Increased to 1.56% of average assets for Q4 2023, up from 1.55% for the full year.

Efficiency Ratio: Improved to 55.0% in Q4 2023 from 45.6% in Q4 2022.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

On January 24, 2024, Bankwell Financial Group Inc (NASDAQ:BWFG) released its 8-K filing, detailing its financial performance for the fourth quarter and full year of 2023. The bank holding company, which offers a range of financial products and services including commercial and retail lending, reported a modest increase in net income for the fourth quarter, although its full-year earnings saw a slight decline.

Financial Performance and Challenges

Bankwell Financial Group Inc (NASDAQ:BWFG) faced a challenging economic environment in 2023, marked by volatility and rising interest rates. Despite these headwinds, the company managed to post a quarterly increase in net income, thanks to a credit for loan losses which helped offset an increase in noninterest expenses and a decrease in revenues. The full-year picture was less rosy, with a decrease in net income attributed to higher noninterest expenses, although this was partially mitigated by increased revenues and a lower provision for loan losses.

The bank's net interest margin, a key metric for financial institutions, contracted both for the quarter and the year, reflecting the impact of rising funding costs. However, Bankwell's loan portfolio grew modestly, and the company's efficiency ratio showed improvement, indicating better cost control relative to revenue.

Financial Achievements and Importance

Bankwell's ability to grow its tangible book value per share to $33.39, representing a 15% compounded annual growth rate since December 31, 2020, stands out as a significant achievement. This growth in tangible book value is a testament to the company's ability to enhance shareholder value over time. Furthermore, the bank's Return on Average Tangible Common Equity (ROATCE) of 14.70% and Return on Average Assets (ROAA) of 1.13% for the year are indicative of strong profitability metrics that are crucial for investor confidence in the banking sector.

"Thank you to my colleagues who helped the Company generate quality returns for our shareholders amidst a volatile economic backdrop in 2023. We achieved a total year Return on Average Tangible Common Equity (ROATCE") of 14.70% while generating a 1.13% Return on Average Assets (ROAA). Tangible Book Value grew to $33.39 per share, which represents a 15% Compounded Annual Growth Rate since December 31, 2020," noted Bankwell Financial Group President and CEO, Christopher R. Gruseke.

Analysis of Bankwell's Performance

Bankwell's performance in 2023 reflects the resilience of its business model in a challenging economic climate. The company's strategic focus on maintaining a well-positioned balance sheet and implementing innovative deposit solutions are expected to support its growth trajectory going forward. The bank's anticipation of a trough in the Net Interest Margin in the third quarter of 2024 suggests that management is preparing for continued pressure on this front, but they remain confident in the bank's ability to navigate these challenges.

Overall, Bankwell's mixed financial results for 2023 highlight the bank's ability to adapt to economic fluctuations and maintain a steady course. The declared dividend is a positive signal to shareholders, reinforcing the company's commitment to returning value. As Bankwell looks ahead to 2024, investors will be watching closely to see how the bank's strategies unfold in the face of an evolving financial landscape.

For more detailed information and analysis, investors are encouraged to review the full earnings release and accompanying financial statements.

Explore the complete 8-K earnings release (here) from Bankwell Financial Group Inc for further details.

This article first appeared on GuruFocus.