Barrett Business Services Inc (BBSI) Reports Incremental Growth in Q4 and Full Year 2023

Q4 Net Income: Increased to $14.6 million, or $2.16 per diluted share.

Full Year Net Income: Rose to $50.6 million, or $7.39 per diluted share.

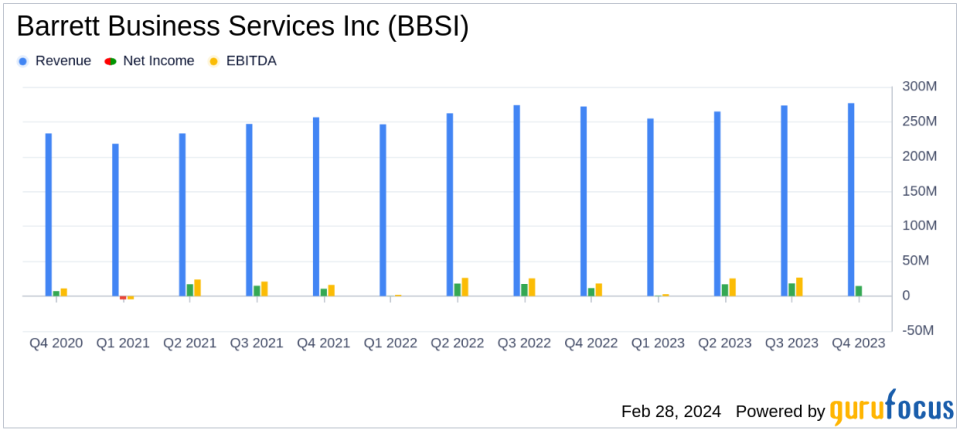

Revenue Growth: Q4 revenues up 2% to $276.7 million; full year revenues up 1% to $1.07 billion.

Gross Billings: Q4 gross billings up 5% to $2.05 billion; full year gross billings up 4% to $7.72 billion.

Workers' Compensation Expense: Decreased as a percent of gross billings to 2.6% in Q4 and 2.7% for the full year.

Liquidity: Unrestricted cash and investments at $152.2 million, with the company remaining debt-free.

Capital Allocation: Confirmed regular quarterly cash dividend of $0.30 per share and repurchased $34 million of stock in 2023.

On February 28, 2024, Barrett Business Services Inc (NASDAQ:BBSI) released its 8-K filing, detailing its financial performance for the fourth quarter and the full year of 2023. BBSI, a leading provider of business management solutions, including payroll administrative services and staffing services, reported a net income of $14.6 million for Q4, translating to $2.16 per diluted share, and a full year net income of $50.6 million, or $7.39 per diluted share.

The company's revenue growth was modest, with a 2% increase in Q4 to $276.7 million and a 1% increase for the full year to $1.07 billion. Gross billings, a key performance metric, saw a more significant rise of 5% in Q4 to $2.05 billion and 4% for the full year to $7.72 billion. This growth was attributed to an increase in worksite employees (WSEs) from net new clients and higher average billings per WSE, despite reductions in WSEs at existing clients.

Workers' compensation expense, a significant cost for BBSI, improved as a percentage of gross billings, dropping to 2.6% in Q4 and 2.7% for the full year, benefiting from favorable prior year liability and premium adjustments. The company's liquidity remained strong, with unrestricted cash and investments totaling $152.2 million, and it continued to operate debt-free.

Capital allocation strategies included a confirmed regular quarterly cash dividend of $0.30 per share and an active stock repurchase program, with $34 million of stock bought back at an average price of $91.15 per share in 2023. BBSI also paid over $8 million in dividends for the year, totaling more than $42 million in capital returned to shareholders.

Looking ahead, BBSI's CEO Gary Kramer expressed confidence in the company's momentum and value proposition, expecting continued growth in gross billings and WSEs for 2024. The company anticipates gross billings growth of 6% to 8%, an increase in the average number of WSEs of 4% to 5%, and a gross margin as a percent of gross billings of 2.95% to 3.15%, with an effective annual tax rate remaining at 26% to 27%.

Barrett Business Services Inc's performance in 2023 demonstrates its resilience and ability to grow amidst challenges. The company's focus on expanding its client base and retaining existing customers, coupled with prudent financial management, positions it well for continued success in the business services industry. BBSI's strategic initiatives, including its health benefits offering and effective capital allocation, reflect a commitment to creating value for shareholders and enhancing its competitive edge.

Investors and stakeholders can look forward to BBSI's conference call, scheduled for February 28, 2024, to discuss the year's financial results in more detail and to address any questions regarding the company's outlook and strategy moving forward.

For a more comprehensive understanding of Barrett Business Services Inc's financials and strategic direction, interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Barrett Business Services Inc for further details.

This article first appeared on GuruFocus.