Barrick (GOLD) Exploring Expansion Opportunities for Lumwana Mine

Barrick Gold Corporation GOLD is making significant strides in transforming the Lumwana copper mine into a Tier One asset with an extended lifespan beyond 2060. The latest quarterly performance has provided momentum to the ongoing production ramp-up, showcasing the mine's untapped potential.

Barrick is currently assessing additional expansion opportunities based on an updated geological model. Furthermore, drilling at the Kababisa prospect has revealed higher-grade deposits, highlighting the potential for increased mining flexibility.

The Lumwana pre-feasibility study aligns with Barrick's strategy to enhance the long-term copper profile of the mine through the development of the envisioned super pit. This ambitious plan aims to unlock the mine's full potential, driving sustained growth and profitability.

Barrick's commitment to Africa since 2019 has solidified Lumwana's significance in the expansion of its strategic copper portfolio. In addition to contributing significantly to Barrick's bottom line, the mine has become a vital contributor to Zambia's economy, injecting more than $2.3 billion through royalties, taxes, salaries and local supplier purchases.

Reflecting its commitment to the local community, Barrick follows a global policy of sourcing suppliers locally. Last year, the company spent $432 million, accounting for 83% of its total procurement, with Zambian suppliers and contractors. Moreover, Barrick has initiated the "Business Accelerator Program" aimed at building the capacity of Zambian contractors in the mining supply chain.

Barrick's dedication to local employment is also evident, with 99.3% of Lumwana's employees and 98% of its contractors being Zambian nationals. As a participant in the United Nations' REDD+ project, Lumwana actively contributes to reducing greenhouse gas emissions resulting from deforestation. The mine has engaged with its communities to promote and support this environmentally responsible initiative.

Barrick's ongoing expansion plans for the Lumwana copper mine demonstrate its commitment to long-term growth, benefiting both the company and the local economy. With the mine's potential yet to be fully realized, GOLD is poised to establish Lumwana as a leading copper asset in the global market.

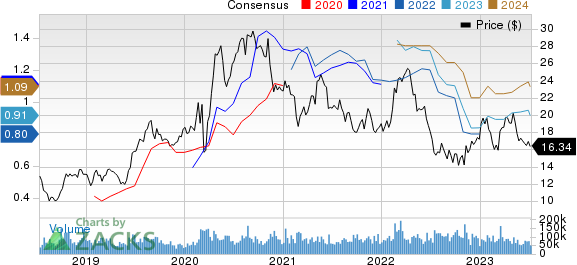

GOLD shares have lost 3.8% in the past year against the 13.5% growth of its industry. The Zacks Consensus Estimate for the company’s current-year earnings has been revised 3.2% downward in the past 60 days. The consensus estimate for current-year earnings is currently pegged at 91 cents, suggesting year-over-year growth of around 21.3%.

Image Source: Zacks Investment Research

Copper production from Lumwana declined 15% year over year in the first quarter of 2023, impacted by lower grades processed due to lower mining rates. Barrick expects attributable production of 260-290 million pounds for Lumwana in 2023. Attributable production from the mine was 267 million pounds in 2022.

The company also projects total copper production in the range of 420-470 million pounds for 2023. It envisions copper production to be stronger in the second half of the year, primarily due to steadily increasing throughput at Lumwana.

Barrick Gold Corporation Price and Consensus

Barrick Gold Corporation price-consensus-chart | Barrick Gold Corporation Quote

Zacks Rank & Key Picks

Barrick currently has a Zacks Rank #3 (Hold).

Better-ranked stocks worth a look in the basic materials space include PPG Industries, Inc. PPG, L.B. Foster Company FSTR and Linde plc LIN.

PPG Industries currently carries a Zacks Rank #1 (Strong Buy). The Zacks Consensus Estimate for PPG's current-year earnings has been stable over the past 60 days.

PPG Industries’ earnings beat the Zacks Consensus Estimate in three of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 6.8%, on average. PPG shares have gained around 29% in a year.

The Zacks Consensus Estimate for FSTR's current-year earnings has been stable over the past 60 days. L.B. Foster currently carries a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

L.B. Foster’s earnings beat the Zacks Consensus Estimate in each of the last four quarters. It has a trailing four-quarter earnings surprise of roughly 140.5%, on average. FSTR shares have rallied around 48% in a year.

Linde currently carries a Zacks Rank #2 (Buy). The Zacks Consensus Estimate for LIN’s current-year earnings has been revised 0.7% upward in the past 60 days.

Linde beat the Zacks Consensus Estimate in each of the last four quarters. It delivered a trailing four-quarter earnings surprise of 6.9% on average. LIN shares have risen roughly 32% in the past year.

Disclaimer: This article has been written with the assistance of Generative AI. However, the author has reviewed, revised, supplemented, and rewritten parts of this content to ensure its originality and the precision of the incorporated information.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

PPG Industries, Inc. (PPG) : Free Stock Analysis Report

L.B. Foster Company (FSTR) : Free Stock Analysis Report

Barrick Gold Corporation (GOLD) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report