Barnes' (B) Aerospace Unit Extends Agreements With Safran

Barnes Group Inc.’s B Aerospace division has extended its long-term agreement with Safran Aircraft Engines for the repair and overhaul of components related to the LEAP and CFM engine programs. The agreement strengthens the Aerospace unit’s position in the industry, enhancing its expertise in machining and assembly of complex engine components.

As part of the agreement, Barnes Aerospace will extend its partnership with Safran Aircraft Engines on the Aftermarket services for LEAP Casings. The collaboration will bolster Barnes Aerospace’s portfolio of LEAP engine products and strengthen its position in the LEAP engine market.

Barnes Aerospace has also expanded its CFM56 Component Repair agreement with Safran Aircraft Engines. Barnes performs the repair services for Safran Aircraft Engines in the latter’s Singapore and West Chester, OH facilities.

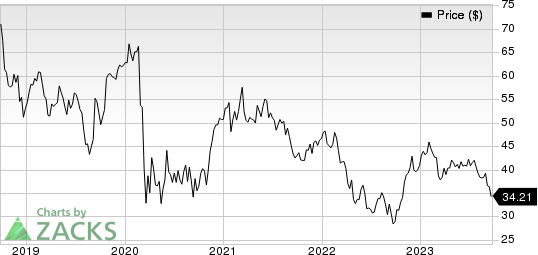

Barnes Group, Inc. Price

Barnes Group, Inc. price | Barnes Group, Inc. Quote

Barnes Aerospace’s agreements are aimed at catering to the growing needs of the aviation industry. B’s focus on innovation, technical expertise, and aftermarket capabilities is expected to contribute to the success of the LEAP and the CFM56 engine programs.

Zacks Rank & Key Picks

Barnes currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader Industrial Products sector are as follows:

Flowserve Corporation FLS presently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 6.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Flowserve has an estimated earnings growth rate of 79.1% for the current year. The stock has jumped 26.9% so far this year.

Graham Corporation GHM currently flaunts a Zacks Rank #1. The company pulled off a trailing four-quarter earnings surprise of 243.1%, on average.

Graham has an estimated earnings growth rate of 400% for the current fiscal year. The stock has rallied 59.8% so far this year.

Applied Industrial Technologies AIT currently carries a Zacks Rank #2 (Buy). The company delivered a trailing four-quarter earnings surprise of 15%, on average.

Applied Industrial has an estimated earnings growth rate of 3.1% for the current fiscal year. The stock has gained 22.9% in the year-to-date period.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Barnes Group, Inc. (B) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report