Barnes (B) Closes MB Aerospace Deal, Boosts Aerospace Unit

Barnes Group B has completed its previously announced acquisition of MB Aerospace, a provider of precision aero-engine component manufacturing and repair services. The deal was valued at approximately $740 million.

This is the largest acquisition in Barnes’ history. It expands B’s aerospace business global original equipment manufacturing (OEM) offering and aftermarket repair capabilities. MB Aerospace’s complementary program focus, global operations, technical capabilities and product offerings boost Barnes’ productivity.

The addition of MB Aerospace strengthens B’s ability to support customer needs throughout the product lifecycle, beginning from new product development and manufacturing to OEM-approved repair solutions for critical structural and rotating aero-engine components.

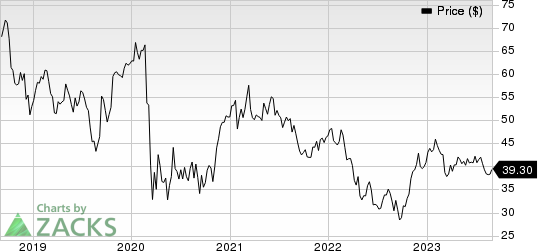

Barnes Group, Inc. Price

Barnes Group, Inc. price | Barnes Group, Inc. Quote

MB Aerospace is part of Barnes’ Aerospace segment. With recovery in the aerospace end market, volume increases within aerospace aftermarket and aerospace OEM businesses are driving the unit’s growth. The OEM business is benefiting from ongoing production rate increases by both Boeing and Airbus. Improved passenger traffic and the resurgence of wide-body activity are fueling the aftermarket business.

The MB Aerospace acquisition is expected to contribute approximately $110 million to sales in the remainder of 2023. It is expected to boost adjusted earnings per share by 25 cents in the same period.

Zacks Rank & Key Picks

Barnes presently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks within the broader Industrial Products sector are as follows:

Flowserve Corporation FLS presently sports a Zacks Rank #1 (Strong Buy). The company pulled off a trailing four-quarter earnings surprise of 6.2%, on average. You can see the complete list of today’s Zacks #1 Rank stocks.

Flowserve has an estimated earnings growth rate of 79.1% for the current year. The stock has jumped 29% so far this year.

Graham Corporation GHM currently flaunts a Zacks Rank #1. The company pulled off a trailing four-quarter earnings surprise of 243.1%, on average.

Graham has an estimated earnings growth rate of 400% for the current fiscal year. The stock has rallied 66% so far this year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Flowserve Corporation (FLS) : Free Stock Analysis Report

Barnes Group, Inc. (B) : Free Stock Analysis Report

Graham Corporation (GHM) : Free Stock Analysis Report