Barings BDC Inc (BBDC) Reports Solid Earnings Amidst Market Volatility

Net Investment Income: $33.4 million for Q4 and $127.8 million for the full year, translating to $0.31 and $1.19 per share respectively.

Net Asset Value (NAV): Increased to $11.28 per share as of December 31, 2023, from $11.25 per share as of September 30, 2023.

Dividend: Quarterly cash dividend declared at $0.26 per share.

Share Repurchase Program: BBDC repurchased 1,849,096 shares at an average price of $7.99 per share, including broker commissions.

Portfolio Activity: 14 new investments totaling $100.9 million and several loan repayments and sales.

Liquidity and Capitalization: Issued $300.0 million in 5-year unsecured notes at a 7.00% coupon, enhancing financial stability.

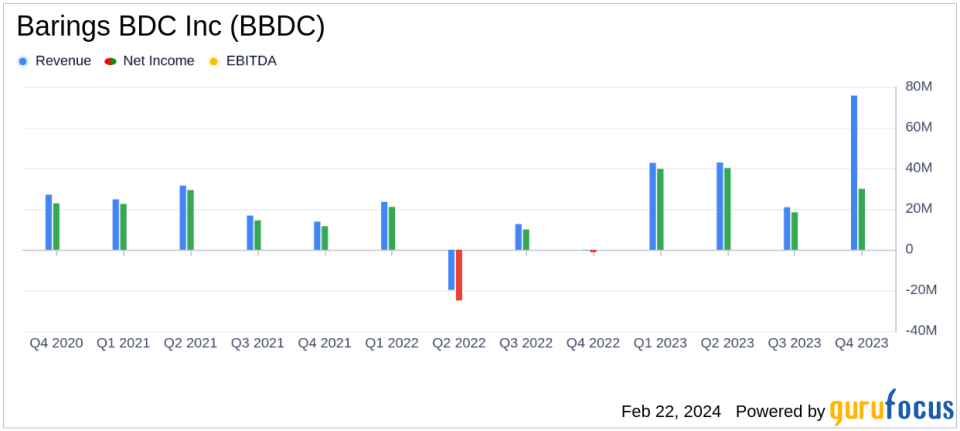

On February 22, 2024, Barings BDC Inc (NYSE:BBDC) released its 8-K filing, detailing its financial and operating results for the fourth quarter and full year of 2023. The company, which operates as a closed-end, non-diversified investment company and has elected to be treated as a business development company, focuses on generating current income by investing in privately-held middle-market companies.

Financial Performance and Challenges

BBDC's performance in Q4 and throughout 2023 reflects the company's strategic approach to investment and underwriting. The company reported a net investment income of $33.4 million for Q4, maintaining a consistent per-share income as the previous quarter. The full year net investment income stood at $127.8 million, or $1.19 per share. However, the company faced challenges with net realized losses of $62.8 million for the year, which was partially offset by net unrealized appreciation of $62.6 million.

The importance of these figures lies in BBDC's ability to sustain its dividend payments and share repurchase program, which are key attractions for investors. The company's net asset value per share increased slightly, indicating a stable financial position despite market volatility.

Financial Achievements and Industry Significance

BBDC's financial achievements, such as the increase in NAV per share and the successful issuance of $300 million in unsecured notes, are significant for the asset management industry. These moves demonstrate BBDC's creditworthiness and ability to secure funding at favorable terms, which is crucial for ongoing operations and growth opportunities.

Key Financial Metrics

BBDC's investment portfolio at fair value stood at $2.488 billion as of December 31, 2023, with a weighted average yield on performing debt investments of 10.5%. Total assets were reported at $2.677 billion, and the debt-to-equity ratio was 1.21x, indicating a leveraged but manageable capital structure.

"BBDC fourth quarter results speak to the strength of our core middle market loan portfolio and our defensive approach to underwriting. In the fourth quarter, we out-earned the dividend by approximately 20%, increased net investment income from the third quarter and repurchased 449,096 shares as part of our share repurchase program. As we enter 2024, we remain focused on delivering strong risk-adjusted returns to our shareholders," said Eric Lloyd, Chief Executive Officer of Barings BDC.

BBDC's liquidity position was bolstered by cash and foreign currencies totaling $70.5 million, with a net debt-to-equity ratio (adjusted for unrestricted cash and net unsettled transactions) of 1.15x. This liquidity is crucial for BBDC to respond to market opportunities and meet its financial obligations.

Analysis of Company's Performance

BBDC's performance in the fourth quarter and full year 2023 showcases its resilience in a challenging market environment. The company's strategic investments and prudent financial management have allowed it to maintain a stable NAV, declare consistent dividends, and engage in share repurchases, which are positive indicators for investors. The issuance of new debt at a competitive rate further strengthens BBDC's financial position, providing the flexibility to navigate future market conditions.

For more detailed information on BBDC's financial results, including the full income statement and balance sheet, please refer to the 8-K filing.

Barings BDC Inc (NYSE:BBDC) remains committed to delivering value to its shareholders through careful investment selection and robust portfolio management. The company's latest financial results reflect a solid foundation and a strategic approach to navigating the complexities of the market.

Explore the complete 8-K earnings release (here) from Barings BDC Inc for further details.

This article first appeared on GuruFocus.