Barclays and Breeze Airways Unveil the Breeze Easy Visa Signature Co-Branded Credit Card

Airline also debuts breezy rewards loyalty program.

73% of surveyed fliers prefer a rewards credit card from an airline like Breeze that flies from a smaller airport convenient to their home.

SALT LAKE CITY, March 26, 2024--(BUSINESS WIRE)--Breeze Airways and Barclays US Consumer Bank today announced the debut of the Breeze Easy™ Visa Signature® credit card.

Breeze’s first co-branded credit card comes less than three years after the airline’s launch and offers up to 10X BreezePoints for Breeze purchases including airfare and trip add-ons, such as premium seating, additional checked bags and even inflight snacks and beverages. Other benefits include complimentary inflight Wi-Fi on Breeze’s Airbus fleet, priority boarding and accelerated earn on a wide range of everyday purchases, including grocery stores and restaurants.

Breeze’s focus on jet service from underserved regional airports, along with its credit card partnership with Barclays, addresses some flyers’ most common pain points, as revealed in a recent survey conducted by Wakefield Research:

64% of flyers would prefer to fly out of a smaller, regional airport with nonstop flights, over a large hub, while 73% would prefer a rewards credit card from an airline that flies from an airport that’s convenient to their home.

Over half of regional flyers avoid major airports because of long security lines (63%) and large crowds (53%), and nearly half find expensive parking (49%) and congestion that could delay flights (47%) as turn-offs.

61% of those surveyed would likely apply for an airline’s rewards credit card if the airline flew out of a nearby regional airport.

"We’ve expanded rapidly since we took to the skies in May 2021. Today, we announced five more cities, so we now offer affordable flights from 56 cities across the US and are the largest carrier in terms of destinations served in 11 of those markets," said David Neeleman, Founder and CEO, Breeze Airways. "Combined with Barclays’ trusted track record with major travel brands, I’m confident the Breeze Easy Visa will be THE airline card of choice for Breeze guests and frequent travelers."

The Breeze Easy Visa Signature card is a partnership between Breeze Airways, one of the nation’s newest point-to-point airlines, Barclays, a leading co-branded credit card issuer, along with Visa, a world leader in digital payments.

Barclays is a leading co-branded credit card issuer and financial services partner in the United States, with more than 20 co-branded credit card programs, online savings accounts and personal loans.

"Barclays is committed to being the premier choice for America’s best brands, bringing unique value to their loyal customers," said Denny Nealon, CEO, Barclays US Consumer Bank. "Breeze Airways is unlocking affordable, elevated air travel to so many underserved markets and Barclays is thrilled to help Breeze Easy Visa cardmembers earn rewards for travel and more."

The Breeze Easy Visa features numerous benefits including an introductory sign-up bonus valued at $500 and accelerated earn opportunities across travel and everyday categories.

"Our tagline is ‘Seriously Nice’ and we think this card lives up to that brand promise," stated Neeleman. "In fact, by doubling the BreezePoints earned for all Breeze purchases, we can confidently say the Breeze Easy Visa makes buying and flying with Breeze ‘Twice as Nice!"

The Breeze Easy Visa Signature card benefits include:

50,000 BreezePoints as an introductory sign-up bonus after spending $2,000 in the first 90 days of account opening.

Up to 10X BreezePoints on Nicer Bundles, Nicest Bundles and Trip Add-Ons:

5X when flight is purchased, plus 5X once flight is completed.

Up to 4X BreezePoints on Nice Bundles:

2X when flight is purchased, plus 2X once flight is completed.

Additional points and perks:

2X on eligible grocery store and restaurant purchases including inflight food and beverages.

1X on all other purchases.

Complimentary Inflight Wi-Fi on Breeze’s Airbus fleet.

Priority Boarding for cardmembers and their travel companions on all Breeze flights.

BreezePoints that never expire.

7,500 Anniversary Bonus BreezePoints after spending $10,000 on purchases each card membership year.

The card comes with an $89 annual fee. Terms and conditions apply. Visit MyBreezeEasyCard.com

"We’re thrilled to be joining Breeze and Barclays who are enhancing the travel experience by delivering more rewards to Breeze guests," said Kirk Stuart, senior vice president, head of North America merchant, acquiring & enablement, Visa. "At Visa, we’re committed to being the best way for travelers to pay and be paid, wherever they choose to fly. We’re proud of the unique value we provide to Breeze and Barclays’ customers to meet their evolving loyalty needs."

In tandem with the debut of the Breeze Easy Visa, the airline also announced the launch of its new loyalty program. Dubbed Breezy Rewards™, the program gives members the ability to earn BreezePoints for all Breeze purchases and access other benefits such as no change or cancel fees, seamless booking and flight management tools, and Free Family seating.

BreezePoints were initially introduced when the airline launched in 2021. By rebranding the guest rewards program as Breezy Rewards, Breeze is bringing to life the benefits of being a Breeze Easy Visa cardmember.

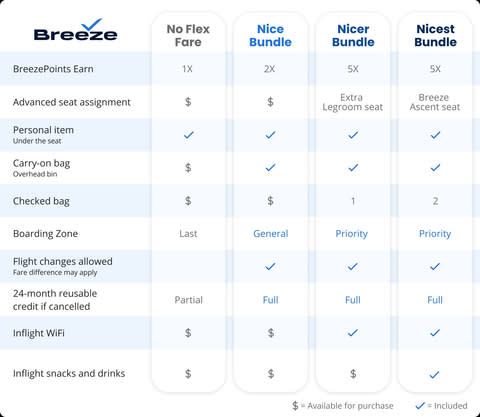

Breeze also introduced a new ‘fare-only’ option for travelers who desire the most basic experience. With the No Flex Fare, flight changes are not permitted but partial credit is issued for cancellations. Guests earn 1X BreezePoints and have up to 24-months to rebook using their remaining credit without an additional fee or penalty. As part of this change, Breeze also enhanced its Nice bundle to include a carry-on bag and added complimentary WiFi to both its Nicer and Nicest bundles.

About Barclays US Consumer Bank

Barclays US Consumer Bank is a leading co-branded credit card issuer and financial services partner in the United States that creates highly customized programs to drive customer loyalty and engagement for some of the country's most successful travel, entertainment, retail and affinity institutions. The bank offers co-branded, small business and private label credit cards, installment loans, online savings accounts, and CDs. For more information, please visit www.BarclaysUS.com.

About Breeze Airways

Breeze Airways began service in May 2021 and has been ranked as one of the U.S.’ best domestic airlines for the last two years by Travel + Leisure magazine’s World's Best Awards (#2 in 2022 and #4 in 2023). Breeze offers a mix of more than 170 year-round and seasonal nonstop routes between 56 cities in 29 states. Founded by aviation entrepreneur David Neeleman, Breeze’s mission is "Nice people, flying nice people, to nice places." With a focus on providing efficient and affordable flights between secondary airports, Breeze is allowing travelers to bypass hubs for shorter travel times. With seamless booking, no change or cancellation fees, up to 24-months of reusable flight credit, and customized flight features delivered via a sleek and simple app, Breeze makes it easy to buy and easy to fly. Learn more about Breeze Airways at flybreeze.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240326312012/en/

Contacts

George Caudill

Barclays Media Relations

gcaudill@barclays.com

Gareth Edmondson-Jones

Breeze Media Relations

gareth.edmondsonjones@flybreeze.com