Barnes Group Inc (B) Reports Mixed Fourth Quarter and Full Year 2023 Results Amid Strategic ...

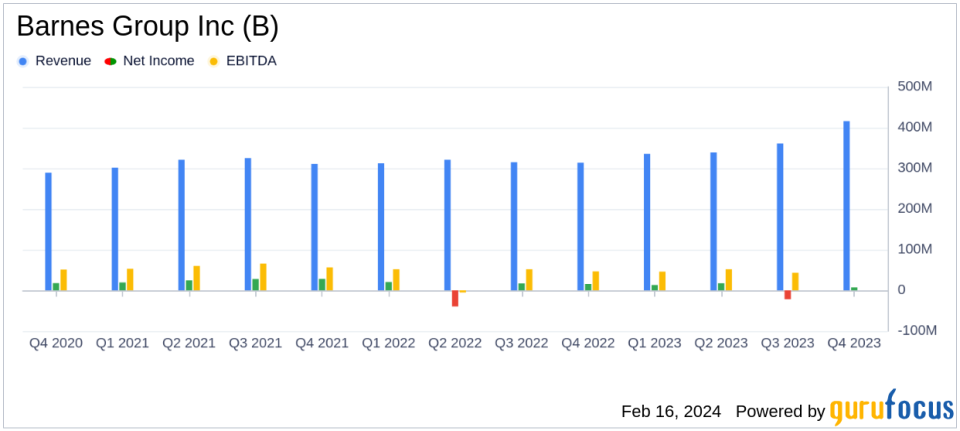

Revenue: Fourth quarter sales increased by 33% to $416 million, and full year sales rose by 15% to $1,451 million.

Net Income: Fourth quarter net income decreased to $7.2 million from $15.6 million, while full year net income increased to $16.0 million from $13.5 million.

Adjusted EPS: Adjusted EPS for the fourth quarter declined by 21% to $0.41, and full year adjusted EPS decreased by 17% to $1.65.

Operating Margin: Fourth quarter operating margin decreased to 7.1%, while full year operating margin improved to 6.1%.

Adjusted EBITDA Margin: Adjusted EBITDA margin for the fourth quarter increased by 50 basis points to 18.8%, and full year adjusted EBITDA margin rose by 20 basis points to 18.6%.

Debt Management: "Net Debt to EBITDA" ratio improved to approximately 3.64, with a commitment to reduce leverage ratio to 3.0x by the end of 2024.

2024 Outlook: Barnes Group Inc (NYSE:B) projects organic sales growth of 4% to 8%, with adjusted EPS forecasted to be between $1.55 and $1.80.

Barnes Group Inc (NYSE:B) released its 8-K filing on February 16, 2024, detailing its financial results for the fourth quarter and full year of 2023. The company, a global industrial and aerospace manufacturer and service provider, has reported mixed results as it navigates through strategic changes and market challenges.

Barnes Group Inc (NYSE:B) operates through two segments: Industrial and Aerospace. The Industrial segment focuses on precision parts and systems for various end markets, while the Aerospace segment supplies components and services for OEM turbine engines, airframes, and industrial gas turbines, as well as aftermarket services. The company has a significant presence in the American market, accounting for around half of its revenue.

Performance and Challenges

The fourth quarter saw a substantial increase in sales, driven by organic growth, acquisition-related expansion, and favorable foreign exchange rates. However, operating margin declined slightly due to increased operating expenses. The full year results also reflected a robust sales increase, with a slight dip in adjusted operating margin. Notably, the adjusted EBITDA margin improved for both the quarter and the full year, indicating effective cost management and operational efficiency.

Despite these achievements, Barnes Group Inc (NYSE:B) faced challenges, including a significant increase in interest expense due to the acquisition of MB Aerospace and a higher average interest rate. This led to a decrease in GAAP EPS and adjusted EPS for both the fourth quarter and the full year. The company's strategic focus on portfolio optimization and long-term profitable growth strategy, including the divestiture of its Associated Spring and Hanggi businesses, is crucial as it aims to shift towards higher growth, margin, and value-driven business.

Financial Achievements and Importance

The company's financial achievements, particularly the growth in organic sales and the successful integration of MB Aerospace, are significant for Barnes Group Inc (NYSE:B) and the broader industrial products industry. These achievements demonstrate the company's ability to expand its market presence and enhance its capabilities, which are essential for maintaining competitiveness and driving long-term growth.

Financial Tables and Analysis

Barnes Group Inc (NYSE:B)'s balance sheet shows a strong liquidity position with $90 million in cash and $357 million in available credit facility capacity. The company's commitment to reducing its leverage ratio is evidenced by the improvement in its "Net Debt to EBITDA" ratio. The 2024 outlook suggests confidence in the company's ability to achieve profitable growth and disciplined cost management, which are expected to drive margin expansion and cash flow.

The company's segment performance highlights the Aerospace segment's significant sales increase, although operating profit declined due to the MB Aerospace acquisition's short-term purchase accounting adjustments. The Industrial segment experienced a slight decrease in sales, but operating profit improved, reflecting better productivity and favorable pricing.

Overall, Barnes Group Inc (NYSE:B)'s financial results reflect a period of transition and strategic realignment. While the increased interest expense and decline in adjusted EPS present challenges, the company's focus on organic growth and operational efficiency, along with its strategic divestitures and acquisitions, position it for future success.

Investors and stakeholders are encouraged to review the full earnings report and join the conference call for further insights into Barnes Group Inc (NYSE:B)'s performance and strategic outlook.

Explore the complete 8-K earnings release (here) from Barnes Group Inc for further details.

This article first appeared on GuruFocus.